The US stock market has entered a period of stagnation with increased geopolitical tensions abounding. However, there are high hopes that incoming trade deals or tariff solutions could ensure Wall Street booms once again this year. For Nvidia (NVDA), that could be monumental, as its clear market dominance has paved the way for the stock to reach a high of $235 in 2025.

The company has failed to live up to the high expectations it set in 2024. Specifically, it jumped more than 174% that year to outperform the market by a wide margin. Although it hasn’t done as well this year, it should still beat Wall Street outright when it’s all said and done, with market share being a primary reason why.

Also Read: Nvidia (NVDA): Is $175 Next After Its Record-Breaking Q1 Earnings?

Nvidia’s Market Dominance has Stock Eyeing $235 Ceiling in 2025

The Dow Jones Index, S&P 500, and Nasdaq all began Tuesday sliding amid ongoing macroeconomic and geopolitical concerns. That has, more or less, been the defining characteristic of the US stock markets year so far. Increased volatility has been the prevailing theme, with few companies proving to be the exception.

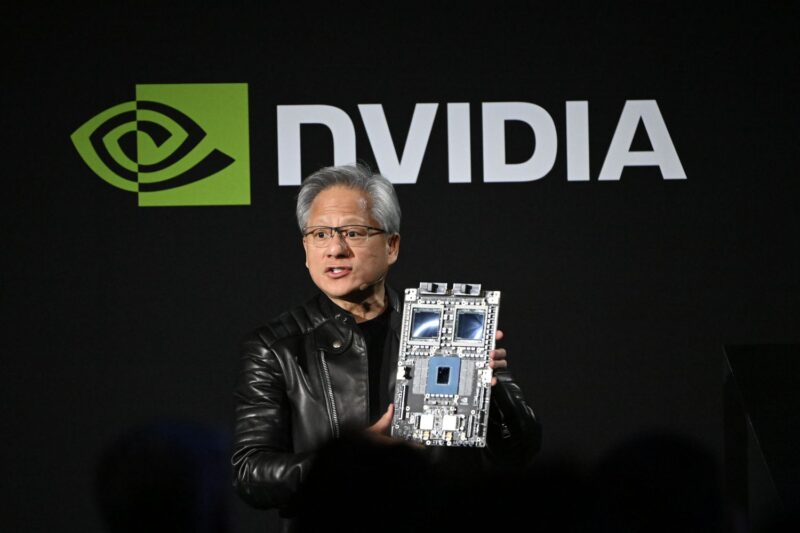

One company that has failed to live up to its high hopes was Nvidia. The AI chipmaker surged more than 25,000% over the last decade, while the S&P 500 only jumped 180%. That set a clear standard that has not been met five months into the year. However, that may change, as Nvidia’s market dominance has paved the way for the stock to reach the $235 mark in 2025.

Also Read: Nvidia (NVDA) Is a Billionaire Favorite as Experts Say Revenue Can Triple

At the end of 2024, Nvidia had controlled a remarkable 82% of the entire GPU market. By comparison, AMD—its next closest competitor—only held about 17% of the industry. That isn’t all, as its data center business owns an astronomical 98% of the entire market share.

With the AI market poised to grow at a compound annual growth rate of 31% over the next seven years, Nvidia could benefit. Moreover, at that rate, it could reach an annual revenue of $1.31 trillion by fiscal year 2032.

That reality and trajectory are bound to have massive implications on this year. According to CNN data, Nvidia has a median price target of $175. Yet, its bull projection sat at $235, showcasing its 67% upside. With so much market share and unprecedentedly strong financial metrics, a turnaround in the market could set the tech giant up for a prolonged run. Most importantly, it could turn that high-end outlook into a target.