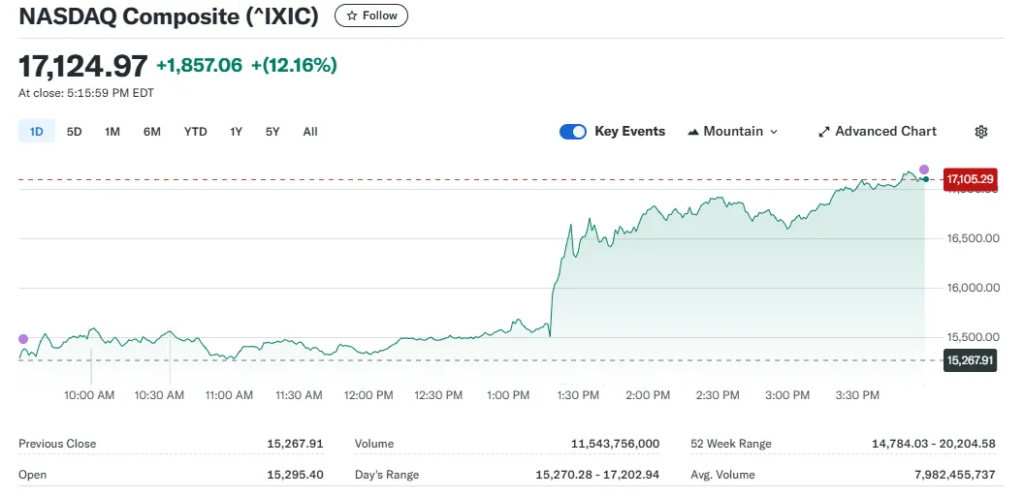

The recent Nasdaq rally has been incredible to witness, with the tech-heavy index experiencing its second-best day on record this past Wednesday. With a jaw-dropping 12% gain, investors are now looking ahead to what this might mean for the remainder of 2025. This extraordinary turnaround happened right after President Trump surprised everyone with his announcement about pausing tariffs for most countries, though he actually increased the rates on China to 125%. The unexpected policy change completely transformed the mood on Wall Street and sent many investors hurrying back into stocks after several days of pretty intense selling.

Now that markets seem to be settling down a bit after this dramatic reversal, many investors are searching for the best opportunities to take advantage of this ongoing Nasdaq rally, especially in technology stocks that were at the forefront of this amazing recovery.

Also Read: Pi Network Surges 100% After Breakout: Is $1.87 the Next Target?

Tesla, S&P 500, and Trump Tariffs: How to Pick the Right Stocks Now

Top 3 Stocks to Buy After the Historic Nasdaq Rally

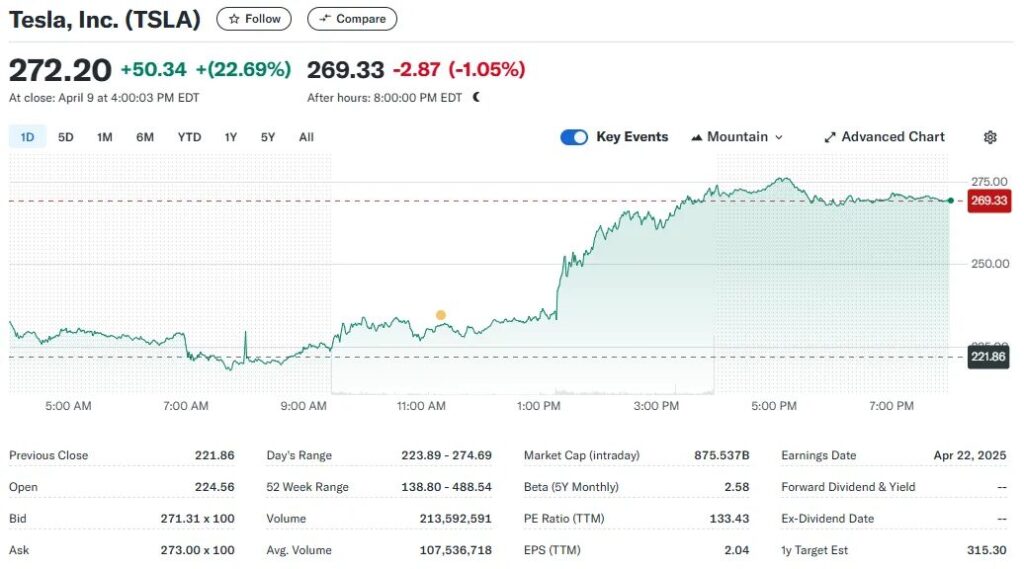

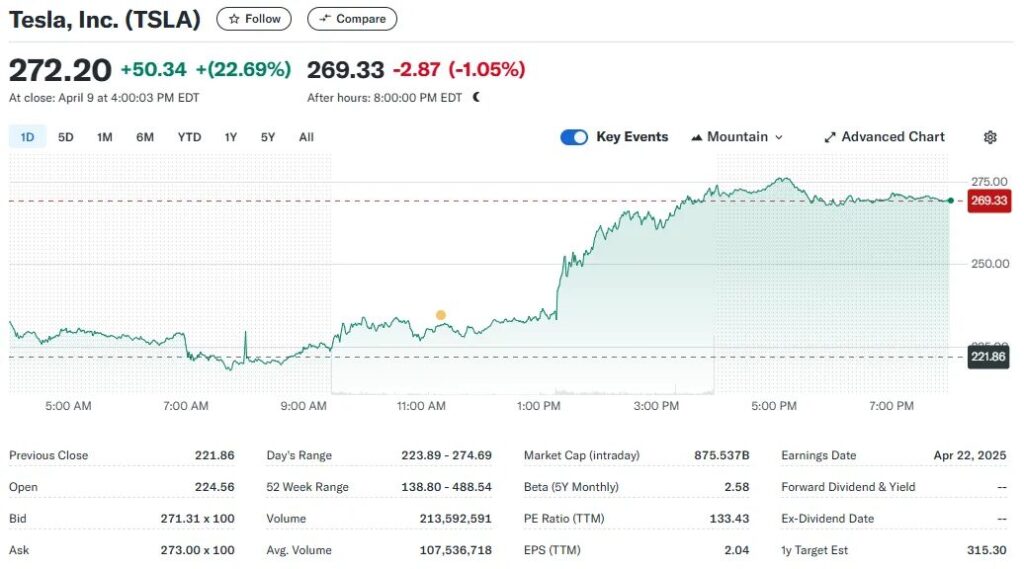

1. Tesla (TSLA): Electric Growth Trajectory

Tesla’s stock forecast is looking incredibly promising right now after shares shot up by an impressive 23% during Wednesday’s market surge. As one of the top performers in the past years, Tesla has basically reaffirmed its status as a market leader despite facing some challenges in recent months. The company’s reduced dependence on Chinese manufacturing, thanks to its massive factories in Texas and Berlin, puts it in a pretty good position to handle the ongoing trade tensions between the U.S. and China.

President Trump wrote on Truth Social:

“I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

2. Nvidia (NVDA): AI Powerhouse Leading the Market

Nvidia jumped up by an amazing 19% during Wednesday’s rally, which added about $440 billion to its market value in just a single trading session. The AI chipmaker’s dominant position in the artificial intelligence infrastructure space makes it a really important player in the ongoing technology revolution. And with global trade tensions easing with most countries right now, Nvidia’s international supply chain stands to benefit quite a bit from this development.

Also Read: Throwback Thursday: Trucker Made $1.7 Million With Shiba Inu

Gina Bolvin, President at Bolvin Wealth Management, said:

“A pivotal moment we’ve been waiting for.”

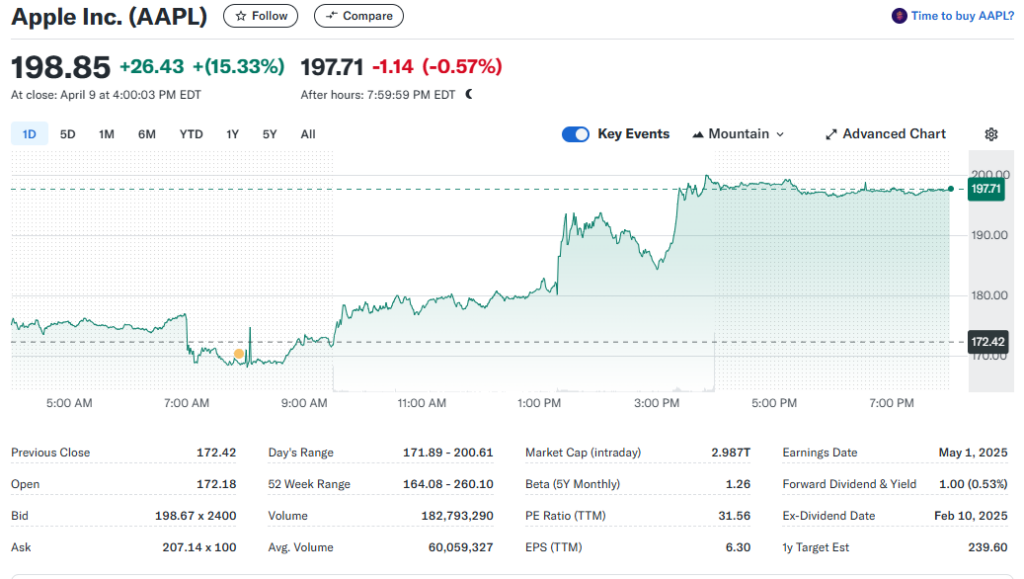

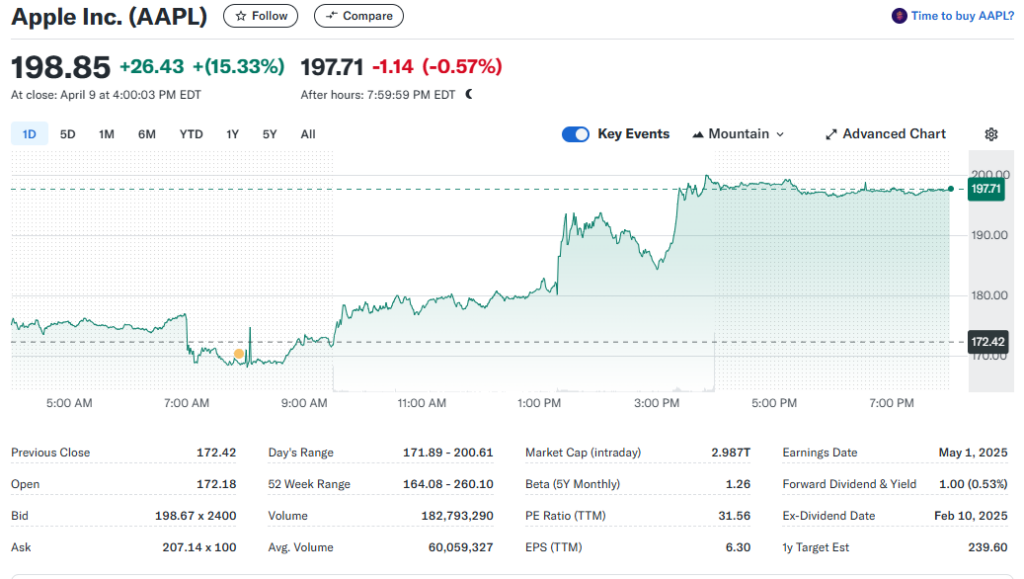

3. Apple (AAPL): Resilience Amid Trade Turbulence

After going through its worst four-day stretch since 2000, Apple shares bounced back with an impressive 15% gain during Wednesday’s surge. The company’s strategic decision to diversify its manufacturing operations outside of China provides a significant buffer against the elevated 125% tariffs that are now facing Chinese imports. Apple’s strong ecosystem and growing services revenue stream make it well-positioned to benefit from the improved sentiment in the market.

4. Nasdaq’s Breathtaking 12% Surge: Second-Largest Gain in Its History

The Nasdaq Composite’s historic 12.16% surge on Wednesday was truly something to behold, representing its second-largest single-day gain ever and the best performance since way back in 2001. The tech-heavy index, which had actually entered bear market territory earlier in the week, bounced back in spectacular fashion after Trump’s tariff announcement.

Also Read: Ripple’s XRP Forecasted To Reach $5.5, Here’s When

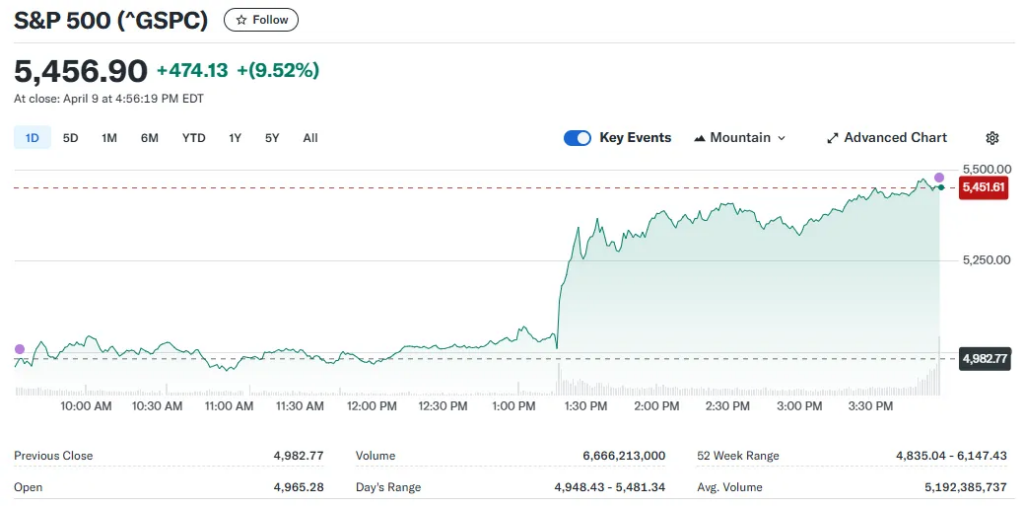

5. S&P 500’s Remarkable Recovery: How a Single Afternoon Changed Everything

S&P 500 also delivered an absolutely eye-popping performance, jumping 9.52% to close at 5,456.90. This marked its third-best day since World War II and the strongest rally since the 2008 financial crisis. The surge was particularly remarkable because it erased nearly a week of steep losses in just a single trading session. What’s even more interesting is that the rally began almost precisely at 1:00 PM when Trump made his announcement, with the index gaining hundreds of points in a matter of minutes.

Why These Five Stocks Lead the Market

These companies actually share some important characteristics that position them really well for continued success in the current market environment. All of them benefit from strong brand recognition, dominant positions in their markets, and strategic approaches to managing their global supply chains amid the ongoing trade tensions with China. Tesla, Nvidia, and Apple each represent different aspects of the tech sector’s strength, from electric vehicles to AI chips to consumer electronics, providing investors with diverse exposure to the Nasdaq’s continued rally.

Just as Masayuki Kubota, Chief Strategist at Rakuten Securities, described the market move, it is, indeed:

“A wonderful big surprise.”

As the S&P 500 continues to stabilize at the time of writing following this historic rally, these stocks offer some really compelling investment opportunities for those looking to capitalize on the improved market sentiment while also maintaining some protection against potential volatility when the 90-day tariff pause.