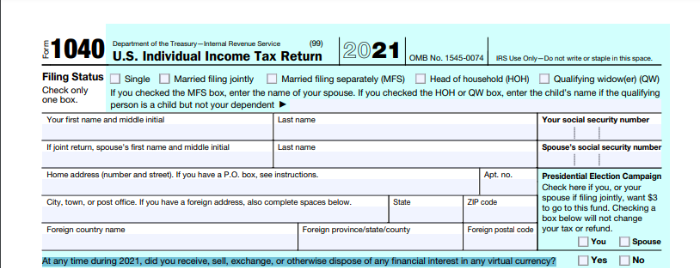

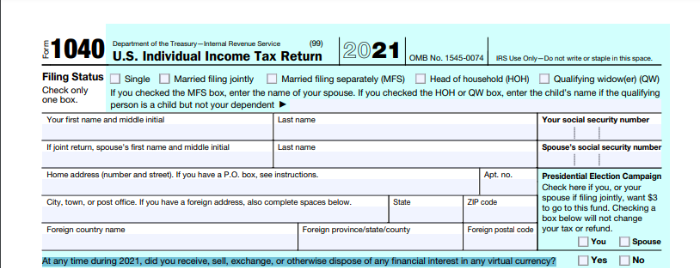

The 2021 version of the Internal Revenue Service form 1040 saliently featured a line item [highlighted in the snapshot attached] asking if filers at any time during the year “received, sold, exchanged, or otherwise disposed of any financial interest in any virtual currency.” The said specification, to some extent, implied that the agency intended to make crypto a point of focus in the future.

Scope expanded to NFTs

The agency recently updated its annual income tax instructions and per the released draft, the taxable category does not include the phrase “virtual currency” anymore. In a move to expand the scope of accounted assets, the said phrase has been replaced with “digital assets,” which outrightly includes Non-Fungible Tokens [NFTs]. Per the draft instructions,

“Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology.”

It further clarified by specifying individual components that fall under the said category by adding,

“For example, digital assets include non-fungible tokens (NFTs) and virtual currencies, such as cryptocurrencies and stablecoins.”

Last year’s US tax-filing instructions had a very thin definition for virtual currency. The statutory body described it as a digital token “that functions as a unit of account, a store of value, or a medium of exchange.”

Per the latest released document, crypto investors must report taxable income on any NFT sales, exchanges, gifts, or transfers for the 2022 tax year. Notably, the final tax instructions have not yet been released, which means, the crypto definitions could still be subjected to alteration.

Also Read – IRS will nullify taxes on this type of cryptocurrency

Alongside monitoring and assessing crypto assets on filers, the agency also intends to bring down crypto non-taxpayers. As reported earlier, the IRS launched ‘Operation Hidden Treasure’ to crack down the lawbreakers.

The agency put together a task force that was trained in the tracking of various types of crypto income and had also tied together with the civil and criminal branches of the IRS for Crypto Tax Fraud Enforcement.

Read More – Crypto: Decoding what IRS’ ‘Operation Hidden Treasure’ is all about