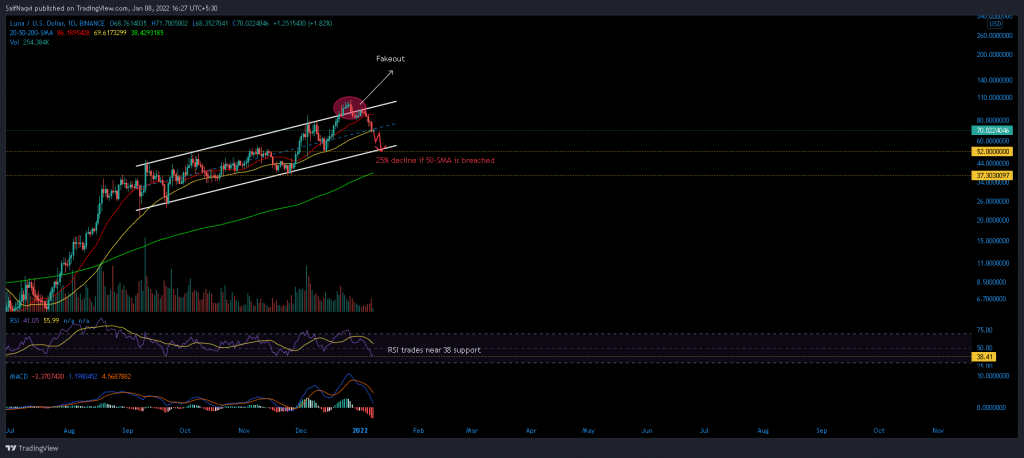

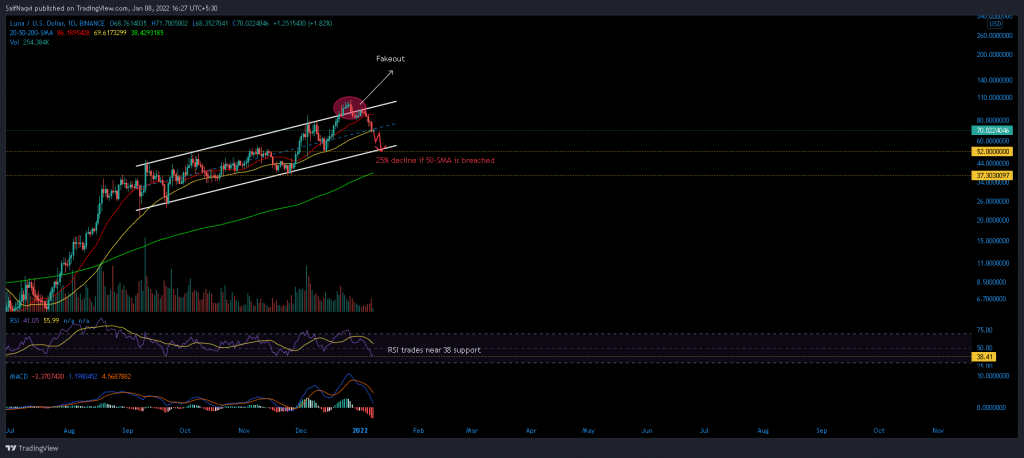

LUNA’s price was on the edge of a threatening sell-off after a breakout attempt failed a week ago. Should the price weaken below the daily 50-SMA (yellow), an additional 25% decline could develop in the coming weeks. At the time of writing, LUNA traded at $70.1, down by 2.67% over the last 24 hours.

Terra (LUNA) Daily Timeframe

LUNA’s up-channel has extended since September 2021 as the price continued to form a series of higher highs and higher lows. A failed breakout or ‘fake out’ was observed a week ago after the price attempted to close above the upper trendline on weak buy volumes. Now back within the confines of its channel, LUNA’s price hunted for support at the 50-SMA (yellow).

The daily 50-SMA (yellow) has been quite significant, offering support on multiple occasions during LUNA’s run up since September. Should LUNA weaken below the confluence of its 50-SMA (yellow) and the channel’s mid-line, a 25% sell-off could grip the market. The outcome would see LUNA make way to the bottom trendline of its channel around $52. In fact, bulls could suffer another catastrophic loss of if sellers push the price below $52. New longs at the daily 200-SMA (green) would then be LUNA’s best chance of a recovery.

Indicators

The daily RSI traded below 45 and provided more assistance to sellers than buyers. However, the RSI has established a support region around 38 in the recent past and an extension towards the oversold territory was not a guarantee.

Similarly, the MACD was amidst a steep decline but optimism would remain as long as the index continued to trade above its mid-line.

Conclusion

The RSI and MACD needed to develop further to call a market direction. For the moment, LUNA’s 50-SMA (yellow) could minimize losses going forward. However, expect a 25% sell-off if this MA is breached by sellers.