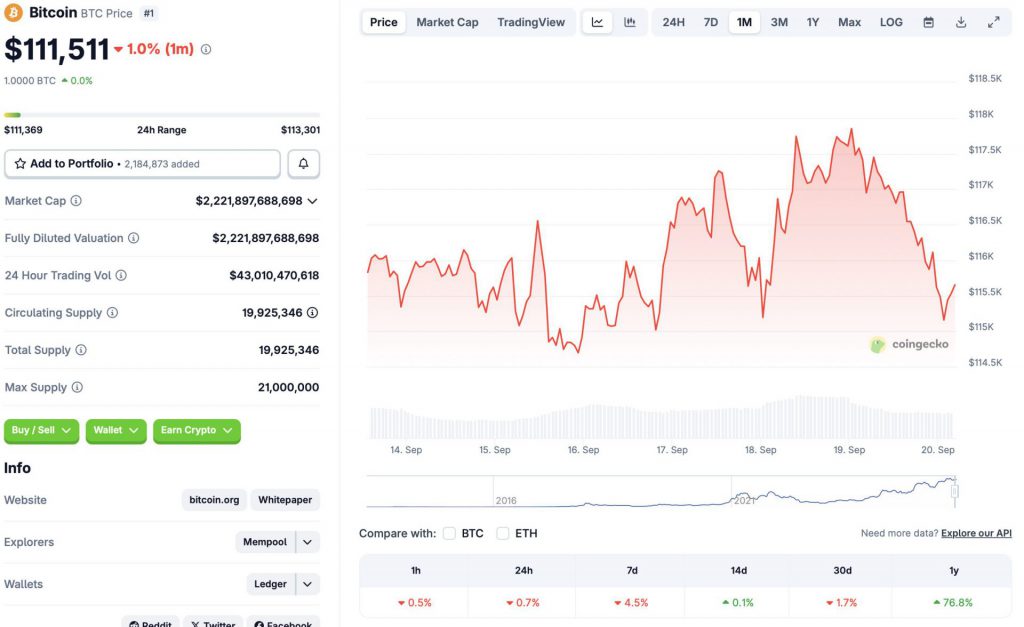

The cryptocurrency market is facing a substantial crash after a brief rally last week. Bitcoin (BTC) has fallen further to the $111,500 price level. According to CoinGecko data, Bitcoin (BTC) has fallen 0.7% in the last 24 hours, 4.5% in the last week, and 1.7% over the previous month. Despite the steep correction, BTC is up 0.1% in the 14-day charts and 76.8% since September 2024.

Why Is The Crypto Market Falling?

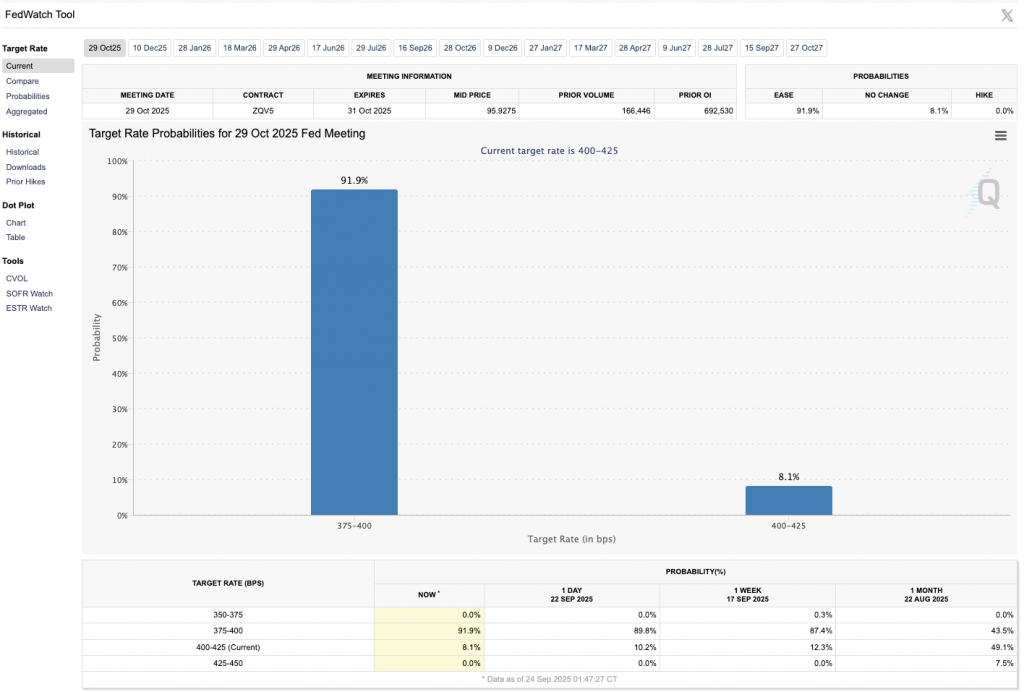

Bitcoin’s (BTC) downturn comes despite an interest rate cut earlier this month. The Federal Reserve slashed interest rates by 25 basis points, leading to a brief market rally, before this week’s correction. Federal Reserve Chair Jerome Powell delivered a speech yesterday, where he stated that weakness in the labor market is outweighing concerns about stubborn inflation. The development prompted the Fed to cut interest rates.

Powell further stated, “Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation. Two-sided risks mean that there is no risk-free path.”

The uncertain path may have led to a dip in investor sentiment. Bitcoin (BTC) and the larger crypto market may have succumbed to the Fed’s slightly restrictive stance.

Will Bitcoin Fall Below $100,000?

According to CoinGlass data, the crypto market faced $292.30 million worth of liquidations in the last 24 hours. If the liquidations continue, Bitcoin (BTC) could continue its downward trajectory.

Bitcoin (BTC) has some support at the $112,000 price level. BTC’s price may consolidate around current levels for the time being. If BTC dips below $110,000, it would face substantial risks of falling to $100,000.

Also Read: Arthur Hayes Lays Out How Bitcoin Can Hit $3.4 Million

There is a chance that Bitcoin (BTC) will recover over the coming weeks. The CME FedWatch tool hints at a 91/9% chance of an interest rate cut in October. Another interest rate cut could trigger a market-wide rally. Such a development could push Bitcoin’s (BTC) price to a new all-time high.