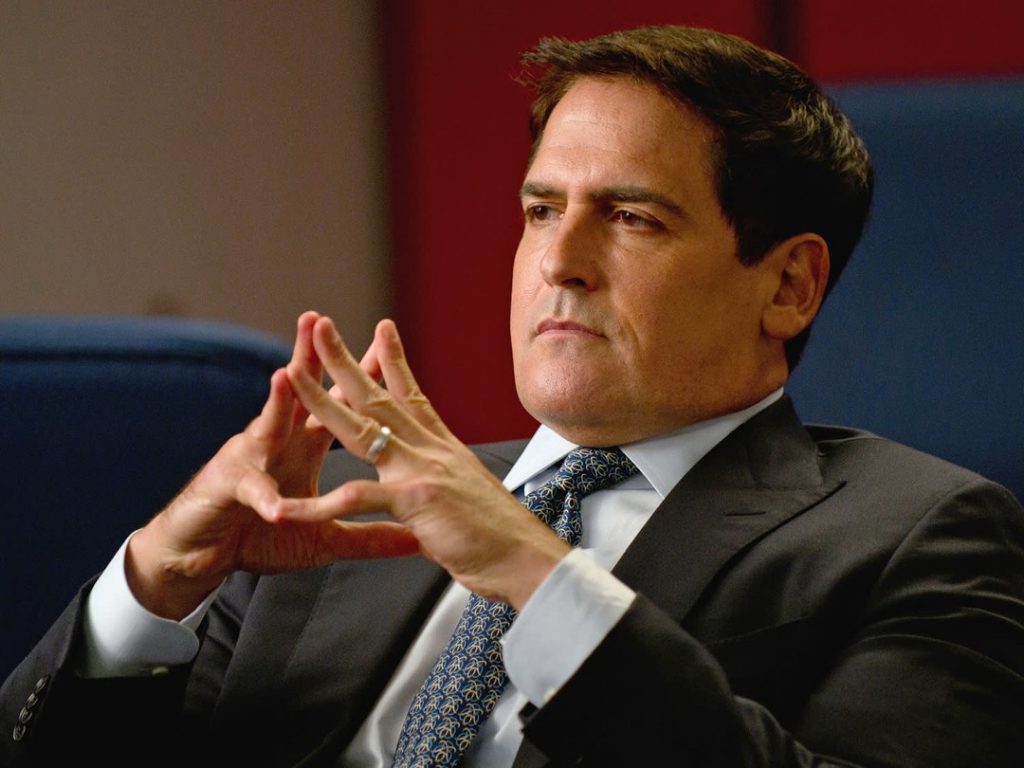

In a series of posts to X (formerly Twitter), Shark Tank star Mark Cuban called out the US Securities and Exchange Commission (SEC) for their crypto regulation tactics. Indeed, the owner of the NBA’s Dallas Mavericks did not mince words when he noted the ineffectiveness of the agency in its primary goal.

Within the post, Cuban said the agency was “really, really bad at protecting investors from scams.” Moreover, he championed the digital asset regulation approach of Japan. Using the Mt. Gox situation as the basis for his argument, he noted the ability of Japanese regulators to learn, adapt, and advocate innovation. Whereas Cuban berated the inability of the US to do anything remotely similar.

Also Read: Mark Cuban Warns Over ‘Unprecedented’ Post-Bitcoin Halving

Mark Cuban Calls Out SEC for Crypto Approach

Over the last several years, the dissension between the digital asset market and United States regulators has only increased. Indeed, the government agency has continually opted for regulation through an enforcement approach. Subsequently, it has encouraged disclarity and confusion, as well as an increase in lawsuits levied on various companies operating in the country.

Now, one of the most prominent entrepreneurs in the country has spoken out. Longtime cryptocurrency advocate and Shark Tank star Mark Cuban took to X to berate the SEC for its crypto regulation. Specifically, he compared it to Japan’s approach, illustrating an immense dichotomy between the two countries.

“Japan famously learned from Mt. Gox and renovated their regulation so that when the largest failures in crypto history happened, they didn’t hurt Japanese stakeholders,” Cuban said in his post. “The SEC didn’t learn [expletive]. Not a [expletive] thing when Mt. Gox happened,” he added.

Also Read: SEC Challenges Ripple (XRP) Defense In Final Response

Additionally, Cuban said the SEC is “still so stupid to think the mere process of registration protects investors. Th only actions they take are after the facts. See Madoff. See FTX. See Chinese stocks.”

Thereafter, Cuban said that even the most harmful scam tokens that the SEC is seeking to regulate “haven’t lost as much money” as penny stocks that trade in bankrupt companies. Finally, the NBA owner expressed his opinion on the performance of the agency regarding its chief call.

“My point is that the SEC is really, really bad at protecting investors,” he stated. Finally, he professed, “And as bad as I think they are, they are probably worse.” Conversely, the statement is certainly an indictment of how many feel the agency has approached the regulation of cryptocurrencies over the last year.