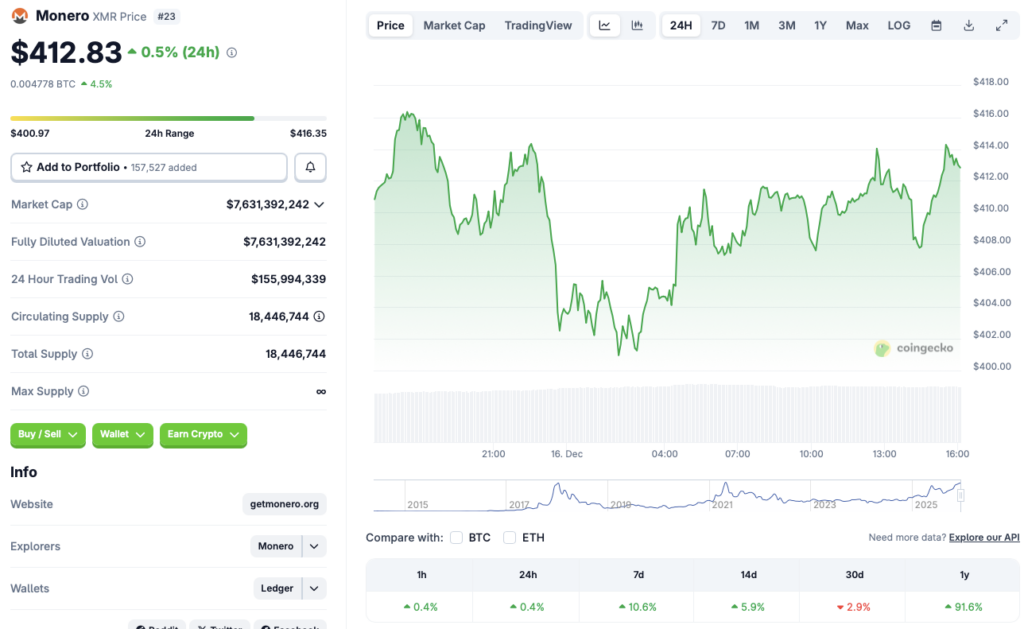

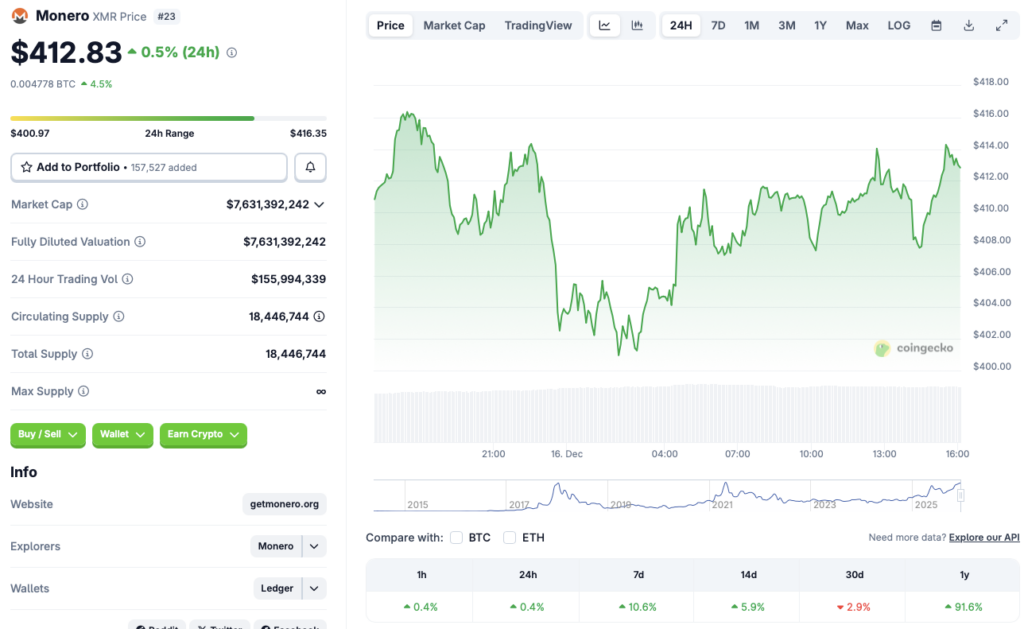

While the larger cryptocurrency market is facing yet another price correction, Monero (XMR) is going the other way around. According to CoinGecko’s Monero data, the privacy-focused crypto asset has rallied 0.4% in the last 24 hours, 10.8% in the last week, 5.9% in the 14-day charts, and a whopping 91.6% since December 2024. Despite the rally, XMR has faced a 2.9% correction over the previous month. Let’s discuss why Monero (XMR) is seeing a rally, while other assets are crashing.

Why Is Monero (XMR) Rallying While The Market Is Falling?

Monero’s (XMR) price surge is surprising, given that the crypto market is facing a steep price correction. According to CoinGlass data, more than $660 million has been liquidated from the crypto market in the last 24 hours. The market-wide crash is likely due to continued macroeconomic worries and investors taking a risk-free approach. Market participants are most probably moving their funds into safe havens such as silver and gold.

Monero’s (XMR) current momentum could be due to increased interest in privacy coins. Investors may have been spooked by the ongoing market carnage and decided to opt for privacy cryptocurrencies. The move towards privacy coins is not something new. The pattern emerged when the crypto market began showing cracks in October. Apart from Monero (XMR), ZCash (ZEC) also saw a rally, but has since experienced a major correction.

Also Read: SEC Chair Calls Crypto “Financial Surveillance Architecture”

Monero’s (XMR) rally may sustain if the demand for privacy coins remains strong. However, given the market scenario, the asset could face a correction at any moment. Macroeconomic conditions are yet to improve, and the global economy is still quite shaky. Silver and gold seem to have the spotlight right now. If things remain as they are, privacy could see continued growth over the coming months.