Polygon’s MATIC has had a rough outing off late as cryptocurrencies witness a period of corrections. Between 7-24 January, its value has depleted by 45%, with its price sliding below $1.50 for the first time since November 2021. This begs the question- is it time to buy its dip?

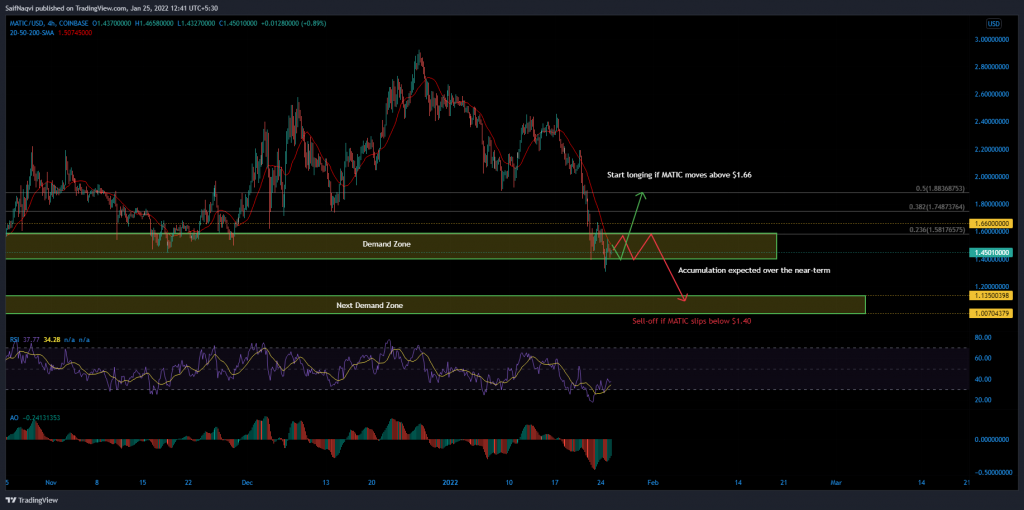

MATIC 4-hour time frame

A closer look at MATIC’s chart showed that its price was trading within a demand zone between $1.60-$1.40. Demand zones are certain areas on the chart where buyers are concentrated in large numbers. These zones hold up as support and usually trigger bull runs as well.

READ ALSO: Is it time to bet against MATIC’s ‘bearishness’?

However, a few observations need to be considered before buying MATIC at its press-time level. For instance, the candles were trading below their daily 200-SMA (not shown) and the 4-hour 20-SMA (red). This meant that the alt was within a short term and long term downtrend and sellers maintained a firm grip on the market. Secondly, MATIC has strung together a chain of lower highs since 17 January; a finding that often dissuades investors from taking up long positions.

With Bitcoin’s recovery looking unsure as of now, most alts, including MATIC were shrouded with uncertainties. Hence, the current demand zone was not guaranteed to trigger a reversal just yet. Observers should wait and see if it can force a close above its daily 200-SMA and 23 January’s swing high of $1.66 before making any kind of bullish bets.

READ ALSO: KuCoin Adds SOL/UST and MATIC/UST Trading Pairs

Indicators

MATIC’s near-term was reinforced by a couple of buy signals on its 4-hour indicators. The RSI was in oversold territory while the Awesome Oscillator formed a bullish twin peak setup. While new longs can hold MATIC within its current zone, bulls would need to push above $1.66 for any kind of an uptrend.

Conclusion

Buying MATIC at its press-time depends on some strict conditions and is not advised for the risk-averse. Another buying opportunity would come to light if the price shifts to its next demand zone between $1.15-$1.00.