Between July 1 and August 23, MicroStrategy purchased an additional 5,050 BTC consequentially bringing the company’s total holdings to 114,042 Bitcoins. The intelligence software company collectively owns Bitcoins currently worth over $7 billion. The firm that has no plans to sell the BTC has gained roughly $3.54 billion in investment.

Michael Saylor, the company’s CEO, has been at the forefront of steering MicroStrategy down the cryptocurrency investment route. This has been beneficial for MicroStrategy, which has carved out a name for itself in the crypto community and on Wall Street.

MicroStrategy Bitcoin

The company’s recent Bitcoin purchase was in September. Saylor announced MicroStrategy purchased an additional 5,050 BTC for around $242.9 million. Prior to this purchase, the company had acquired 13,005 BTC for $489.

They acquired the BTC at an average price of $27,713 per Bitcoin bringing the average money spent to $3.16 billion. The money spent is inclusive of expenses and fees. The Bitcoin owned by the company is currently worth $6.7 billion after its value going up to $60,000 on Friday. This is almost the currency’s all-time high which was $65,000 in April.

The Bitcoin is currently on the company’s balance sheet as advised by the ‘Bitcoin evangelist’ and CEO. Saylor, who began buying BTC in August 2020, advises on having BTC on the balance sheets adding it is better than having US Securities or cash. Square Inc and Tesla also adopted the same strategy.

BTC is reflects as intangible assets on the company’s balance sheets. This means that the value can’t be revised upward even when the Bitcoin price increases. BTC is therefore recorded at its historic cost on the balance sheets.

While writing to the Financial Accounting Standards Board, Saylor said, “ This disconnect between an entity’s financial statements and the economic reality of its financial condition…creates confusion.” He said this before adding that the situation robs the public, investors, and analysts of information needed to make an informed assessment of a business entity.

Other Public Companies Investing in BTC

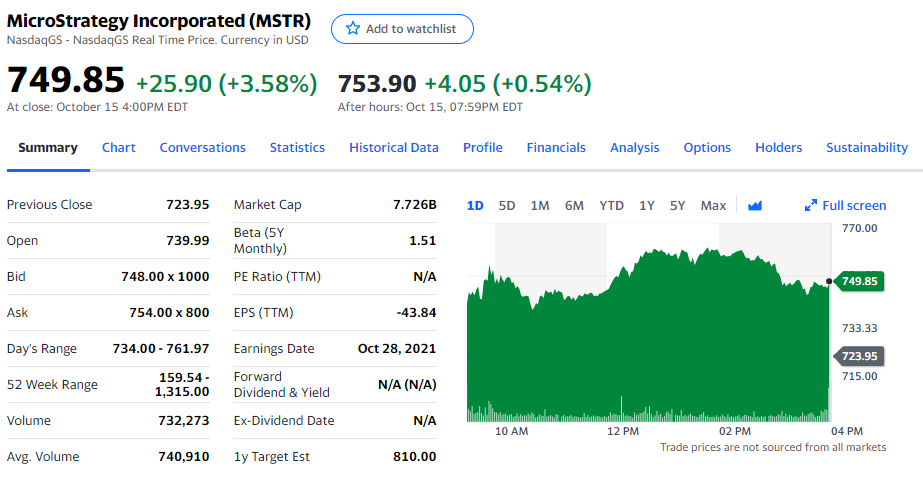

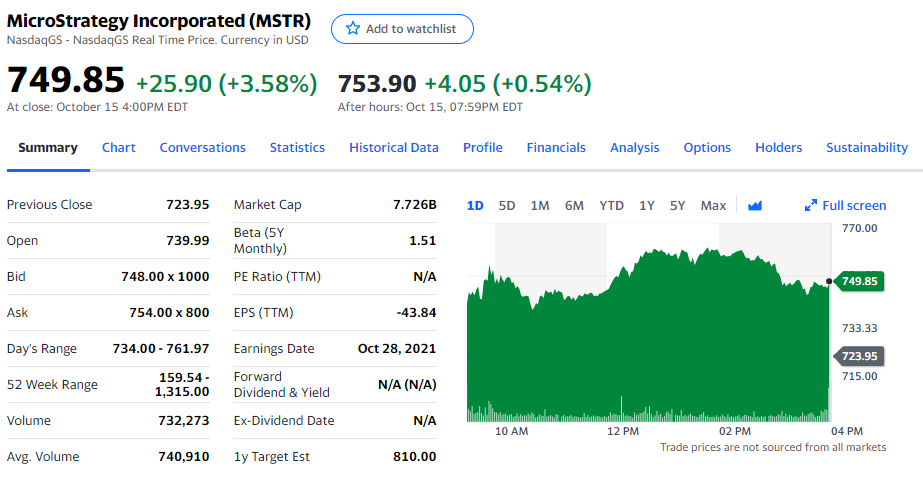

MicroStrategy remains the most extensive public company cryptocurrency investor in the world. The increase in the value of BTC has also helped spur the company’s market value to $8.6 billion. Currently, a share of the company goes for $753.

MicroStrategy is not the only public company taking risks by investing in cryptocurrency. The company, however, paved the way for other companies to follow suit. Tesla is the second-highest Bitcoin holder in the world. The electric-automobile manufacturer holds BTC worth $1.5 billion.

Galaxy Digital Holdings is another top crypto holder. It is, in fact, the largest institutional BTC holder directly involved with the crypto industry having BTC worth $522 million. Voyager Digital LTD, a crypto brokerage, holds BTC worth $390 million.

More on MicroStrategy

MicroStrategy provides cloud-based services and business intelligence. It develops software that analyzes external and internal data to create mobile Apps and make business decisions. Thomas Spahr, Sanju Bansal, and crypto bull Michael Saylor founded the company in 1989.