American business intelligence company Microstrategy released its Q1 financial results on Tuesday. It generated total revenue of $119.3 million in the three months that ended on 31 March 2022, a 2.9% decrease when compared to Q1 2021.

MicroStrategy pays the price for HODLing Bitcoin

The highlight of the report was, however, the digital asset’s section. The company noted a non-cash digital asset impairment charge of $170.1 million in the first quarter, up from Q4 2021’s $146.6 million. The cumulative charge figure, however, stood at $1.071 billion.

As such, impairment usually reflects the decline in the price of an asset relative to the price at which it was acquired. Per the thumb rule, the value of digital assets should be recorded at their cost, and later be adjusted if their value is impaired—or goes down. On the other hand, price rises ain’t accounted for unless and until the asset is sold.

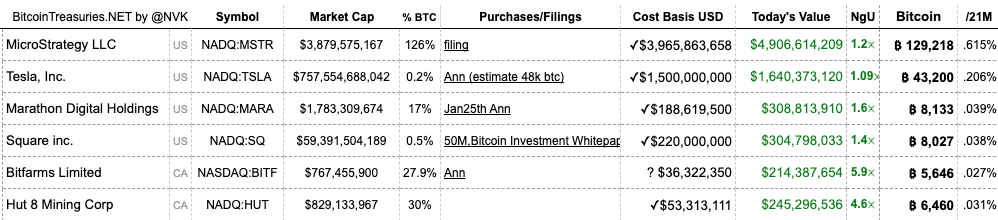

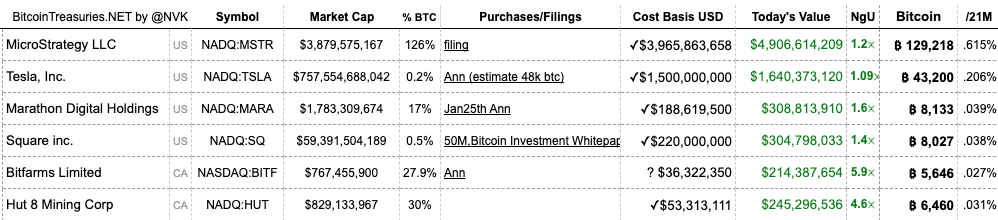

Per data from BitcoinTreasuries, MicroStrategy HODLs the maximum Bitcoin when compared to other single entities. While the business intelligence company possessed over 129,218 BTC, Tesla—the number #2 on the list—held merely 43,200 BTC.

Commenting on the same, the CEO Michael Saylor, said,

“Today, MicroStrategy is the world’s largest publicly traded corporate owner of Bitcoin with over 129,200 Bitcoins.”

The company, quite recently, used a loan against its BTC HODLings for the first time to purchase $190.5 million more of the cryptocurrency. Per Saylor, the same depicts how Bitcoin can “productively” be used. He said,

“We also furthered our position as the leading public company investor in Bitcoin through the issuance of our first Bitcoin-backed term loan. We have demonstrated that our Bitcoin can be productively used as collateral in capital raising transactions, which allows us to further execute against our business strategy.”

Notably, Microstrategy’s 129,218 BTC held at the end of 31 March 2022 were acquired for $3.97 billion, reflecting an average cost per bitcoin of approx. $30,700. At Bitcoin’s press time price of $37,988, the value of those holdings stood around $4.908 billion.