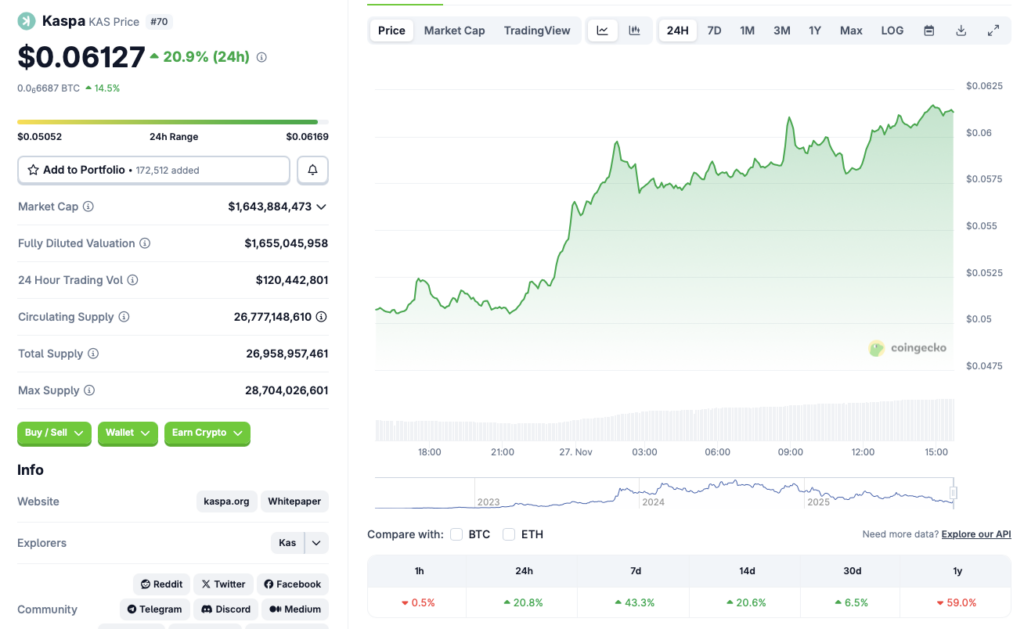

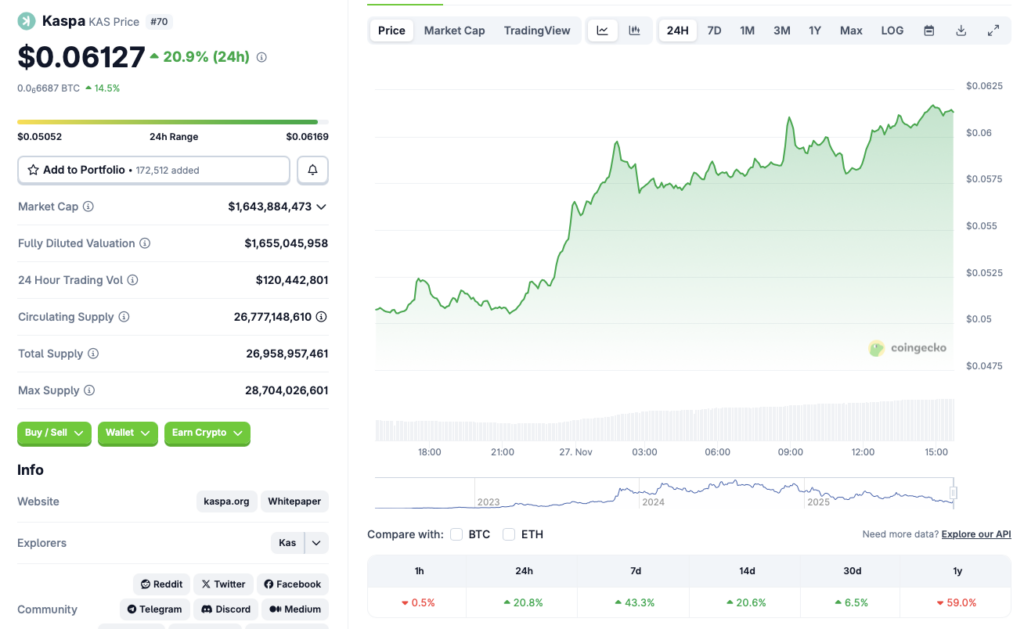

Kaspa is currently one of the best-performing crypto assets, registering a 20.8% price rally in the last 24 hours, according to CoinGecko’s KAS data. KAS is also up by 43.3% over the last week, 20.6% in the 14-day charts, and 6.5% over the previous month. Despite the upswing, KAS’s price has dipped by 59% since November 2024. Let’s discuss why KAS’s price is up, and if the rally will continue over the coming days.

What’s Behind Kaspa’s Price Rally? Can The Rally Sustain?

According to Kaspa-focused X user “Kaspa Builders,” whales had been aggressively purchasing KAS during the market dip. The post notes, “While the market is shaking out weak hands, the top $KAS holders are quietly loading up millions of coins.“

Whales buying Kaspa (KAS) amid the crash may have led to the massive price surge. Moreover, the larger crypto market also seems to be recovering from the recent market dip. Bitcoin (BTC) is on the verge of hitting $92,000, after its recent descent to $82,000. Investor sentiment is also improving amid bullish signals.

Kaspa’s (KAS) price rally may have been further propelled by improving macroeconomic conditions. The chances of another interest rate cut in December have significantly increased over the last few days. According to CME FedWatch, there is an 85% chance of a 25 basis point interest rate cut in December of this year. Moreover, there is a lot of talk about Federal Reserve Chair Jerome Powell being replaced by Kevin Hassett. Hassett has been quite vocal about wanting to lower interest rates further. Kaspa (KAS) and the larger crypto market could experience a massive price surge if the Federal Reserve rolls out another rate cut in 2025.

Also Read: S&P Correction Looms: Raymond James Says Market Could Fall 10%

However, there is always the chance that Kaspa (KAS) will face a correction over the coming days. The market could experience fresh volatility after the Thanksgiving holiday, which could lead to substantial price dips.