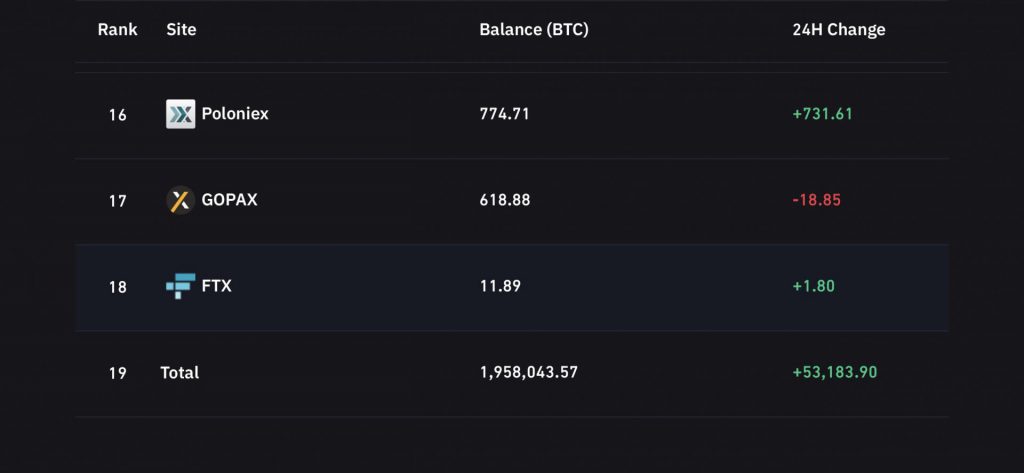

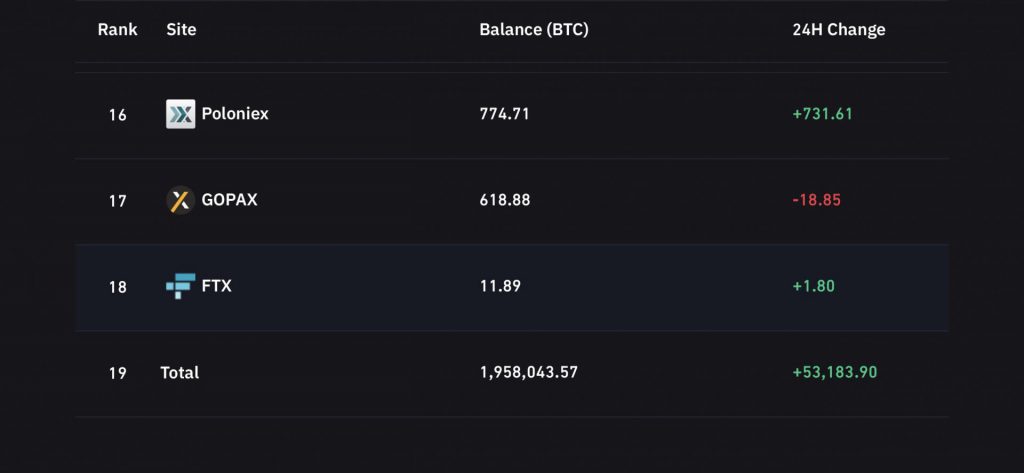

According to Coinglass, there have been 53,183 BTC added to exchanges in the last 24 hours alone. The move marks a turn for the market, which is still finding its footing after the monumental collapse of cryptocurrency exchange firm FTX.

The last week has been an interesting one for Bitcoin. As the world’s most prominent cryptocurrency has seen a deterioration in its millionaire wallets, but an uptick in non-whale investors. Yet, the influx of exchanges in the last 24 hours could be a sign of a small shift.

$871 million Bitcoin Added to Exchanges

The collapse of FTX was a move unlike any that the industry has seen. Seemingly overnight, a massive entity fell from grace, and the widespread contagion of its failure is still being felt following its bankruptcy filings this month.

It was that collapse that triggered mistrust in cryptocurrency exchanges, and centralized systems in the cryptocurrency world, a world that was founded on decentralization. Conversely, the movement of Bitcoin in the last 24 hours could signify that very trust isn’t as fractured as once suspected.

Coinglass has charted the movement of over 50,000 BTC to exchanges in the last 24 hours alone. Specifically, 53,183 Bitcoin — the equivalent of $871 million — through a myriad of exchanges.

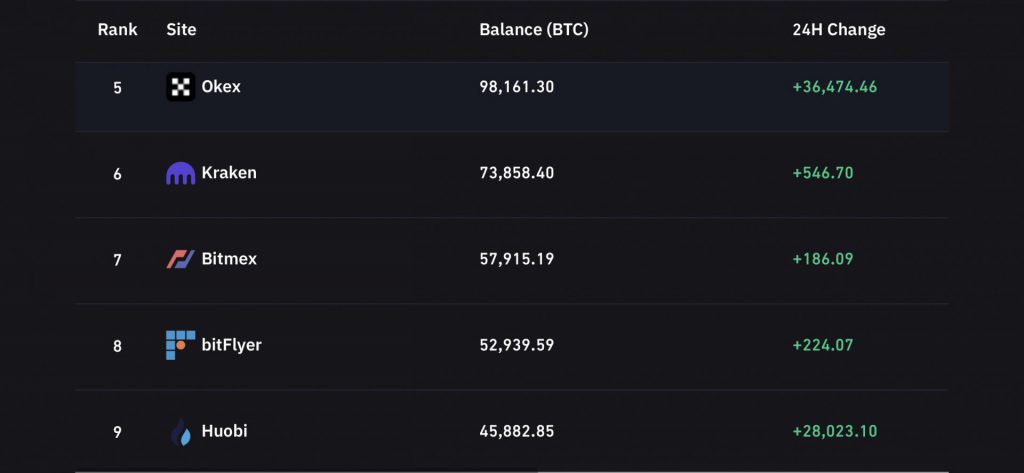

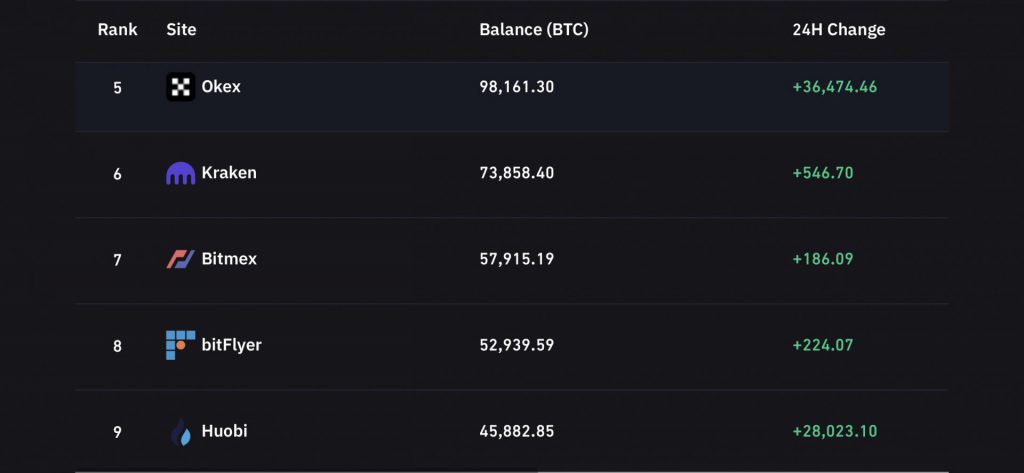

The outlook of Bitcoin’s presence on exchanges is an interesting one, as Binance still holds the greatest accumulation of the token at 585,447.27 BTC. Subsequently, the last 24 hours have seen a massive shift in both Okex and Houbi. Both exchanges have seen 36,474.46 and 28,023.10 added in the last 24 hours, respectively.

Both Okex and Houbi have added to their accumulation of 98,161.30 and 45,882.85 BTC in the last 24 hours. Moreover, both exchanges have seen the jump only in the last 24 hours, and they were not tracking this data to the past seven days.

The development could mean investors’ trust in certain exchanges is gaining. Still, the market is undoubtedly reeling from the effects of FTX’s bankruptcy. Thus, the trust in centralized platforms may not be easy to hold in the mainstream.