Polygon’s MATIC was due for a brief correction after showing signs of weakness above $1.75. Areas of support stretched to $1.45, below which MATIC would slip within a bearish bias. At the time of writing, MATIC traded at $1.78, up by 3.8% over the last 24 hours.

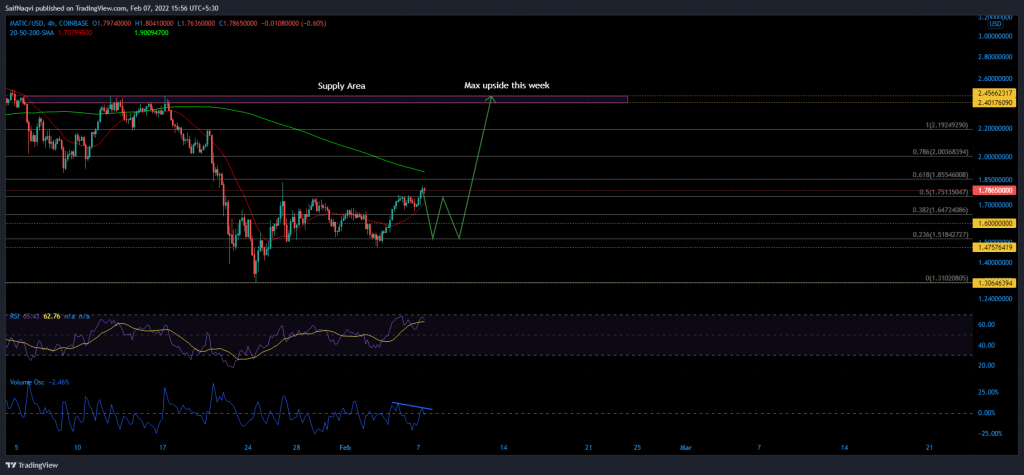

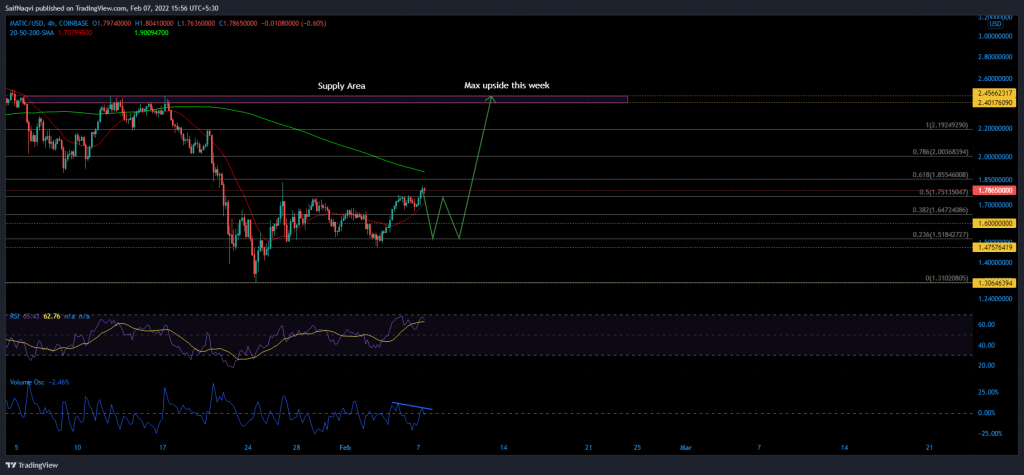

MATIC 4-hour Time Frame

A double top setup on the 4-hour RSI has put MATIC in jeopardy of a near-term correction before the price can advance above its 61.8% Fibonacci level. The zone between $1.75-$1.51 could be home to its price over the next few days as bulls gather strength for a breakout. Chances of an immediate upswing were slim, especially after two lower peaks on the Volume Oscillator created a bearish divergence.

To maintain a favorable outlook, it was important for MATIC to uphold its streak of higher lows above $1.45. A fresh lower low would invalidate the present uptrend and call for a retest of $1.30 support.

Should the price action play out as expected, bulls would challenge the $2-mark after setting up a close above the 200-SMA (green). In either case, upside this week would likely be capped between $2.45-$2.40 supply zone.

Profit-booking?

Meanwhile, data from IntoTheBlock showed that over 160K addresses were profitable at MATIC’s current level, in comparison with 134K addresses which were running at a loss. Since a majority of holders were in the green with their tokens, the market was highly susceptible to profit-booking. Hence MATIC’s short-term trajectory carried more of a bearish threat than chances of an extended rally.

Conclusion

MATIC’s strings could be pulled between $1.75-$1.51 before bulls accumulate numbers for a move above $2. However, the outlook would shift in favor of bears in case of a close below $1.45-support.