PayPal PYUSD stablecoin is changing how businesses pay each other. The company just made its first corporate payment using PYUSD. This shows how digital currencies can make business transactions easier, especially across borders.

Also Read: Solana-Based Popcat Hits New All-Time High: $2 Next?

Unlocking Corporate Payment Potential with PayPal PYUSD Stablecoin and Ernst & Young

A Groundbreaking Transaction

On September 23, 2024, PayPal paid an invoice to Ernst & Young LLP using PYUSD. They used SAP SE’s digital currency hub for this transaction. This shows that stablecoins can work well with existing payment systems.

Streamlining Cross-Border Payments

PYUSD solves many problems with traditional business payments. Jose Fernandez da Ponte from PayPal explained why it’s useful:

“The enterprise environment is very well-suited for it. It’s a very rational conversation to have with the CFO.”

Also Read: Here’s When Dogecoin (DOGE) Will Hit 20 Cents

Partnerships Driving Adoption

PayPal is working with big names like SAP and Ernst & Young. This shows that more companies are accepting stablecoins. Fernandez da Ponte said:

“PayPal, SAP, EY – those are names that are very, very well-established.”

These partnerships could make more businesses use stablecoins for payments. This could change how companies send money across borders.

The Future of Corporate Payments

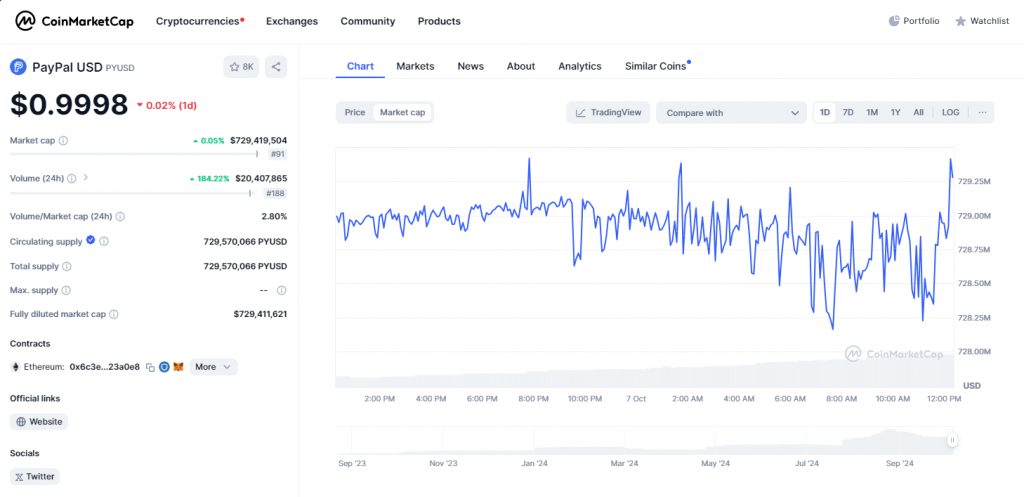

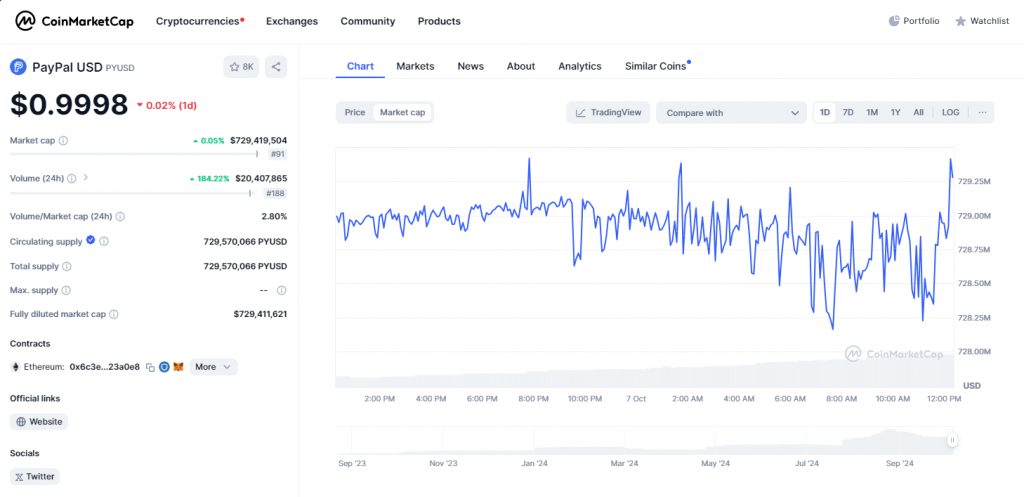

More businesses are seeing the benefits of stablecoin payments. This could change how corporate finance works. PayPal’s PYUSD is worth about $700 million now. It could play a big role in this change.

Also Read: US Stocks: Amazon Emerges As The Next Best Share, May Hit $224 Soon

This first corporate payment with PYUSD is a big step. It shows that digital currencies are becoming part of normal business operations. As more companies use stablecoins, businesses might soon have a new way to make payments that’s faster, safer, and cheaper.

Stay tuned for more helpful and updated information!