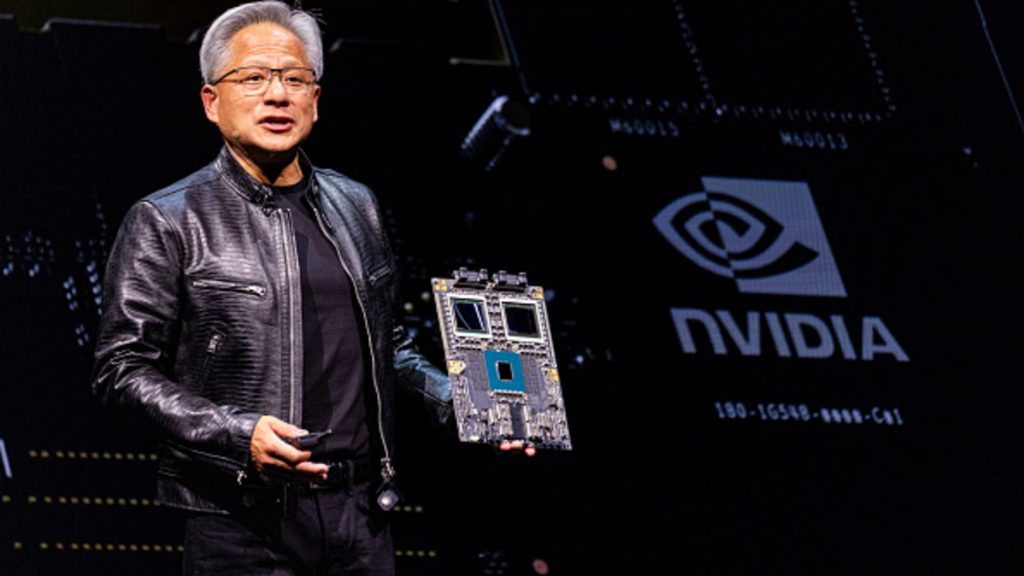

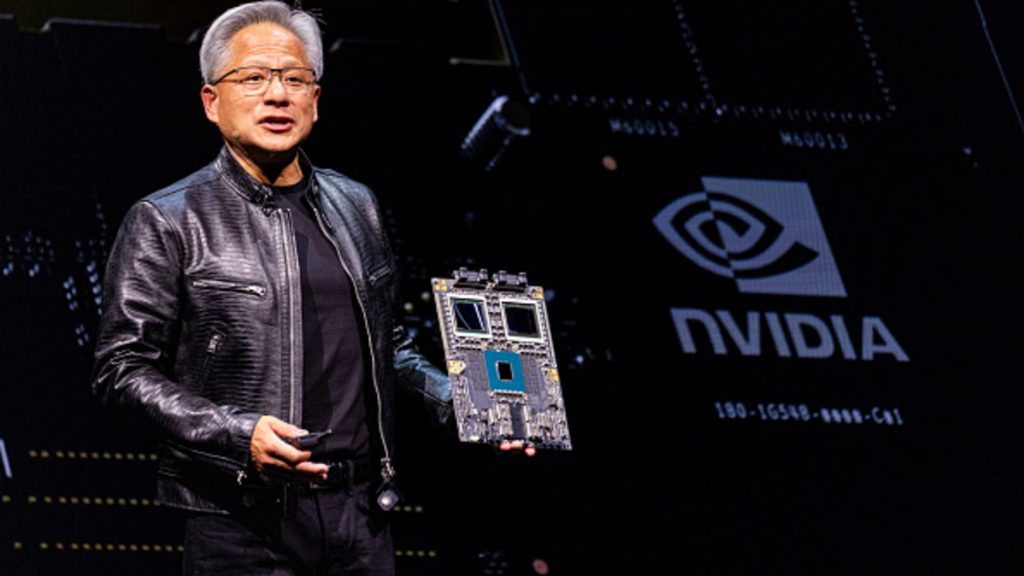

The tech stock that has dominated the market has officially set a new landmark price this year. Indeed, Nvidia (NVDA) has reached an all-time high price of $140 as it continues its impressive 180% surge throughout 2024. Indeed, the tech stock is separating from the pack and showing its worth amid an influx of demand.

Early Monday, shares had increased more than 2.4% to reach a price of $1141.28. Moreover, the S&P 500 and Dow Jones Industrial Average had fallen 0.1% and 0.3%, respectively. The greatest challenge to its market dominance may be the incoming Tesla (TSLA) earnings data, as the chipmaker looks to hold onto its lead in the tech sector.

Also Read: Nvidia Dominates Earnings: Up 16% in a Month. Time to Buy or Sell?

Nvidia Sets New Record as it Continues Dominating 2024

The technology sector has undergone a rapid change over the last several years. With the arrival and rapid evolution of AI technology, the stock market has seen companies with roots in the sector thrive. Perhaps none have dominated to the level of Nvidia

The chipmaker had continued to establish its dominance heading Monday. Indeed, Nvidia saw its NVDA stock price reach a $140 all-time high as it continues to increase on its already 180% price surge that’s taken place throughout 2024. The latest record price surpasses the landmark value set just last week for the company.

Also Read: Nvidia New AI Venture May Help Its Stock Soar: NVDA To Target $200?

Yet, with increased demand comes increased competition. For Nvidia, the next test will be incoming earnings data for Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Tesla (TSLA). These companies are looking to get a spark from the release of their respective reports.

Wall Street projects that the aforementioned companies spent a combined $60 billion in Q3. That would be a 56% increase from a year prior. That shows the massive funding being placed in the increased competition in the sector. Nvidia’s ability to weather the storm will showcase its strength as things heat up to the end of the year.