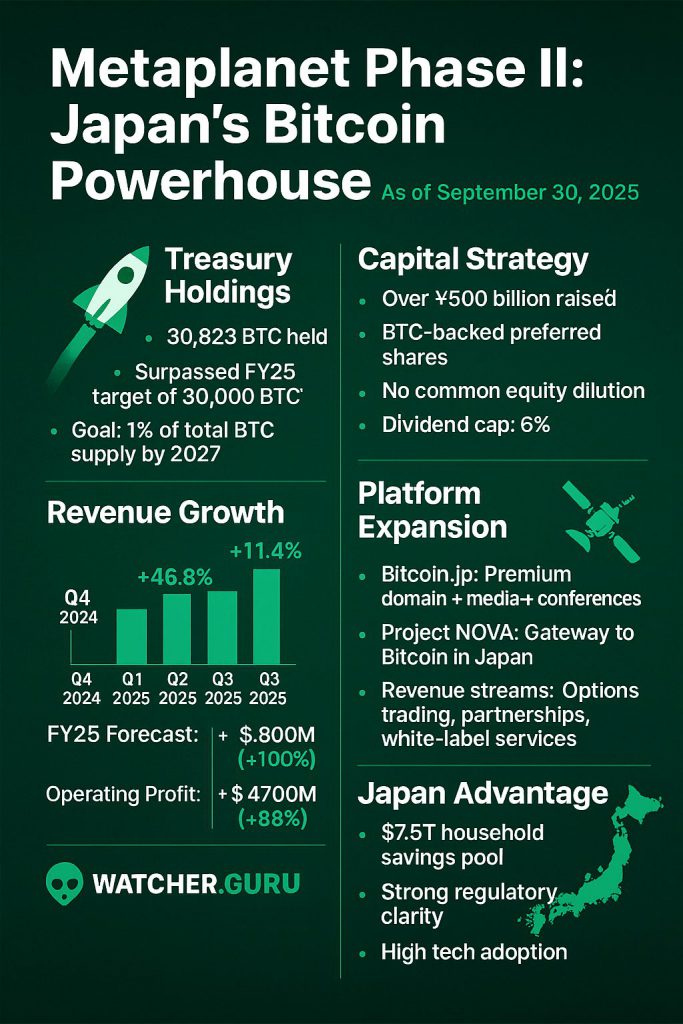

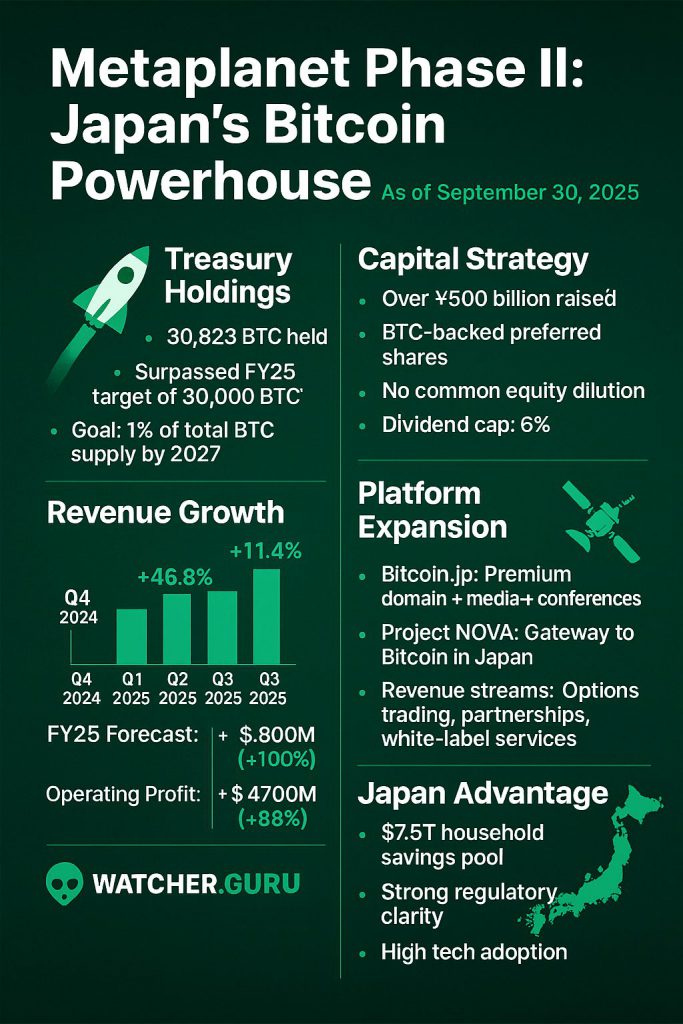

Metaplanet’s Bitcoin purchase of approximately $600 million has positioned the Japanese firm as the fourth-largest publicly listed Bitcoin holder globally right now, with total Metaplanet Bitcoin holdings now reaching 30,823 BTC. This Metaplanet Bitcoin acquisition marks a significant milestone in corporate cryptocurrency adoption, and it also establishes the company as a leading Metaplanet corporate Bitcoin holder in Asia. The strategic Metaplanet Bitcoin treasury expansion comes alongside record financial performance, along with some ambitious plans for continued Metaplanet Bitcoin purchase activity through 2027.

Metaplanet’s Strategic $600M Bitcoin Acquisition Boosts Holdings to 30,823 BTC

This most recent Metaplanet Bitcoin acquisition places the company in the top 30,823 BTC of stocks of Metaplanet Bitcoin in the world, ranking it among the top corporate Bitcoin holders, alongside MicroStrategy, Marathon Digital, and even Riot Platforms. This Metaplanet Bitcoin acquisition has been carried out by strategic financing and cash reserves.

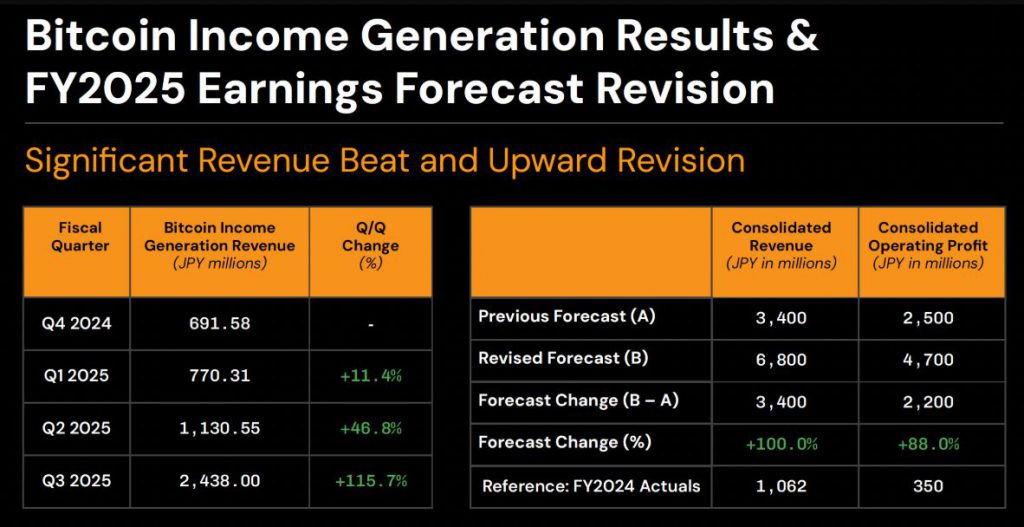

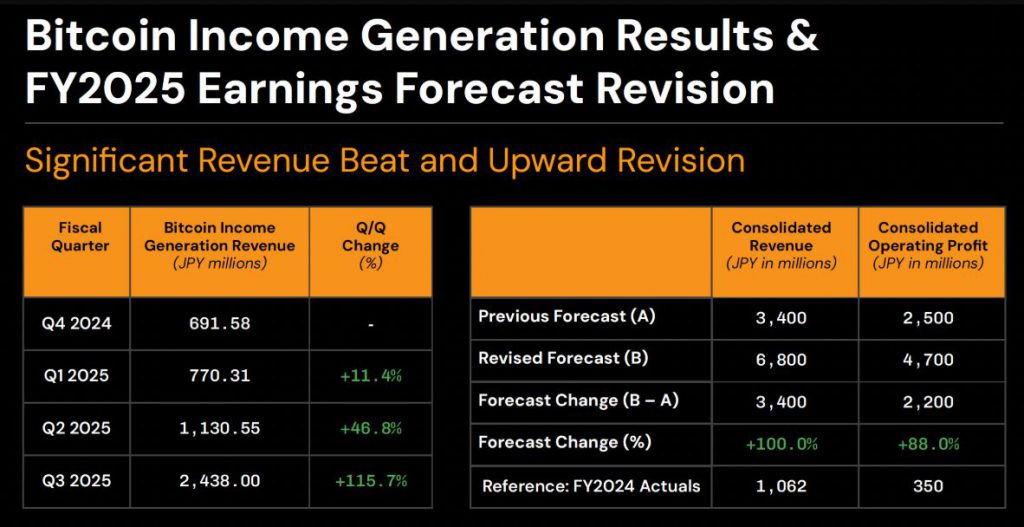

Record Revenue Supports Bitcoin Treasury Growth

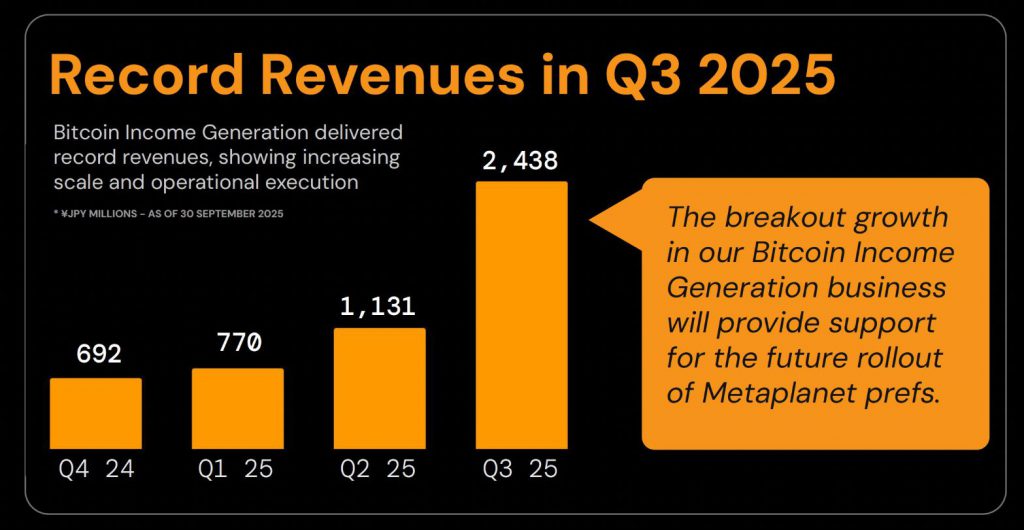

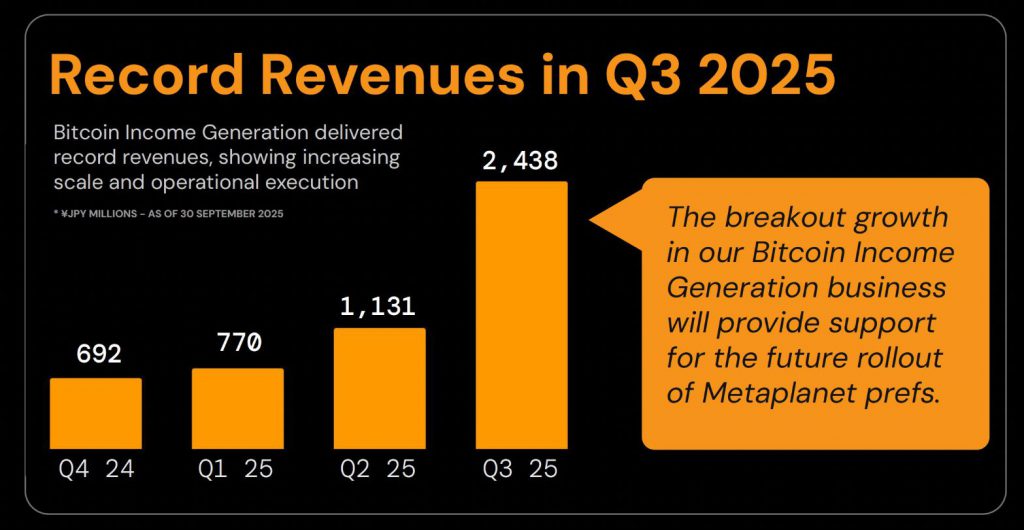

Metaplanet’s Bitcoin Income Generation segment has delivered exceptional Q3 2025 results, actually recording ¥2.438 billion in quarterly revenue. At the time of writing, the company has revised its FY2025 consolidated revenue guidance to ¥6.8 billion, which represents a 100% increase from previous forecasts, and operating profit projections have been increased to ¥4.7 billion as well.

CEO Simon Gerovich stated:

“Based on Q3 performance, we have revised our FY2025 consolidated guidance.”

Also Read: Metaplanet’s $5 Billion Bitcoin Bet Surpasses Coinbase Holdings

$5.4 Billion Capital Raise for 210,000 BTC Target

The Metaplanet corporate Bitcoin holder has announced an expansion of its Metaplanet Bitcoin treasury thus adding 750 billion yen (estimated 5.4 billion U.S. dollars) in the coming three years. The company is already targeting 210,000 BTC by the close of the years 2027, and this is almost seven times more than what Metaplanet Bitcoin holdings is currently.

Gerovich had this to say:

“The breakout growth in our Bitcoin Income Generation business will provide support for the future rollout of Metaplanet prefs.”

The company’s “Phase 2” strategy actually focuses on scaling complementary business lines to support ongoing Metaplanet Bitcoin purchase activity, along with increasing perpetual preferred issuance capacity.

Also Read: Metaplanet Issues $208 Million Bonds To Buy More Bitcoin