The last day of February began on a lackluster note for Bitcoin and by extension, the altcoin market. As a result, the majority of DeFi tokens were trading in the red, with the overall market cap slipping by 3.65% to $128 Billion. However, Uniswap seemed to be defying the broader market trend. The alt was doing all the heavy lifting and was the only token trading in the green among its top 10 DeFi counterparts.

Ethereum and BSC turn heads towards Uniswap

The latest surge in price came at a time when Ethereum and BSC whales turned their attention to Unsiwap. As per Whalestats, Uniswap was the most widely held token among the top Ethereum wallets over the last 24 hours.

Furthermore, the network was the most used DeFi smart contract among the top 1000 BSC wallets in the same time window, overtaking altcoin leader Ethereum. The cumulative gas consumed on the Uniswap network spiked by over 260% – showing a renewed interest by BSC whales.

Total Value Locked Is Moving Upwards

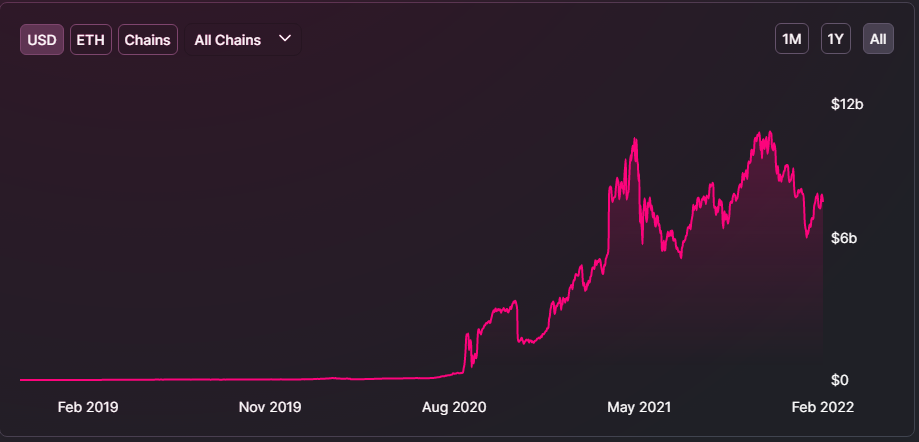

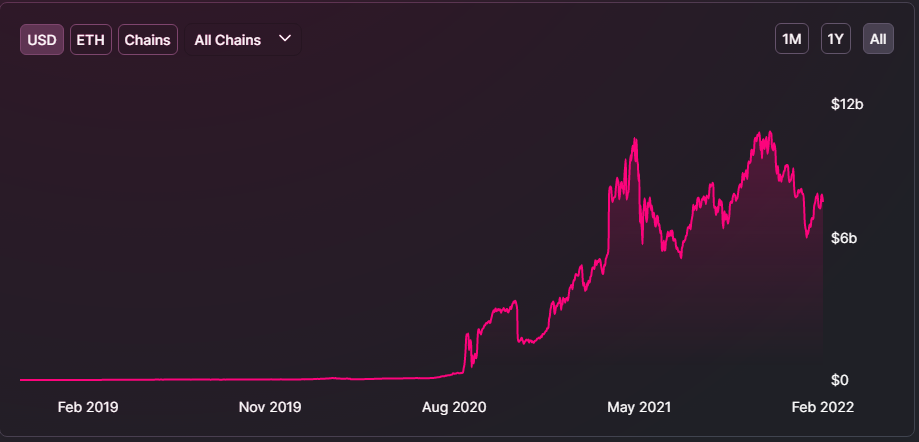

Meanwhile, the network’s TVL has ticked up meticulously during February, touching $7.5 Billion at press time. TVL, or ‘total value locked’, represents the overall value of crypto assets deposited in all the functions that a DeFi protocol offers, such as staking, lending, and liquidity pools. While the metric can fluctuate along with UNI’s market value, the TVL has consistently recovered in February even though UNI was down by 14% during the month. This meant that the TVL was growing largely due to an increased number of deposits on the network.

Uniswap Trending on Social Media Platforms

Uniswap’s numbers did not go unnoticed in the community. LunarCrush showed that the network’s weekly social dominance spiked by over 2,000%, grabbing the spotlight within DeFi tokens. Healthy social volumes and dominance increase buying euphoria among market participants, which often leads to fresh peaks on the chart.

Uniswap Daily Chart

Speaking of charts, bulls were injecting life into Uniswap’s market after the price fell to a 1-year low on 24 February. The resulting move coincided with an oversold RSI – a reading which offers a discounted buy opportunity for traders. However, bulls had to offer more for an extended recovery. The price would be viewed as bearish by a majority of traders until a key resistance at $14 is overcome by bulls.

Low activity on Uniswap’s DEX

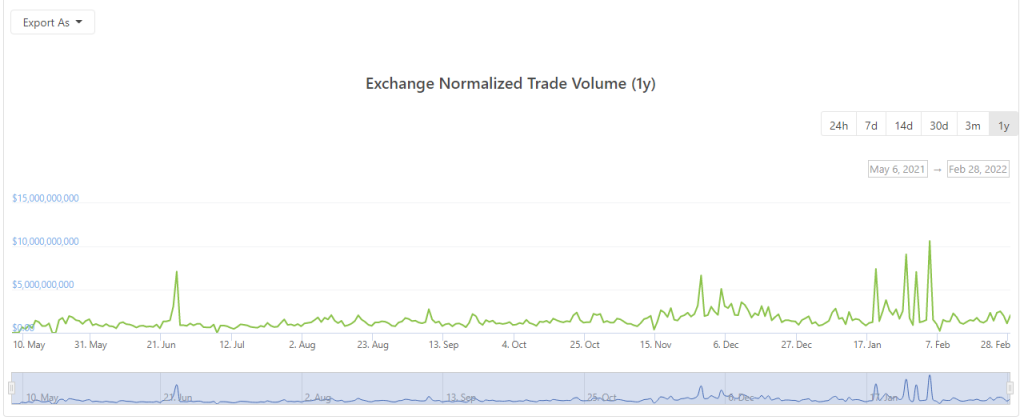

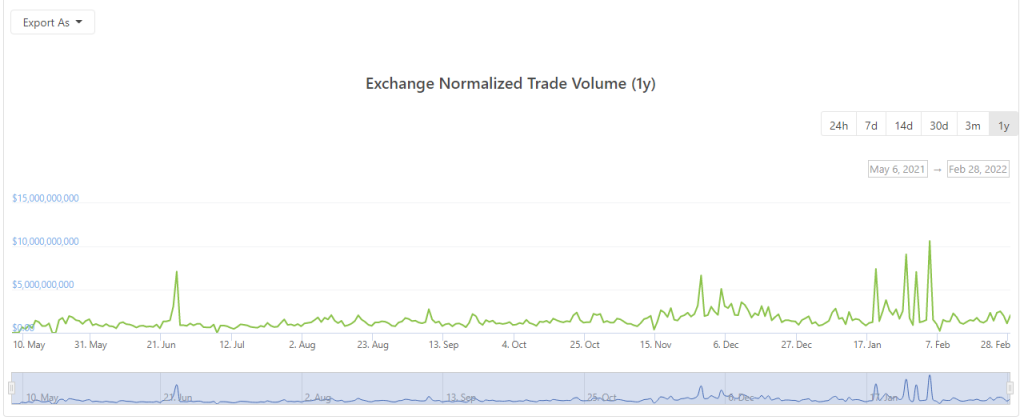

At the same time, a few other metrics would also need to start showing signs of improvement. For instance, users have avoided trading on the Uniswap exchange for the most part of February. As per CoinGecko, the exchange’s normalized trading volume remained bleak, averaging at $1.7 Billion per day over the past three weeks as compared to peaks of $9 Billion and $10 Billion seen during Jan-end and early-Feb.

Conclusion

Uniswap is on the right track to rebuild its price, grabbing the attention of whales and social media users. However, trading volumes on the Uniswap DEX remain low and the network would need to pick up on all fronts for a more organic rally.

At the time of writing, UNI traded at $9.8, up by 11% over the last 24 hours.