BAYC and its native crypto have been making it to the crypto/NFT headlines consistently of late. Apecoin, for instance, has been defying the broader market trend over the past few days, despite the rich list controlling more than half of its supply.

Further, less than a day back, Yuga Labs—the creator of the Bored Ape Yacht Club NFT collection—announced the date of its ‘Otherside‘ metaverse launch. More recently, Chinese sportswear brand Li Ning publicized that it will be releasing a clothing line featuring images of BAYC #4102.

How BAYC’s macro-NFT landscape looks like

On the whole, the BAYC landscape has noted legit growth figures over the past 24-hours. Per data from CryptoSlam, the collection sales noted a 95.6% incline over the past day. Alongside, the active wallets too swelled up by 42.3%.

As a result, the collection’s floor price rose by almost 7% as well. At press time, participants had to shell out a minimum of 139 ETH to own a token from this collection.

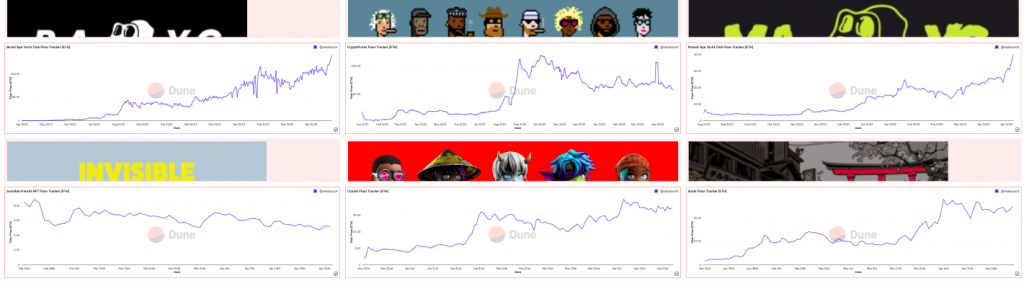

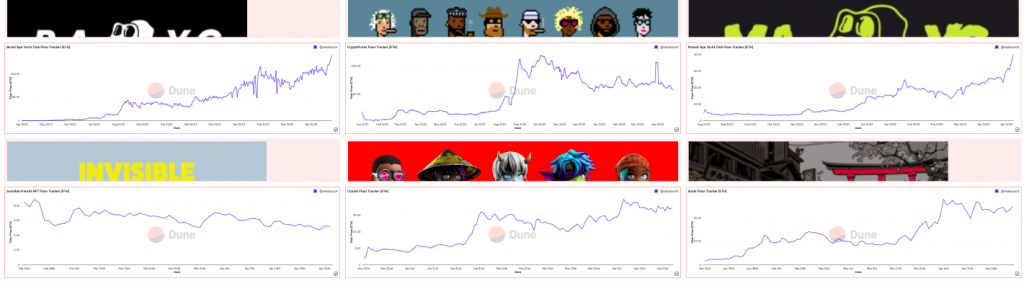

When compared to the past few days, the floor price of other top collections like CryptoPunks, Invisible Friends, CloneX, and Azuki has been on the dip. Only BAYC, alongside MAYC, has been able to maintain its price uptrend.

Despite the aforementioned positives, it wouldn’t be fair to ignore BAYC’s gray lining at this stage. The average HODL period of BAYC NFTs has dipped by more than 20.1% over the past day to 71.48 days. Parallelly, the number of sellers has inclined by more than the number of buyers [84% v. 76%], indicating that the profit-booking greed has started luring HODLers.

So, if the said condition continues to prevail, BAYC’s floor price would find it challenging to maintain its high levels. For the buy-sell shuffling to swiftly happen, the demand needs to incline simultaneously.