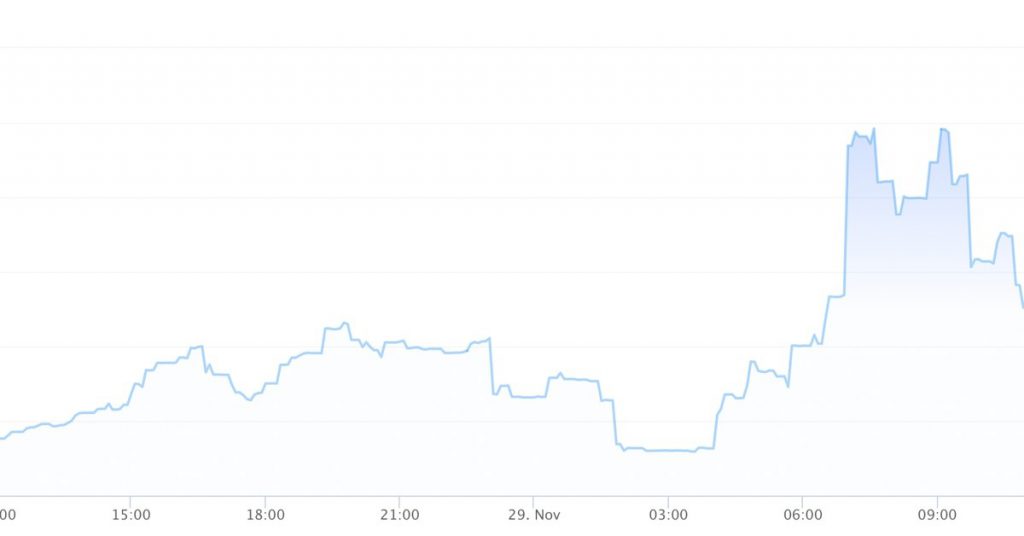

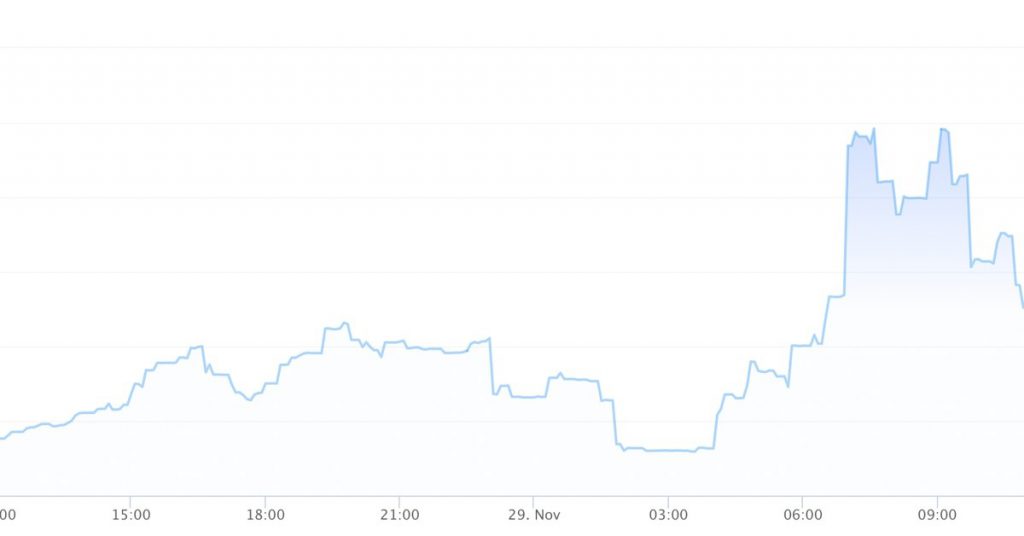

Omicron cryptocurrency has spiked more than 900 percent in the last 48 Hours.

The token came into existence earlier in November. The token shares its name with a new Covid-19 variant first discovered in South Africa on November 23. It appears to have risen for no other reason than the newly-named coronavirus strain. The WHO named the strain after the fifteenth letter of the Greek alphabet. Omicron’s official website describes itself as a “decentralized currency protocol built on Arbitrum.”

READ ALSO: Top 5 Cryptocurrencies to Watch This Week

The token as a fork of the OlympusDAO Defi protocol is on the Ethereum blockchain. Each OMIC Defi token has a basket of assets, “giving it an intrinsic value that it cannot fall below.” But details about the current market cap and supply of the OMIC token are unclear at the moment. The total supply of this crypto token stands at 1,000,000. Meaning the majority of its tokens are still in the process of mining and trading.

Omicron Listing

Investors need to be very careful before trading in Omicron. The reason is that there is little information available on this coin despite its sudden surge in value. Cryptocurrencies such as Bitcoin and Ethereum and global markets are in a tailspin. Neither CoinGecko, Crypto.com bitcoin, nor crypto exchange has a listed market cap.

The token exists on Ethereum scaling technology-Arbitrum. This means that trading is only possible on the controversial decentralized exchange SushiSwap. The central authority in charge does not regulate these types of exchanges. They are often prone to hacks, exploits, and so-called rug pulls where investors end up losing a lot of money.

The crypto-token SQUID, inspired by the hit Netflix series Squid Game, was giving 3000 percent returns in three days. The crypto-token crashed to zero after the token developers did the rug pull. This is the kind of scam where token creators leave the market along with the investors’ money. The website and social media handles of crypto were non-functional within hours.

READ ALSO: Are Crypto Trading Bots Profitable?

Investors lost more than Rs 25 crore. All their money turned zero in less than five minutes. The Omicron crypto-currency has spiked more than 900 percent in the last 48 hours. Details about the current market cap and supply of the OMIC token are unclear at the moment. There is little information available on this coin despite its sudden surge. Neither CoinGecko, Crypto.com bitcoin, nor crypto exchange has a listed market cap.

Conclusion

Omicron appears to have risen for no other reason than the newly-named corona-virus strain. This similar spike in market value to that of the crypto-token SQUID does not imply that Omicron, too, might crash. It is a reminder that investors should be careful in the current environment of unregulated, decentralized exchanges. There are a lot of hacks, exploits, and rug pulls. With little known about crypto and not much data available, do your research first.