Back in 2021, when the NFT fad was at its peak, collectibles were extremely popular among investors. However, as the euphoria fizzled out, people started exiting the arena. Of late, the buzz associated with NFTs has yet again risen. However, there’s not much to rejoice in, for collectors are slumped in deep dejection at the moment.

Arcade protocol’s Advisor ‘Cirrus’ recently revealed that over the last couple of days, the NFT market has seen “the worst liquidation cascade” in history. Over the past 96 hours, there have been around 1244 liquidations. The figure doesn’t include “forced sellers” who sold their collateral to repay loans before going underwater. To contextualize, on an average day over the last year, only around 10-15 NFT loans would be liquidated.

Beanz NFTs [Azuki’s derivative companion project] were hit the hardest, for they accounted for more than half the liquidations [636, i.e. over 3% of their supply]. The state of affairs, however, seems to be improving. Shedding light on the same, ‘Cirrus’ revealed that underwater loans have been depleting, and added,

“Good news is that the rate of liquidations has slowed drastically over the last few hours. Think we’re [we are] done with those sharp one-day moves down that we’ve seen over the last few days.”

Also Read: Bitcoin Flips Cardano, Solana to Claim 2nd Spot in NFT Sales

Collectors start saying ‘no’ to NFTs

The controversial launch of Azuki Elementals, an offshoot NFT project from the creators of the original Azuki NFT collection, almost single-handedly managed to disrupt the state of the NFT market. The project initially sold out within minutes and generated around $38 million in revenue for Azuki creator, Chiru Labs. However, the community started criticizing it, for NFTs from the new collection were almost the same as the ones from the original Azuki collection. In fact, the minting mishap ended up adding more fuel to the fire. Consequentially, Azuki was called out for allegedly scamming collectors, who are now demanding their ETH back.

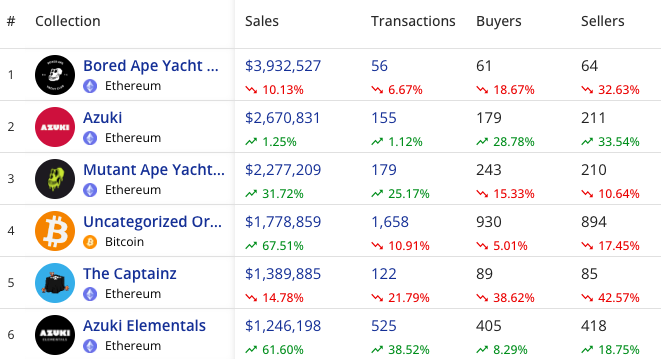

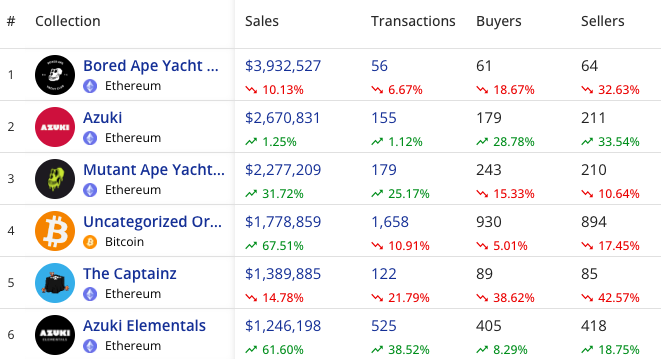

Currently, the number of sellers in the Azuki and Azuki Elementals market is more than the number of buyers, bringing light to the pessimistic spiral. Around a month back, Azuki’s floor price revolved above 17 ETH. However now, it is down to 6.8 ETH. Elementals sold for around 1.7 ETH initially. However, it dropped down to 0.74 ETH a day back.

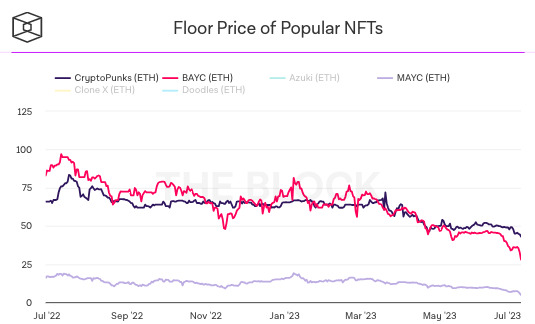

The state of other blue chip collections like Bored Ape Yacht Club also seems to be impacted. The number of transactions taking place on a daily basis has been shrinking, with sellers yet again having an upper hand. As illustrated below, BAYC’s price is currently hovering around multi-month lows. At press time, one NFT from this collection was selling for merely 27.9 ETH. The last time Bored Ape Yacht Club’s floor price dropped below 30 ETH, was in the latter half of 2021.

The base price of other prominent collections like CyptoPunks and MAYC have also registered slight declines. In all, the state of the NFT market continues to remain fragile.

Also Read: Ethereum Founder: I Feel Bad That Solana is Getting ‘Hit’