The US stock market has continued its rather shocking downfall to start this week. However, that has not been the case for the Magnificent 7, with the market’s mega-cap stocks all in the green. That includes Nvidia (NVDA), which is rallying back toward $100 and may be too cheap to ignore, but is now the time to buy in?

The company had been the best performer throughout the entirety of 2024. However, that changed dramatically this year. With the US stock market plummeting amid geopolitical concerns and trade wars, there are few that have been caught in the middle as much as the AI tech firm has. The question is, does its upside make it a no-brainer buy as March approaches?

Also Read: Nvidia CEO Meets With Chinese Officials Amid US Trade War

Nvidia Falls Below $100 as Stock Becomes Wall Street’s Best Bargain

With the global economy caught in a period of increased uncertainty, the US stock market has struggled. Nvidia has emerged as a key player caught in the increased volatility. The company’s shares started Tuesday up 2.8% in a notable comeback. However, it has still dropped more than 18% over the last 30 days.

That could provide a key entry point for investors, however. Indeed, the recent Wall Street sell-off may have made Nvidia too cheap to ignore, making it one of the best bargain buys available. With the unmitigated hype surrounding its future and importance, it still has the potential to turn things around.

Also Read: How $4,500 Investment Turned $1 Million With Nvidia Stock (NVDA)

The company hasn’t been this cheap since long before OpenAI’s ChatGPT emerged. Put into context, its value is almost unbelievable. The company is projected to generate $4.43 earnings per share (EPS) by the end of this fiscal year. Moreover, it is projected to hit $5.65 by the end of 2026. At its current price value, it is at a price-to-earnings (P/E) ratio of around 20.

That is undoubtedly a steal. Moreover, the company’s price-to-earnings-growth (PEG) ratio makes it even more attractive. With Nvidia earnings expected to jump 50%, its PEG ratio would sit at around 0.44, with ratios under one indicating a stock that is certainly cheaply priced.

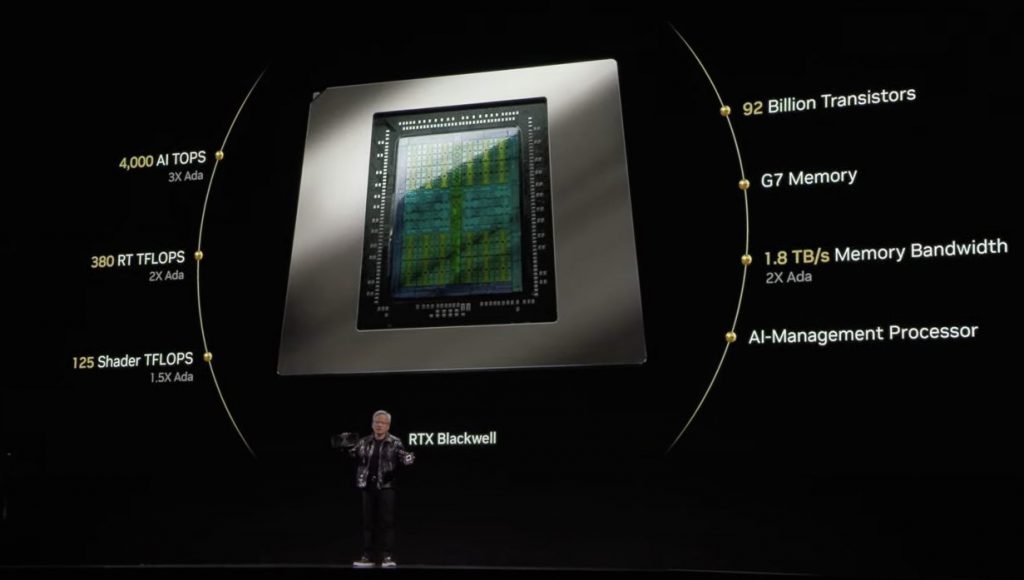

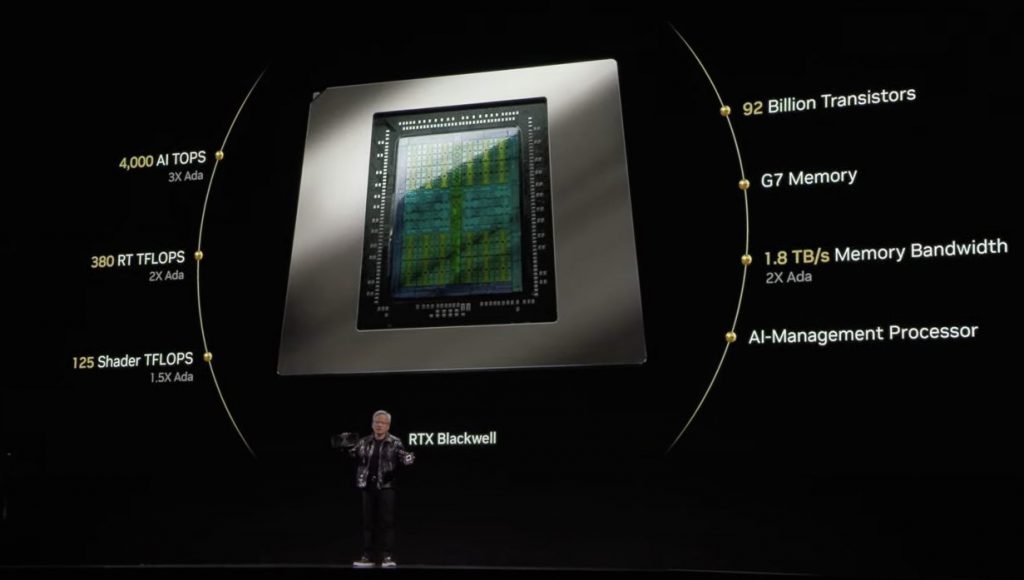

That doesn’t even factor in the rapid AI investment that is still taking place. The industry is expected to grow to around $2 trillion in the next decade. Subsequently, Nvidia stands at the center of that development. Its invaluable facets should have it benefit as much as anyone by that increased value and capital expenditure.