Cryptocurrencies are at the center of attention in the world of finance. Whether you like them, or not, they are here to stay. The fact that major economies of the world are taking crypto seriously is a testament to the growth of the industry. In the latest development, Norway’s central bank, Norges bank, has officially revealed that its national digital currency will be based on Ethereum (ETH).

The nation’s central bank has released the source code of its central bank digital currency (CBDC) sandbox. The sandbox is currently available on GitHub. Its objective is to provide a means of communicating with the test network. According to the official CBDC partner of the Norges Bank, Nahmii, it offers capabilities for creating, burning, and transferring ERC-20 crypto tokens.

The sandbox frontend, which was written in React, is intended to provide a simple and user-friendly interface for interacting with the test network. There is role-based access control in place for crucial operations like token creation and burning.

Furthermore, according to Nahmii, the Ethereum-based wallet MetaMask is not supported by the current version of the code by design. It may only be accessed privately by users who have the necessary credentials.

When will Norway launch its Ethereum-based CBDC?

Norway’s national bank formally declared its intention to carry out CBDC testing in April of 2021. It is expected to identify a preferred CBDC solution by comparing several designs over the course of two years.

Additionally, the bank noted that interoperability was one of the most crucial concerns. The bank assessed various technical solutions in a working paper referring to potential CBDC architectures, including those based on blockchains like Ethereum, Bitcoin, and Bitcoin SV.

Nonetheless, more complicated and intriguing use cases, like batch payments, security tokens, and bridges, will be incorporated into future sandbox development. However, this requires both more front-end development and work on customized smart contracts.

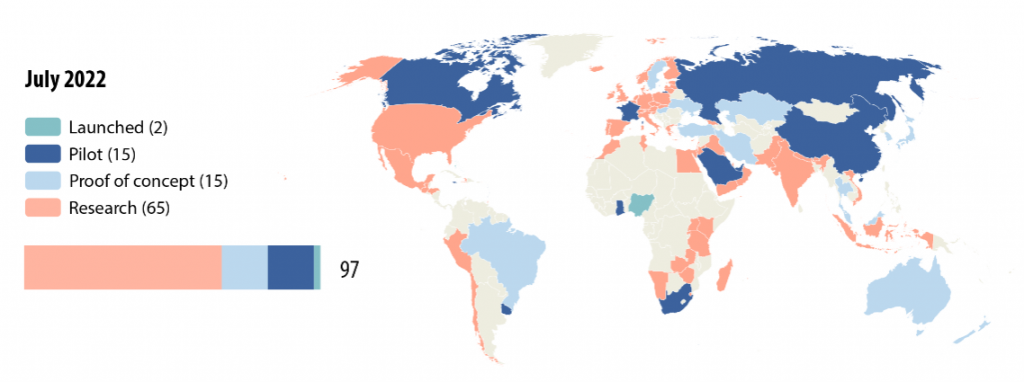

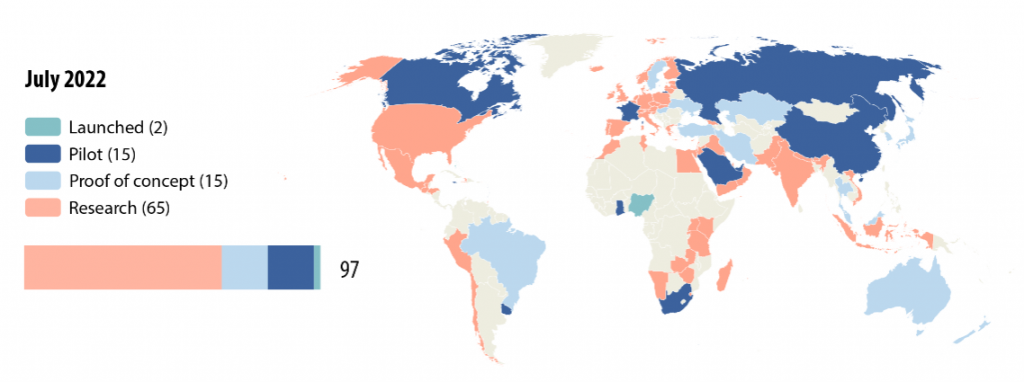

Meanwhile, CBDCs are taking off on a global front. According to an IMF (International Monetary Fund) report, 97 countries are actively working on their own CBDCs. However, only two have launched their digital currencies, Nigeria and The Bahamas.