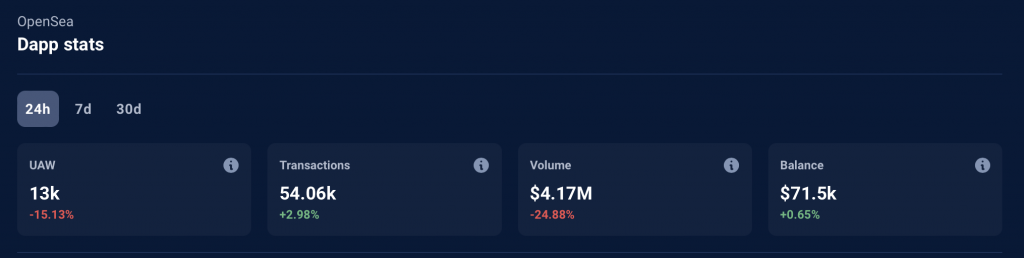

According to data on DappRadar, NFT (non-fungible token) marketplace OpenSea has seen a 24.88% drop in daily volume. In the last 30 days, volume has fallen by 30.87%. Additionally, unique active wallets have dropped by 15.13% in 24 hours. However, unique active addresses have fallen by only 0.44% in the monthly charts.

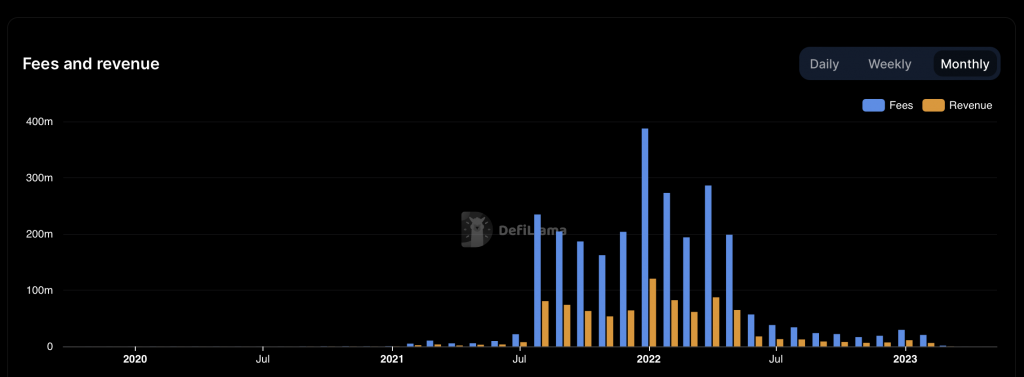

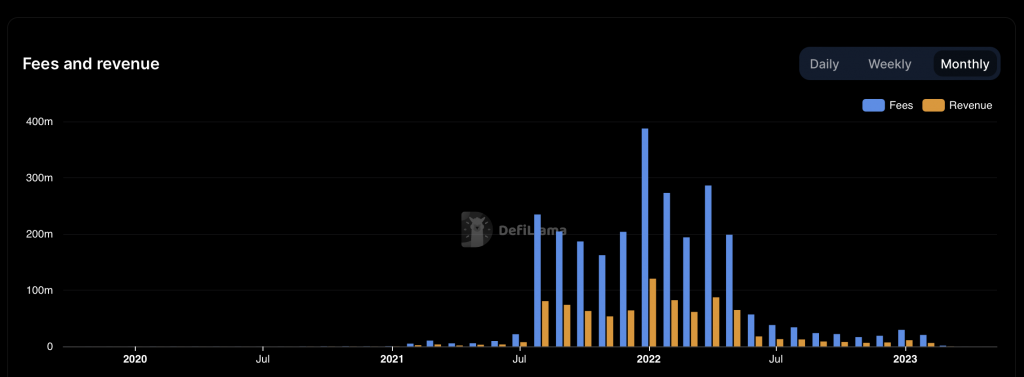

Looking at OpenSea’s fees and revenue, it becomes clear that the NFT marketplace has seen a downtrend since mid-2022. In March 2022, OpenSea saw revenues of $61.33 million; in March 2023, it had revenues of $172.33k. The drop represented a whopping 99.72% fall. The platform’s fees have also fallen from $193.94 million in March 2022 to $1.41 million in March 2023.

The fall in OpenSea’s fee and revenue since mid-2022 may be attributed to the crypto market crash during the summer of 2022. Several firms went underwater, and the situation was further enhanced by the FTX collapse in November 2022. Furthermore, the general interest in NFTs seems to have faded since their boom in 2021. However, it is also possible that the fall in daily volume is because of a court conviction in an NFT insider trading lawsuit.

Former OpenSea manager convicted in NFT insider trading case

According to Reuters, the former manager of OpenSea who was charged with insider trading of NFTs was found guilty of wire fraud and money laundering on May 3.

Nathaniel Chastain, a former product manager at OpenSea, would decide which NFTs would be displayed on the website’s marketplace. Prosecutors claimed that after making these choices, he routinely bought these NFTs and sold them again after they had been highlighted.

Daniel Filor, the defense attorney, said in the trial’s closing arguments that Chastain wasn’t guilty. He argued that Chastain had allegedly never been informed that the material was meant to be confidential. Allison Nichols, the prosecuting attorney, asserted that Chastain was aware that he was breaching the law. She claimed that he made the trades using anonymous OpenSea accounts because he was worried about getting caught.