The AI revolution is now making the markets competitive, with companies having an edge and dominance in the AI domain, scooping up major gains. This scenario has hit Oracle Corporation, a leading multinational tech company, as the firm reported stunning revenue metrics displaying a 350% revenue jump. In its recent report, Oracle Corporation shared how its AI cloud business is expected to spike ahead, predicting $144B worth of revenue generation by the year 2030. This prediction has fueled the Oracle share price by 23%, signalling a momentous shift in the global AI cloud domain.

Also Read: T-Mobile Faces Rep Exodus as Stock Slides on SpaceX Spectrum Deal

Oracle Share Price Jumps 27%: What’s the Deal?

Oracle Corporation has announced the Q1 projections for the year 2026, stating that bullish AI cloud demands are increasing at a rapid pace. The firm shared that it expects its cloud infrastructure to grow 77% from $18 billion this year. Later on, the statement includes a fresh analysis, a prediction expecting its revenue to eventually hit $144 billion over the subsequent four years (2030).

“We expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years,” said CEO Safra Catz in a statement Tuesday.

Catz later shared how the firm has signed multi-billion-dollar contracts with three new customers, helping it lead the AI cloud computing domain.

.”We signed four multi-billion-dollar contracts with three different customers in Q1,” said Oracle CEO Safra Catz. “This resulted in the RPO contract backlog increasing 359% to $455 billion. It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build. Over the next few months, we expect to sign up several additional multi-billion-dollar customers. And RPO is likely to exceed half a trillion dollars. The scale of our recent RPO growth enables us to make a large upward revision. To the cloud infrastructure portion of Oracle’s overall financial plan. Which we will be presenting in detail next month at the Financial Analyst Meeting. As a bit of a preview. We expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year. And then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years.” The statement shared.

ORCL Stock Update

The aforementioned bullish projections were quick to impact ORCL’s share price, which jumped 23% overnight, sitting at $232 at press time.

“Oracle stock, $ORCL, surges over +23% after reporting earnings with a +359% increase in contracted revenue. As we continue to reiterate, we are still so early in the AI Revolution.”

BREAKING: Oracle stock, $ORCL, surges over +23% after reporting earnings with a +359% increase in contracted revenue.

As we continue to reiterate, we are still so early in the AI Revolution. pic.twitter.com/ZuepvHiMZC— The Kobeissi Letter (@KobeissiLetter) September 9, 2025

Oracle Corporation Stock: Where To Next?

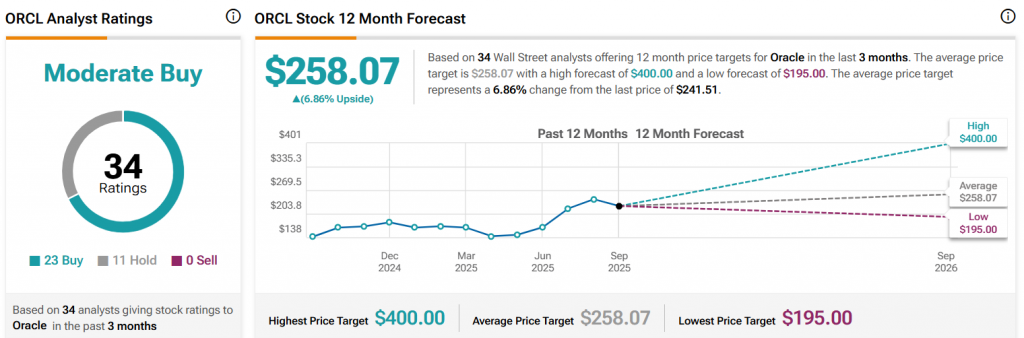

As per TipRanks ORCL share data, the stock is eyeing a new high of $400, which it can achieve soon, considering the bullish projections above.

“The average price target for Oracle is 258.07. This is based on 34 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $400.00, and the lowest forecast is $195.00. The average price target represents a 6.86% increase from the current price of $241.51.”

Also Read: GameStop Stock Jumps After GME Earnings Beat and Dividend Warrant