Nvidia (NVDA) stock is attracting heavy bullish sentiments as its price is skyrocketing in the charts this year in 2024. The stock reached an all-time high of $974 early this month and is now trading at the price range of $908. It is now among the top-performing stocks in the US as it geared up to climb above the $1,000 mark.

Also Read: Dogecoin: Elon Musk’s Tesla To Enable DOGE Payments

Its price got another boost after Cantor Fitzgerald raised Nvidia’s stock target this week. Cantor Fitzgerald raised the ‘buy’ target for Nvidia and predicted that its price could reach $1,200 in the near term. The financial services firm remains bullish on the stock as the US market is recovering from the slump.

Both Down Jones Industrial Average and the S&P 500 Index printed new all-time highs this month. While the S&P 500 Index hit 5,189, the Dow Jones Industrial Average touched 39,282 before briefly retracing its gains.

Also Read: European Central Bank Declared Bitcoin Dead: BTC Rose $22,300 From Then

Nvidia Stock Price Prediction: Forecast Estimates An Upward Swing Towards $1,600

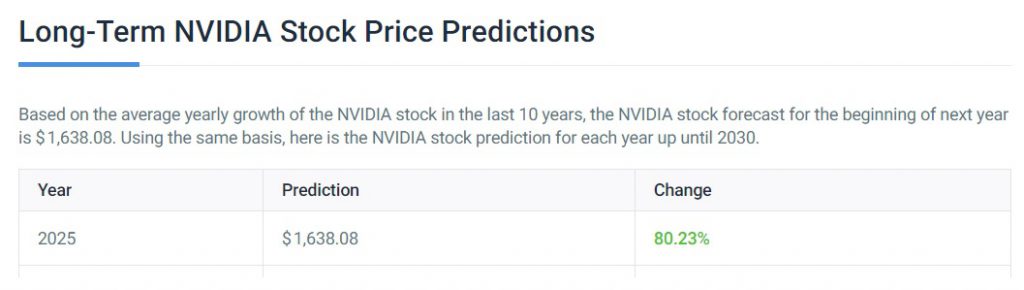

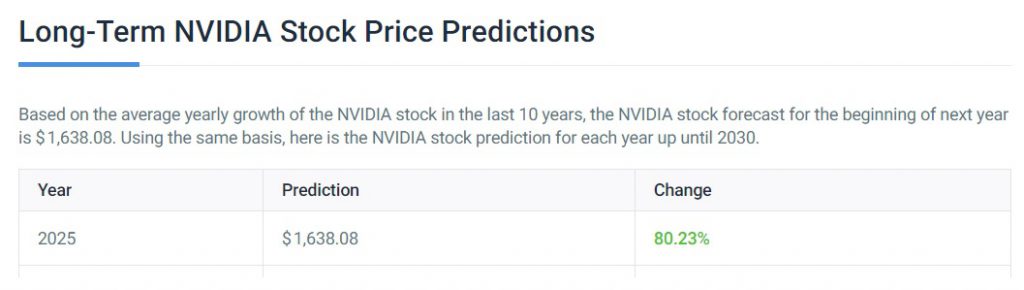

Leading on-chain metrics and price prediction firm CoinCodex has also painted a rosy picture for Nvidia’s stock. According to the price prediction, Nvidia stock could spike another 80% from its current price of $908 and hit a new all-time high of $1,638. That’s an upward tick and a return on investment (ROI) of around 80% from today.

Also Read: BRICS: Elon Musk Says America Will Go Bankrupt

The timeline given for the price rise is one year. The forecast states that Nvidia stock could trade at the $1,600 level sometime next year in 2025. Therefore, an investment of $10,000 in Nvidia today could turn into $18,000 in 2025, if the prediction is accurate.

Also Read: Global Conflicts To Make This US Defense Stock Breakout in Price

However, there is no guarantee that Nvidia could climb above the $1,600 level next year in 2025. The US stock market is volatile and cuts both ways due to global macroeconomic pressure. It is advised to do thorough research before taking an entry position in the US markets.