Vice President Kamala Harris has declared her support for President Joe Biden’s 44.6% capital gains tax proposal. The proposal would be the highest in history. It also includes a 25% tax on unrealized gains for high-net-worth individuals (more than $100 million in wealth).

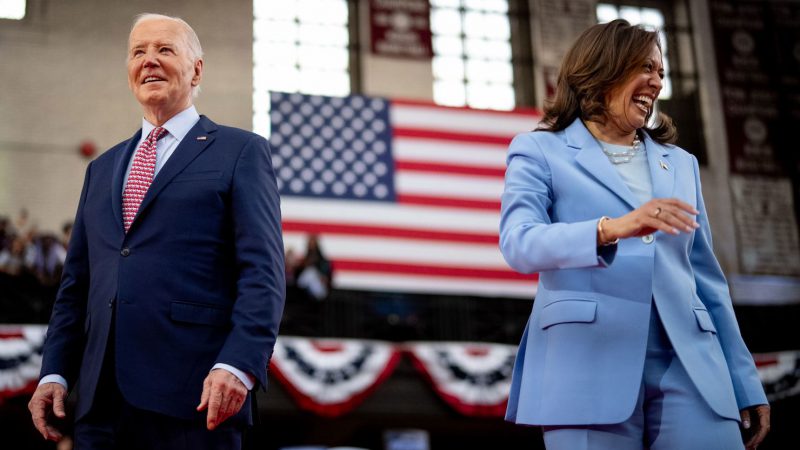

Harris’ campaign shared support for the tax proposal as the 2024 Democratic National Convention is underway. Harris spoke Monday at the event in Chicago along with President Biden. The democratic nominee has also proposed tax cuts beyond Biden’s budget. These include an exemption for tipped workers, a $6,000 tax credit for parents of newborns, and an expanded child tax credit that the Biden budget doesn’t extend beyond 2025.

Vice President Harris also proposed bumping the corporate tax rate to 28%, her campaign said Monday. The current corporate tax rate is 21%. This is down from 35% after Donald Trump signed the 2017 Tax Cuts and Jobs Act, which will expire after 2025.

Also Read: Cryptocurrency: Top 2 Bullish Sentiment Coins To Buy Right Now

James Singer, a spokesperson for the Harris campaign, said in a statement of Harris’s proposal that “unlike Donald Trump, whose extreme Project 2025 agenda would drive up the deficit, increase taxes on the middle class by $3,900, and send our economy spiraling into recession – her plan is a fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.”

It is expected that passing these tax proposals will be extremely difficult if Kamala Harris is elected President. The current state of Congress, even if controlled by Democrats, will be very divided on the proposal.