Veteran trader and Bitcoin (BTC) critic Peter Schiff has often been at odds with his son, Spencer Schiff, who on the other hand is a proponent of BTC. Senior Schiff took to Twitter today and shared a poll on the current fall of BTC. The CEO of Euro Pacific Capital Inc. asked his followers if the market would run out of buyers first, or sellers.

To this, Schiff’s son, Spencer replied saying that his “Bitcoin Derangement Syndrome” is causing the veteran trader to spend too much time looking at the price.

However, many were surprised at the response from Spencer. Some even asked him to be more respectful to his dad.

However, this was not the first time the father-son duo have been at odds regarding the original cryptocurrency. On the 26th of August, Peter Schiff took to Twitter and wished his son a happy birthday. Additionally, he said that he was proud of the man his son had become despite his temporary obsession with Bitcoin (BTC).

To this, Spencer replied that he is not obsessed, but rather is a fan of anything that would bring prosperity to humans. Furthermore, Spencer highlighted that Bitcoin is one such invention.

However, senior Schiff was not sold. He added that Spencer was still young and had a lot to learn. In addition, he said that his youth gives him the time to make mistakes and earn his money back.

Schiff is a popular Bitcoin critic, but many in the community often welcome his thoughts and views.

Bitcoin mining difficulty to surge?

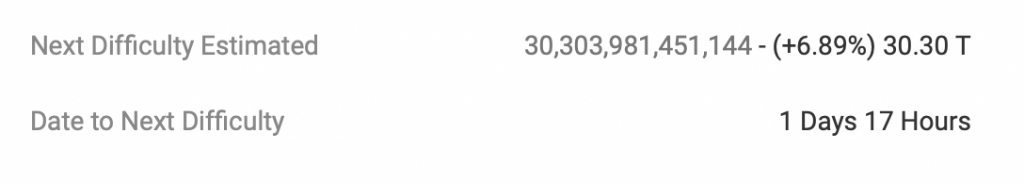

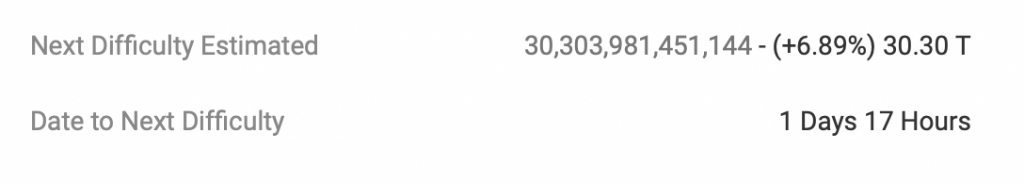

Schiff’s comments come in as the original cryptocurrency plummeted below $20,000. However, according to the data from BTC.com, the Bitcoin network will see its first major surge in mining difficulty in nearly 7-months.

The bitcoin mining difficulty adjustment is expected to roll out in less than 48 hours. Furthermore, as per the initial expectations, mining difficulty is expected to increase by nearly 7%.

At press time, BTC was trading at $19,863.59, down by 0.8%.