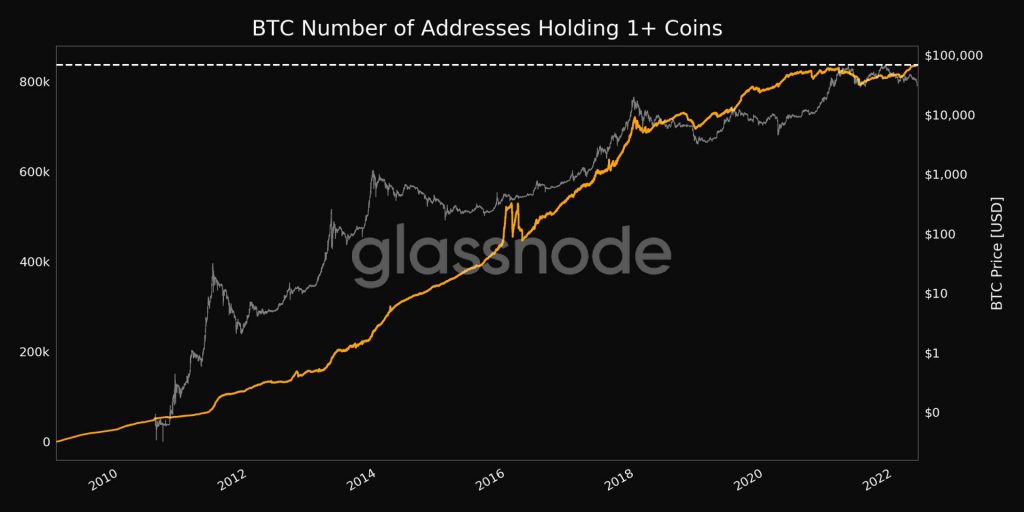

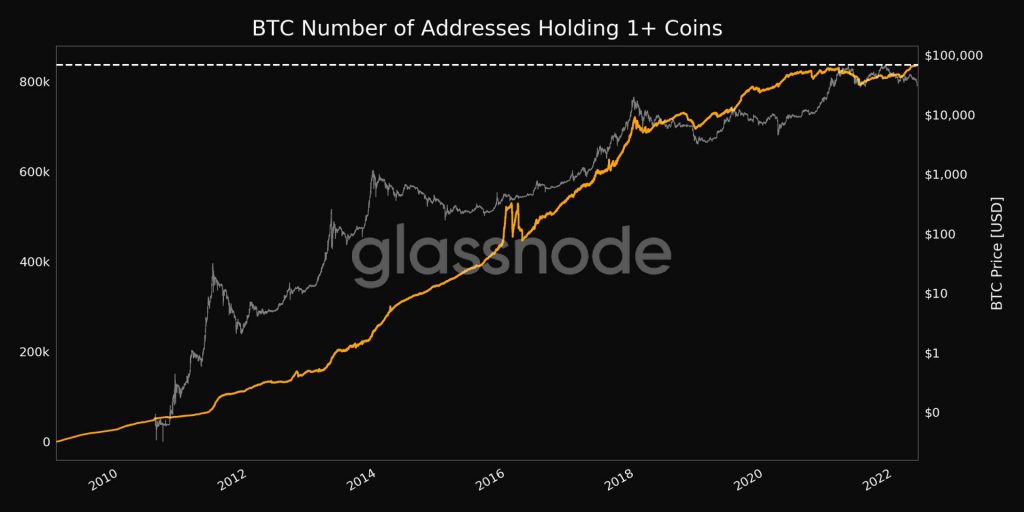

As per the data from Glassnode, the number of addresses that hold at least 1 bitcoin hit an all-time high of 836,922.

Thanks to the soaring adoption and global acceptance, the numbers are significantly higher. It’s not just the individual investors that are accumulating bitcoin and other cryptocurrencies. The number of retail investors who hold at least 0.01 bitcoin also seems to have touched an all-time high of 9,989,557.

Bitcoin plummets below $30k

The markets were not showing mercy to anyone as the price of bitcoin fell to $29,944, falling below the $30k support. But it gradually recovered and is trading at $31,060 at the time of writing. Bitcoin dragged the entire market down with it, as almost all the coins are trading in the red.

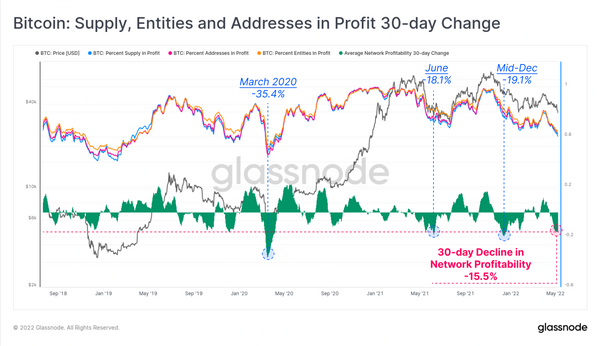

The entire crypto market, especially the bitcoin holders, has been under immense pressure as the prices fell notably. The network profitability also fell by more than 10%. The high volatility and downtrend are primarily due to the markets’ response to FED’s interest hikes. The markets initially had a positive run during the initial time of the announcement but immediately moved opposite to drop considerably.

As the price of BTC plummeted, it failed to maintain a support level and is currently trading 54% down from its all-time high.

The BTC market has displayed a higher volatile movement with exchange-related volumes, derivative markets, and stablecoins. The BTC accumulation rate has been a bit quiet this month as the market is displaying weaker prices. Data reveals that smaller investors are the strongest accumulators compared to larger investors. But they are showing a weaker accumulation as compared to the month of February and March.

As the Bitcoin market develops and more institutional money enters the market, it has become clear that the market reacts to macroeconomic shocks and tighter monetary conditions.