Squid Game token has come to an end as developers rug pull the project leaving investors teary-eyed and heartbroken. Investors were locked out of their own portfolio and were unable to withdraw their funds as it plunged.

The scammers behind the coin plundered $2 million from investors in just 35 minutes and made away with the bounty. Squid coin started modestly with a price of $0.01 and in just three days, it spiked to $4.42, that’s a +44,100% rise.

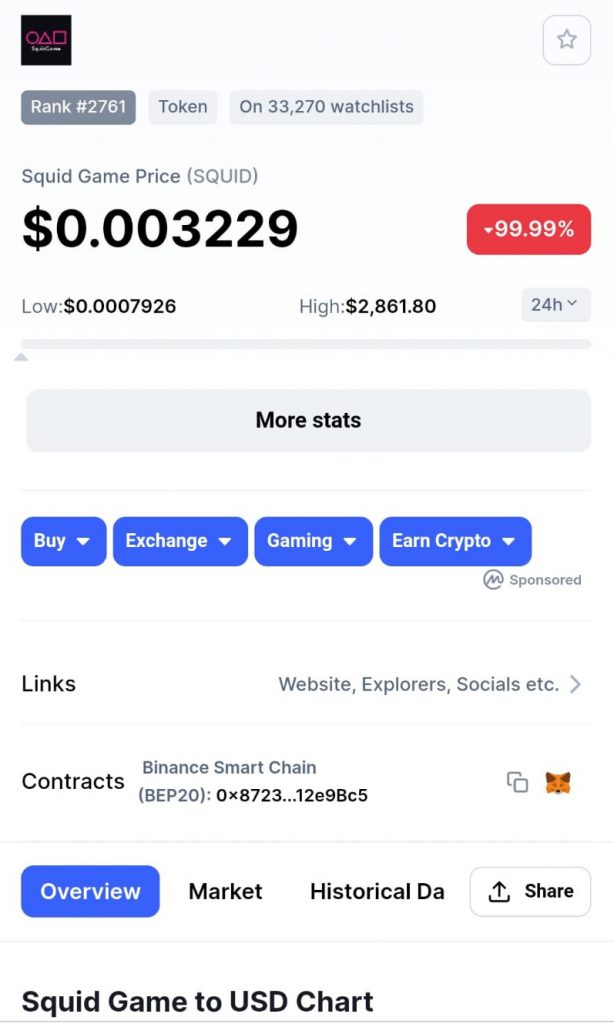

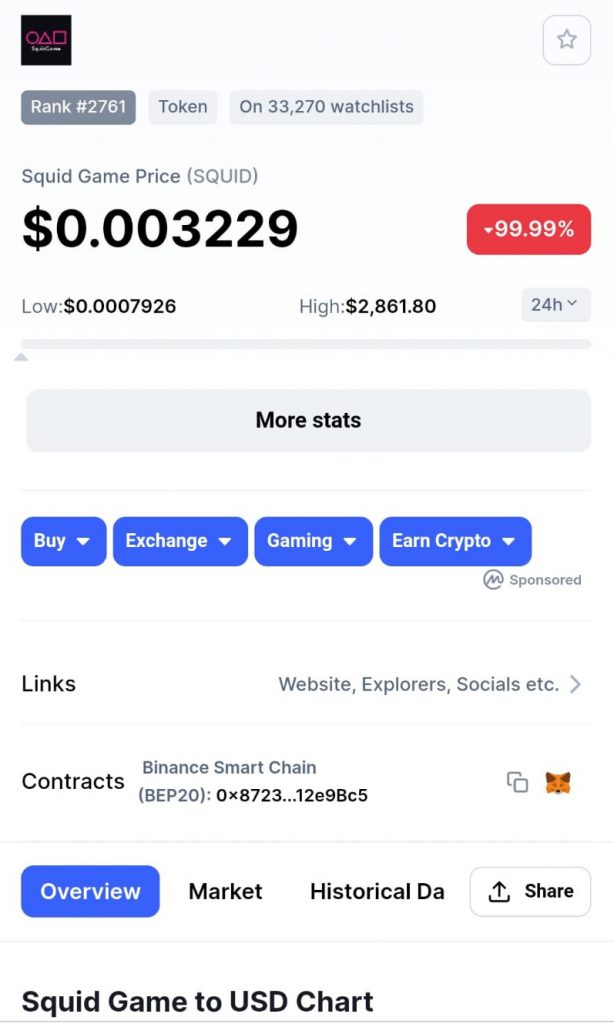

The phenomenal rise grabbed the eyeballs of top news outlets like BBC and CNBC who gave coverage to Squid. Days later, the coin climbed to an unimaginable new all-time high of $2,861 with a +2,30,000% rise. Add to that, the Netflix series Squid Game made the coin even more popular.

Squid Token: Then Disaster Happened

Just when Squid reached $2,861 on November 1, 2021, and investors rejoiced for making generational wealth, the disaster occurred immediately. The coin slumped to $38 in just a second, giving hint to investors that something isn’t right.

That is when investors tried to sell their holdings only to see they were locked out of their own portfolios. An hour later it touched $90 and another hour later it reached $181 and $523 subsequently.

Minutes later and to everyone’s horror, Squid then slipped -99.99% wiping away everyone’s investment. Squid’s website was pulled down by the developers and they vanished in thin air without a trace.

Squid stood at its last yet untradeable price of $0.003386 with a -99.99% crash. The coin gave a reality check to investors that not everything in the crypto market that glitters is gold.

I Lost My Life Savings, I Lost Everything

A shocked investor spoke to CoinMarketCap saying that he lost his entire life savings in Squid. ”The price was multiplying at an abnormal level. And as I was staring at my computer screen, I watched SQUID fall down in a matter of minutes. There was no way to withdraw my funds intact.”

The investor says he doesn’t blame anyone else for the disaster but himself. ”I guess this will serve as a valuable lesson for me to not just jump into meme coins. I am not blaming anyone except myself, but I think there must be some mechanism to avoid this in the future, and for news outlets to stop giving attention to these scammer type tokens.”

Watcher Guru advises investors to scrutinize the newer coins popping up in the marker and not blindly jump into tokens that promise the moon.