Post 13 June’s 15% daily dip, Bitcoin has mostly been consolidating. Initially, it kept revolving in the $20-22k bracket, while after that it dunked lower to the $19k to $21k range. On a couple of days, it did form wicks that extended as deep as $17.6k. However, it managed to keep its boat afloat on most other days.

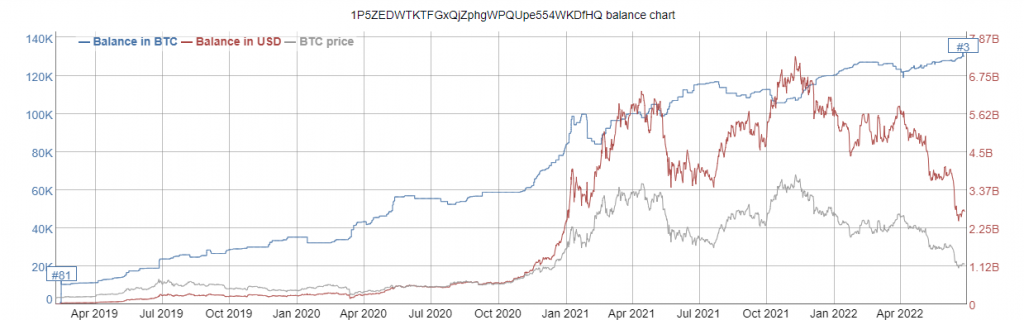

The said range has acted as an attractive accumulation zone. The world’s largest non-exchange whale, for instance, carried forth a host of massive transactions in the afore-highlighted period, bringing up its aggregate balance to $2.8 billion.

Per data from BitInfoCharts, the participant’s address added more than 2500 BTC [2554, to be precise] since mid-June. Its biggest purchase of 565 Bitcoin was made on 23 June at $19.9k. On other days, the transactional volume oscillated between 36 BTC to 488 BTC.

Notably, in terms of overall rankings, this whale ranks third, only behind the exchange wallets of Binance and Bitfinex.

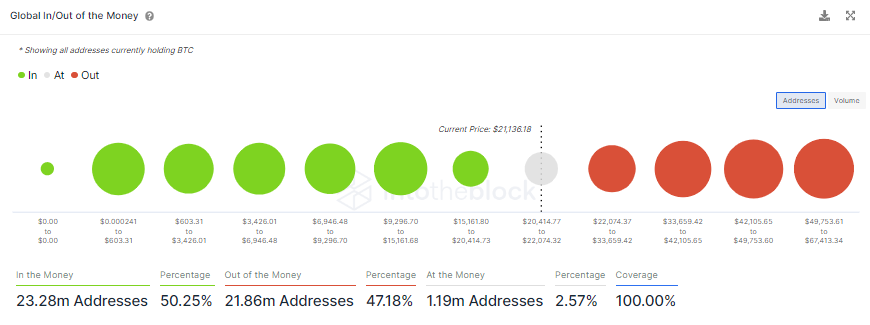

Alongside, it should be noted that Bitcoin has a significant immediate support. As per ITB’s data, in the band extending from around $15k to $20k, over 1.55 million addresses have bought approximately 900k BTC. All these participants are ‘in’ the money, or in profits, making it good support to rely upon.

Others join the Bitcoin accumulation tribe

One of Santiment’s latest tweets brought to light that traders had encashed on the dip by shorting Bitcoin. Notably, altcoins were “only” targeted by them in their ‘against’ bets. As can be noted below, Bitcoin’s funding rate has mostly remained neutral of late. For alts, however, the rate has clearly been in a downtrend.

Chalking out the implication of the same, Santiment asserted,

“Bitcoin is being flocked to as the safe haven.”

Joining all the above dots, it becomes quite clear that investors are doing their job by accumulating Bitcoin for the long run. Bitcoin traders are, however, staying away from the market, and are perhaps waiting for the ongoing trend to become decisive before placing new bets.