Artificial intelligence [AI] is experiencing widespread global adoption, as evidenced by the increasing use of AI-related tools and the surge in AI stock prices. This has prompted prominent economists to draw comparisons to the dot-com bubble of the late 1990s, which eventually resulted in a crash. However, Goldman Sachs does not align with this viewpoint. In a recent note, Peter Oppenheimer, chief global equity strategist at Goldman Sachs Research, said,

“Even as those stocks have rallied substantially, they don’t appear to be in a bubble. We believe we are still in the relatively early stages of a new technology cycle that is likely to lead to further outperformance.”

The “outperformance” appears to be underway. This is because the sector is receiving recognition for its role in driving the stock market. About 20 companies, primarily those involved in AI-related sectors, have been supporting the S&P 500, propelling it into positive territory. Manish Jabra, head of US equity strategy at Societe Generale, previously stated,

“The AI boom and hype is strong. So strong that without the AI-popular stocks, S&P 500 would be down 2% this year.”

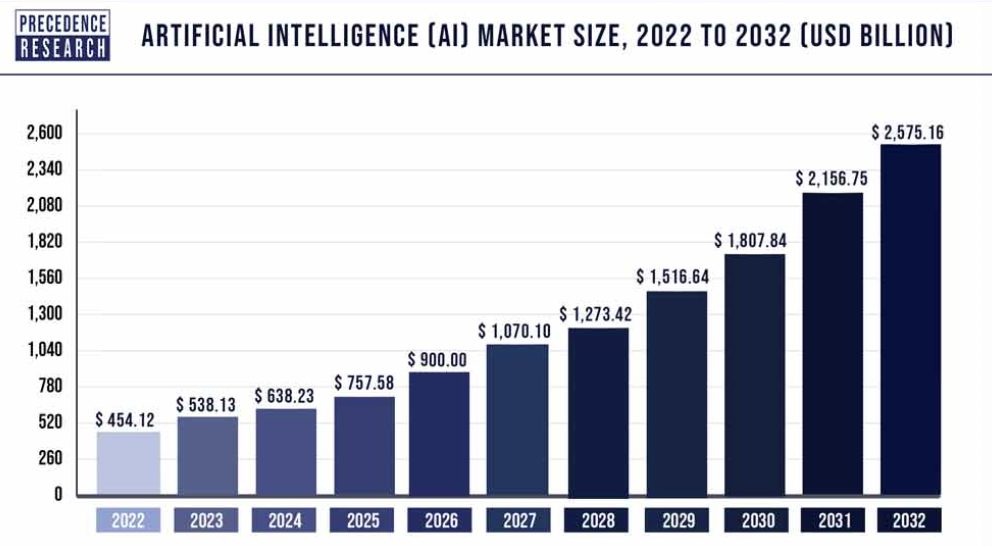

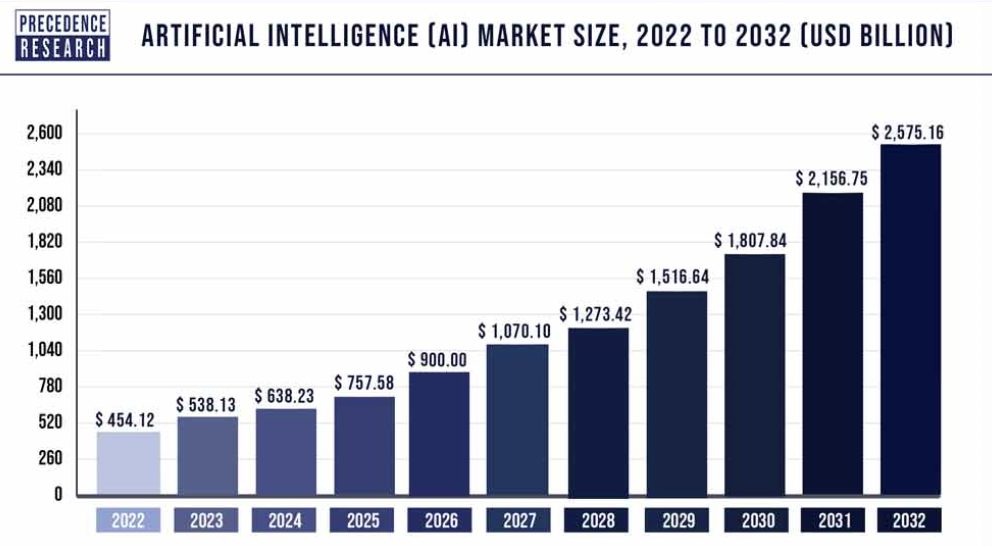

Furthermore, many have placed substantial bets on a surge. For example, Precedence Research anticipates a yearly growth rate of 23% in AI software sales, projecting them to reach $2,575.16 billion by 2032.

While the stakes are high in the AI sector, there are certain challenges that could stop them from ‘outperforming.’

Also Read: Google Pours $20 Million in AI: What About Its Rising Water Usage?

Here’s what could come in the way of AI development

Volatility: Stocks of AI companies are prone to substantial price volatility since they are still in their “early stages”. For example, Upstart Holdings [UPST] experienced remarkable performance in the Nasdaq 100 Stock Index [$IUXX] [QQQ] at the start of August, with a notable surge of +445%. This was mostly driven by the enthusiasm surrounding AI. Nevertheless, the stock’s value has since dropped by 50%, highlighting the risks associated with stocks that get caught up in the AI hype.

Regulatory hurdles: At the time OpenAI introduced ChatGPT, there were no significant regulations or widespread interest governing this domain. However, the substantial expansion of ChatGPT has attracted the attention of regulators worldwide. For instance, the EU AI Act is presently being crafted, focusing on the principle of regulating the industry based on risk levels, with higher-risk AI technologies subject to more rigorous oversight.

The European Union has clearly taken the forefront in this domain, surpassing both the United States and China. Nevertheless, there is a growing emphasis on regulating this arena. Furthermore, influential figures like Elon Musk, Bill Gates, Mark Zuckerberg, and others have convened to deliberate on the future of AI regulations, potentially wielding substantial influence over the sector.

Reliance on Data: AI systems depend on substantial datasets for efficient functioning. Data breaches, issues with data quality, or limitations in accessing crucial data sources can impede the performance of AI companies.

Competitive Landscape: The AI industry has intense competition. Numerous startups and established tech giants are actively competing for a share of the market. This high level of competition can diminish profit margins and constrain growth opportunities.

These points make a case that AI stocks might not be experiencing a speculative bubble. However, it is imperative for investors to perform thorough research, and evaluate the specific fundamentals of individual companies. It is important to thoughtfully weigh their investment objectives and risk tolerance.