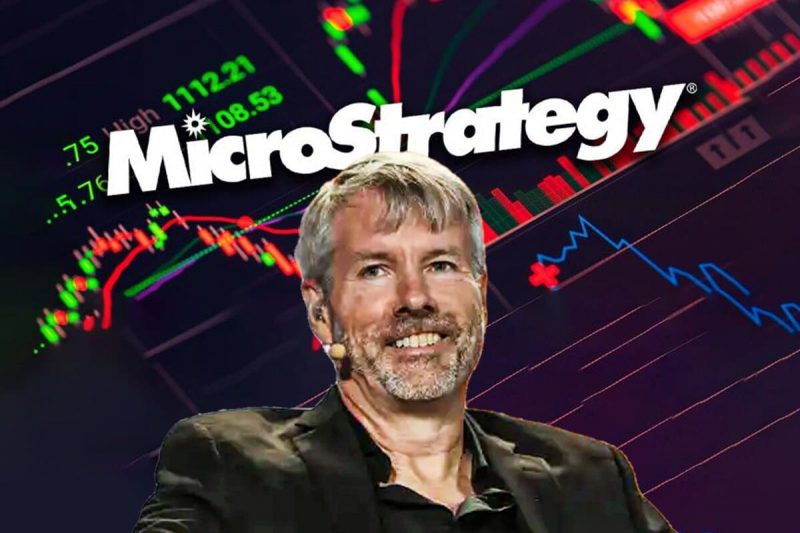

Continuing its accumulation of the cryptocurrency, MicroStrategy has purchased another 11,931 Bitcoin worth $786 million. Indeed, the Michael Saylor-led business intelligence firm has bought the BTC “using proceeds from convertible notes [and] excess cash,” the CEO said in an announcement.

The firm paid more than $65,880 per BTC purchased in its latest acquisition of Bitcoin. Additionally, the development now brings the company’s total Bitcoin holdings to more than 226,331 since it first started buying the digital asset four years ago.

Also Read: Bitcoin: Michael Saylor Reacts To Ethereum ETF Approval

MicroStrategy Adds to Bitcoin Holdings With $786 Million Purchase

Bitcoin has been one of the most talked about facets of the finance sector at this point in 2024. The US Securities and Exchange Commission approved Spot Bitcoin ETFs in January, which catapulted the token into the mainstream. Moreover, the institutional interest drove its price to an all-time high mark of $73,000 in March of this year.

Its recent ascension has proven fruitful for many individuals and entities who have been avid supporters of the asset. One of the most prominent is Michael Saylor’s MicroStrategy, which recently added to its BTC holdings with yet another purchase of more than 11,931 Bitcoin’s worth $786 million.

Also Read: Michael Saylor Says SEC Will Classify Ether As Security, Deny Spot ETFs

Altogether, its Bitcoin holdings sport a worth of almost $15 billion. Since its acquisition of the asset first began in 2020, it has bought BTC at an average price of $36,798, which is a notable discount from its current $65,400 price point, according to CoinMarketCap.

Saylor and the firm most recently followed through on an $800 million convertible note offering to investors. Originally revealed at $500 million, it was raised two more times to its eventual rate. In March of this year, the company also purchased 9,245 BTC for a total of $623 million, showing its continuous strategy in play.