Michael Saylor’s Bitcoin insights show how digital assets are changing the way we store and move wealth. His research on Bitcoin’s growth potential and views on BTC adoption make a strong case for the digital future. His work on Bitcoin as a store of value has changed how big companies invest.

Also Read: Indian Rupee Nosedives to New Lows After Trump Threatens 100% Tariff

Explore Michael Saylor’s Bitcoin Vision: Growth, Adoption, and Global Impact

The Digital Capital Revolution

“Digital capital is the ability to move money at the speed of light anywhere on earth and program it on a computer,” Michael Saylor emphasizes. He elaborates: “What happens when your long-term store of value goes from a building or goes from a portfolio of stocks to a digital asset like Bitcoin? Bitcoin represents the digital transformation of hundreds of trillions of dollars of capital in the world.”

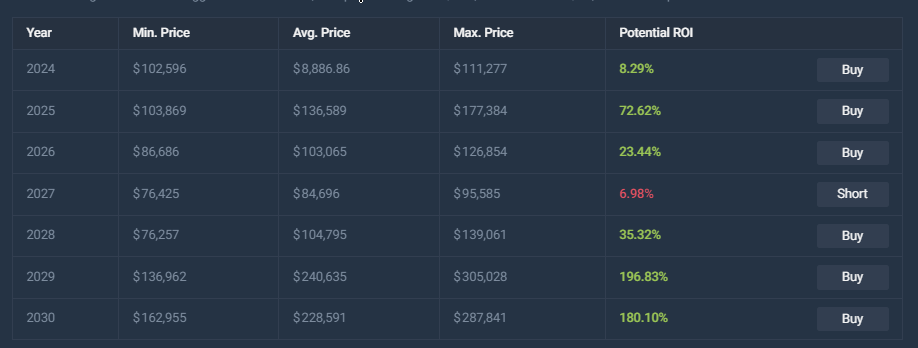

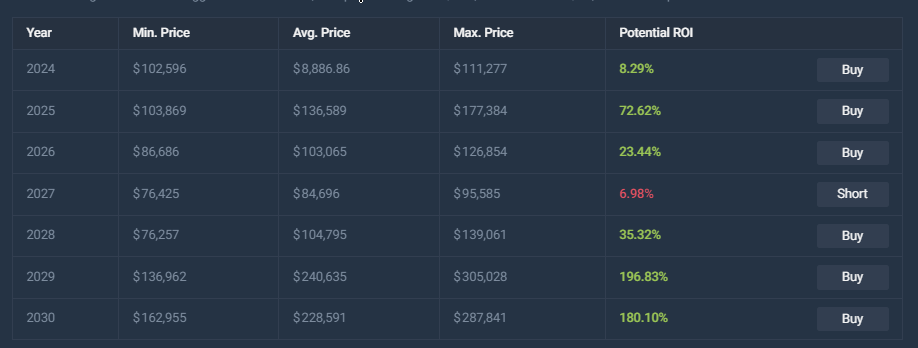

Growth Projections and Value Potential

Looking at Bitcoin’s future growth, Saylor sees big gains ahead: “When you crank in the growth rate, which for me the base case is 29 percent a year on average for 21 years, that gets you from where you are today to 13 million a coin in the year 2045.” He thinks Bitcoin’s total value could hit $280 trillion in twenty years.

Also Read: Ripple: AI Predicts XRP Price After SEC Chair Paul Atkins Assumes Role

Global Economic Impact

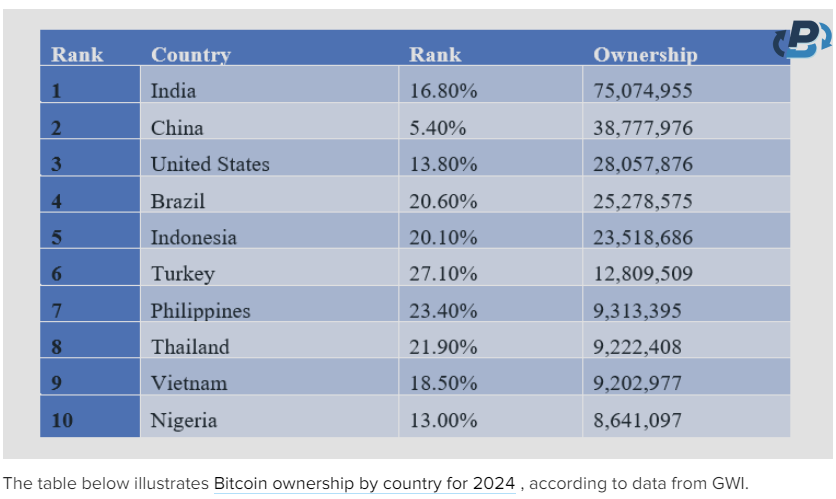

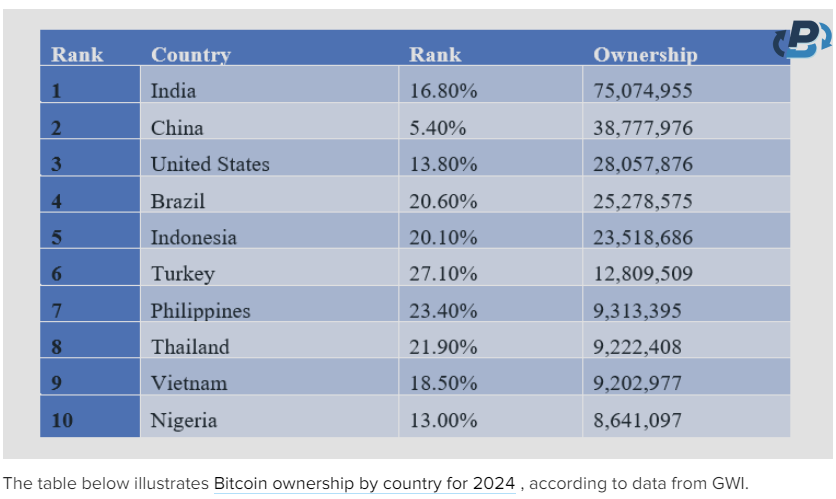

“Bitcoin is a protocol for prosperity,” Saylor declares, comparing it to foundational technologies like “fire, electricity, steel, English mathematics.” His vision positions Bitcoin adoption as particularly vital for underdeveloped nations: “If you’re a type 1 diabetic, you can eat continuously and you’ll starve to death because you cannot store organic energy. If you don’t have a capital asset like Bitcoin, I can send billions or tens of billions of dollars to Africa, you can make billions, the money will just drain out.”

The Future of Global Capital

“Bitcoin is emerging to compete with equity and real estate as world reserve capital,” Saylor asserts. Addressing digital assets’ future, he notes: “Those Africans, they can’t buy real estate in the US. They can’t buy equity in the New York Stock Exchange. It’s global capital.”

Also Read: Shiba Inu: How High Will SHIB Go When Bitcoin Hits $115,000

“Every nation that respects property rights is going to support Bitcoin,” Saylor concludes. His views show that while some countries might push back, Bitcoin keeps getting stronger as a store of value and a way to move money. Michael Saylor’s Bitcoin ideas show how wealth will work in the digital age.