It has been a rather volatile year for the US stock market as a whole. Although the tech industry is still driving significant demand, it has failed to live up to the high hopes it had entering the year. That may be only a matter of time for Nvidia (NVDA), as the stock looks bound for a new all-time high share price sooner rather than later.

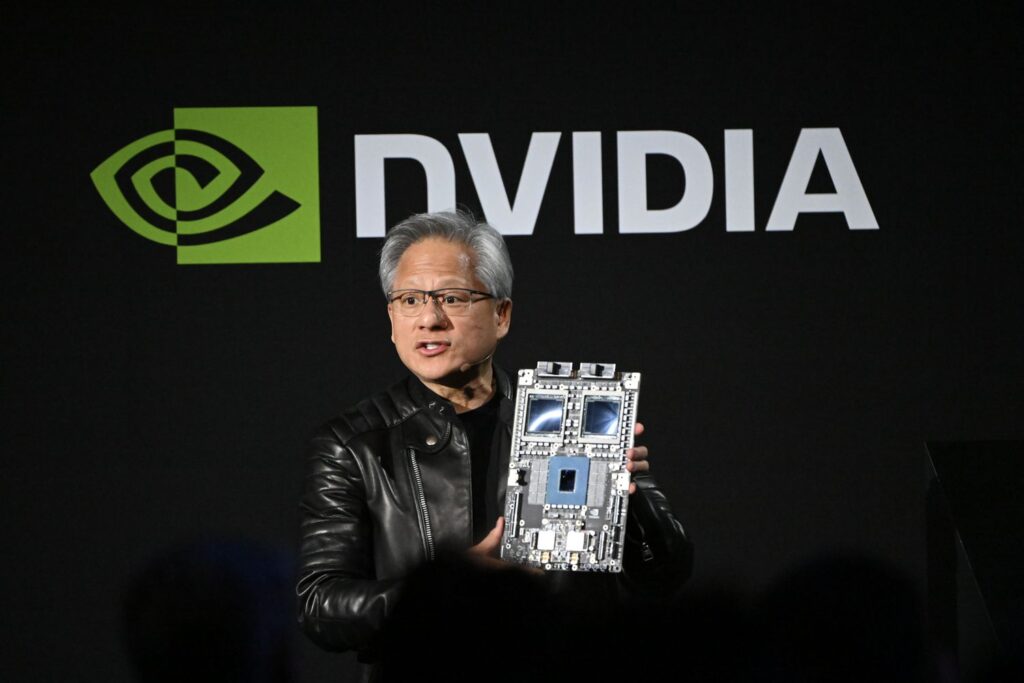

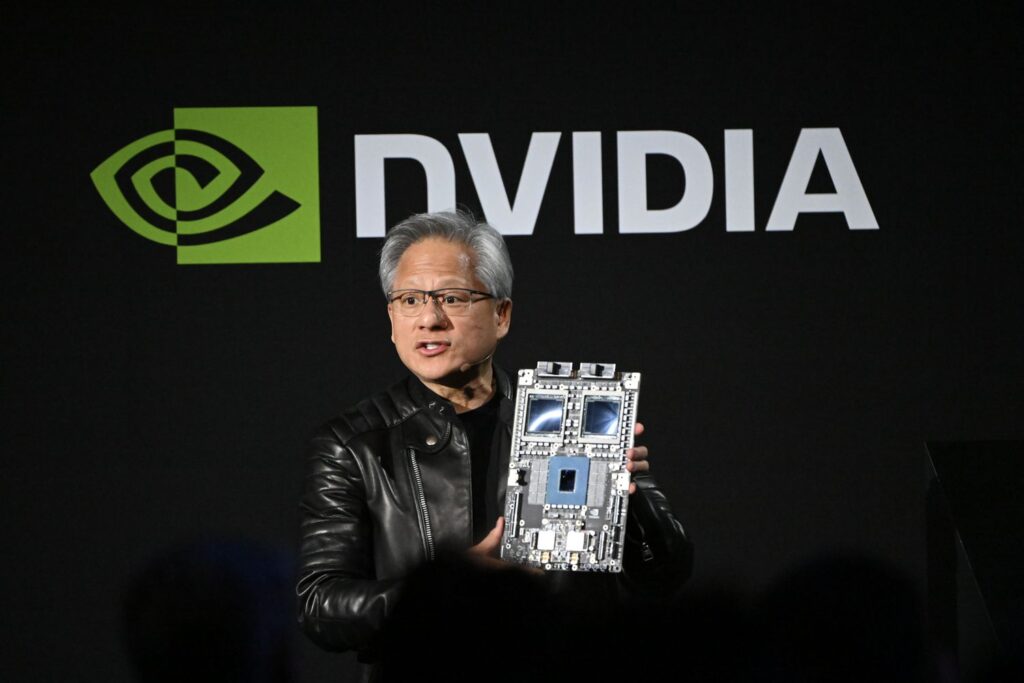

The AI chipmaker ended 2024 as the biggest gainer of the year. It jumped more than 174% and had outperformed the market seemingly across the board. Despite the ongoing sell-off that hindered its price movement, 2025 looks to still be a banner year for the tech firm.

Also Read: Nvidia Chips Make Breakthrough in AI Training Times: NVDA Stock to $150?

Nvidia All-Time High Bound? Why Theres Reason to Believe It Could On Its Way

The US stock market continued its volatility on Friday. Things were off to a strong start, with jobs data pushing the market up. However, things retreated as shares in a host of companies pulled back from session highs. It presented more of the same for Wall Street over the first five months of the year.

That may not be able to hinder the value of one of the biggest tech companies in the world, however. Indeed, Nvidia (NVDA) may be poised to bounce back in a big way, as the stock appears to be bound for a new all-time high sooner rather than later.

Also Read: Nvidia (NVDA): Market Dominance Paves Way For $235 Stock in 2025

The stock had reached a landmark price in January of this year, closing above the $149 price. Even after its 37% decline earlier this year, things look promising. Specifically, because of its continued AI machine learning prominence. The company still controls 95% of the market, with it also having a hold on 92% of the GPU data center space.

Meanwhile, Nvidia’s growth is unprecedented. In Q1 of fiscal year 2025, the stock boasted revenue of $44.1 billion, up 69% year over year. Earnings per share also jumped 33%, with Q2 revenue trending near the $45 billion mark, showcasing 50% growth.

That should allow Nvidia to break through the $150 mark from its current $142 price. It has a $175 median target, representing 23% upside for the stock, with its bullish projection sitting at $235. Altogether, by the end of 2025, it could have jumped more than 60% from where it traded to start June.