The Philippines is the latest country to explore the creation of a strategic Bitcoin reserve. The bill was introduced by Congressman Migz Villafuerte. According to reports, the bill will allow the Philippine central bank, Bangko Sentral ng Pilipinas (BSP), to purchase 2000 Bitcoin (BTC) annually over five years. The central bank will hold the asset for 20 years. The BTC reserve will increase national security and help tackle the country’s debt. The bill has been introduced in the House and is yet to be debated on and passed.

More Bitcoin Adoption Worldwide?

More and more nations are becoming open to creating a Bitcoin reserve for national and financial security. President Trump made it a mission to strengthen the US digital asset industry. Trump signed an executive order within weeks of entering office to create a digital asset reserve for the US. The Philippines is the latest country in an ever-growing list to consider creating a strategic Bitcoin reserve.

Bitcoin (BTC) is the best-performing asset of the last decade and a half. The asset was once shunned by the mainstream finance. Today, more and more nations and financial institutions are opening their doors to BTC.

Bitcoin (BTC) has also entered mainstream discussions after the launch of 11 spot ETFs last year. ETF inflows have led to the asset gaining substantial steam over the last year. BTC has hit multiple all-time highs over the past few months. The asset hit its most recent peak of $124,128 on Aug. 14.

Also Read: BlackRock ETF Flips Coinbase as Top BTC Holder With 781K Bitcoin

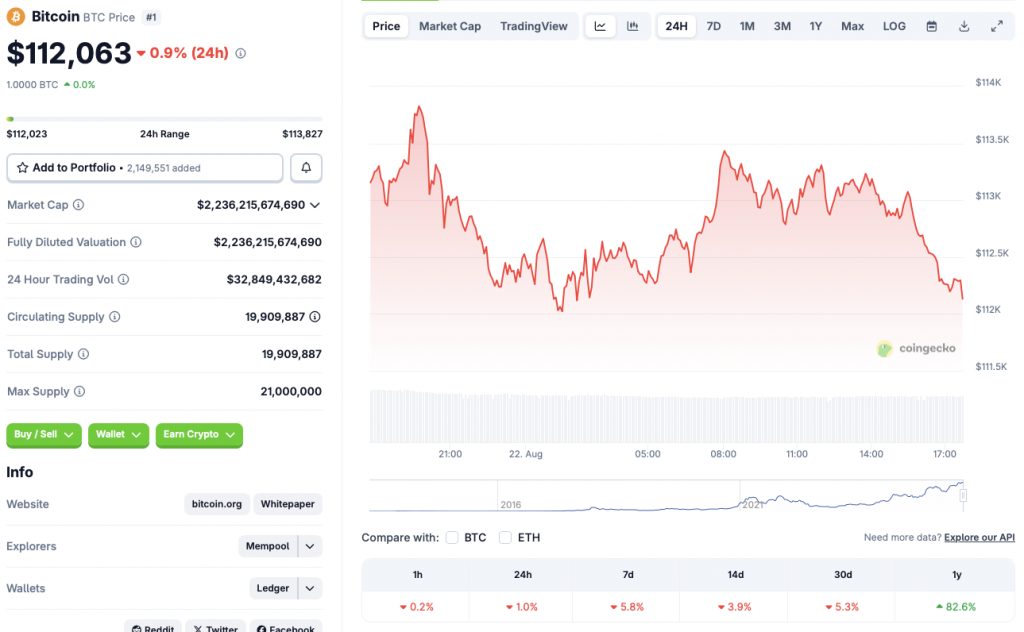

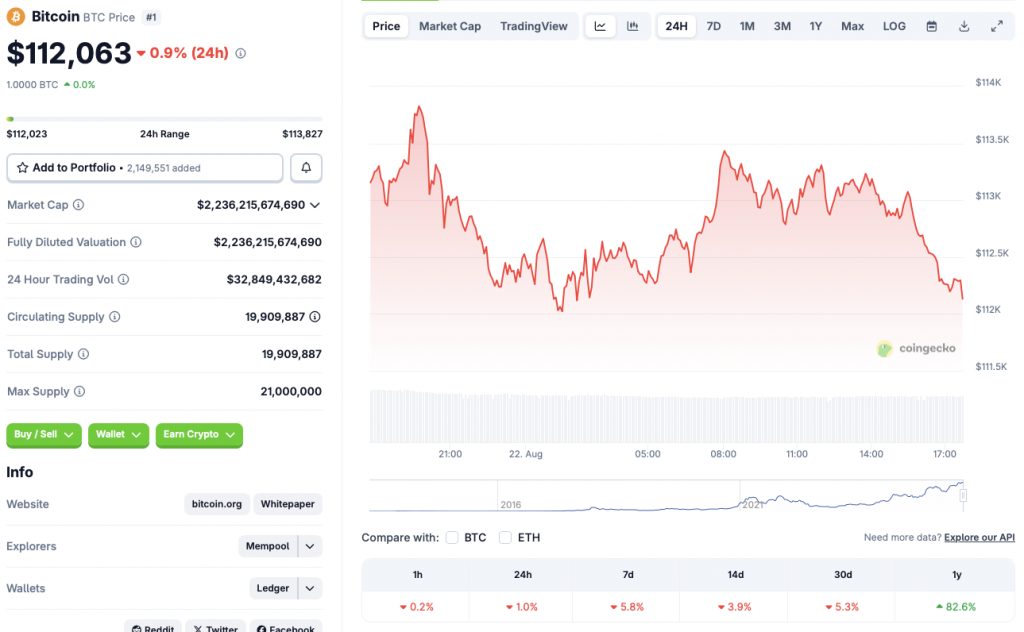

Bitcoin (BTC) has faced a steep correction in the last week due to economic uncertainties. According to CoinGecko data, BTC’s price has dipped to the $112,000 level after its recent climb to a new high. The asset is down 1% in the last 24 hours, 5.8% in the weekly charts, 3.9% in the 14-day charts, and 5.3% over the previous month.

The correction could be due to market participants awaiting the Federal Reserve’s Jackson Hole meeting. The meeting will discuss how the US monetary policy will shape up. A hawkish stance from the Federal Reserve could lead to Bitcoin (BTC) facing further corrections. A dovish stance could trigger another bullish leg for the asset.