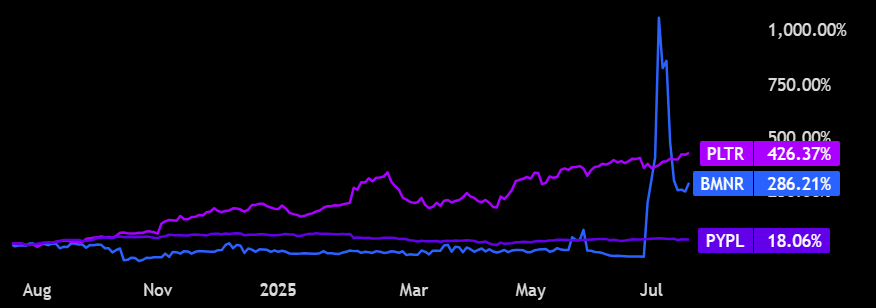

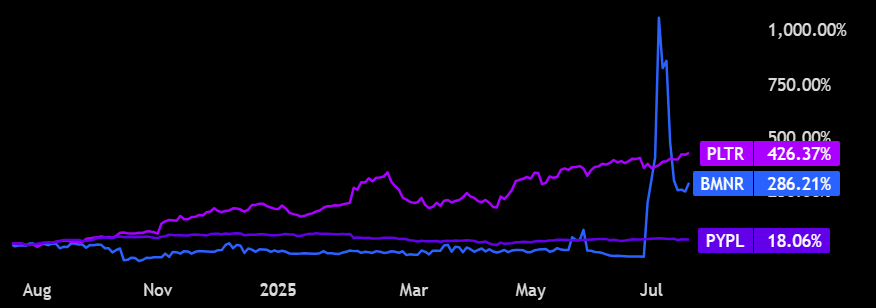

Peter Thiel’s BitMine investment has actually sent shockwaves through the cryptocurrency world as the tech billionaire disclosed a significant 9.1% stake in BitMine Immersion Technologies through his venture capital firm Founders Fund. The BitMine stock 2025 performance has surged more than 400% since the company’s US debut in May, and right now investors are taking notice.

The disclosure shows that Thiel acquired approximately 5.09 million shares, making him one of its largest shareholders. BitMine’s stock price was pushed up 17% to $46.91 in mid-day trading Wednesday, which happened after the news broke.

BitMine’s Ethereum Bet Signals Institutional Buying and Crypto Surge

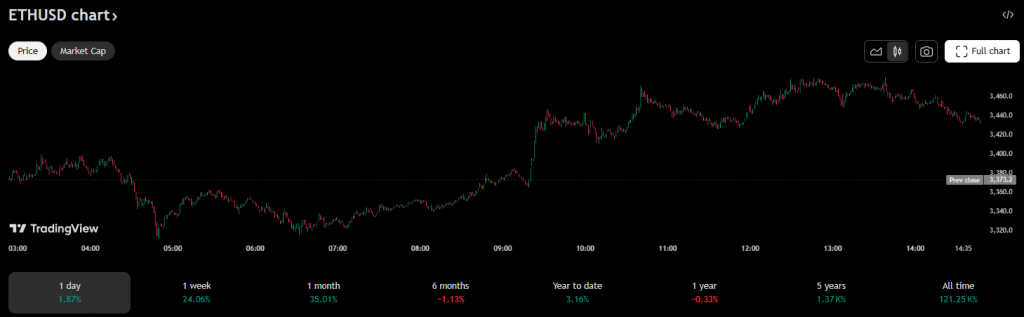

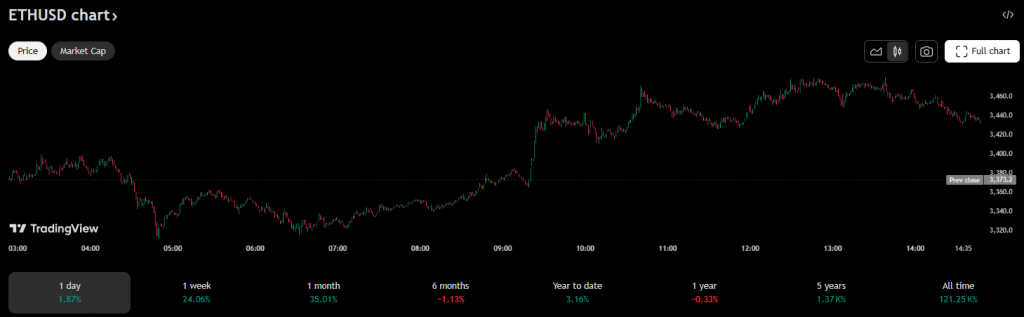

The founders fund crypto bet on BitMine represents growing institutional confidence in Ethereum as a treasury asset, and it’s actually quite significant. BitMine recently disclosed it had a total holding of 163,142 coins, worth more than $500 million at the time of writing. The Peter Thiel’s BitMine investment validates the company’s transformation from Bitcoin mining to an Ethereum treasury powerhouse, along with other strategic moves.

Tom Lee’s Vision Attracts Major Investors

BitMine’s Ethereum holdings strategy was led by Fundstrat’s Tom Lee as Chairman, and the results have been impressive. The company’s $250 million private placement included participation from the founders fund crypto bet alongside Pantera Capital and also Galaxy Digital, among others.

Also Read: Pentagon-Backed MP to Sell $500M in Stock After 283% Rally

Thomas Lee said:

“This transaction includes the highest quality investors across TradFi and crypto venture capital, properly reflecting the rapid and continued convergence of traditional financial services and crypto.”

Thomas Lee had this to say:

“Stablecoins have proven to be the ‘ChatGPT’ of crypto, leading to rapid adoption by consumers, merchants and financial services providers.”

Institutional Ethereum Buying Accelerates

Institutional Ethereum buying gains momentum as companies recognize ETH’s utility, and major players join the trend. The Peter Thiel BitMine investment timing coincides with broader crypto market developments that are happening right now.

Jonathan Bates, CEO of BitMine, also stated:

“The private placement will accelerate BitMine’s treasury holdings shortly after its first treasury purchase on June 9, 2025. FalconX, Kraken, and Galaxy Digital plan to partner with the Company to grow a world class Ethereum treasury strategy alongside existing custody partners, BitGo and Fidelity Digital.”

Also Read: Trump’s World Liberty Buys $10 Million Ethereum: Price Hits $3300

The BitMine stock 2025 performance has been remarkable, with the stock being driven up from its $8 debut price. BitMine’s Ethereum holdings now provide access to native protocol features including staking and DeFi mechanisms, which is actually quite valuable. Institutional Ethereum buying interest continues growing as the founders fund crypto bet validates Ethereum’s treasury potential, and analysts expect more companies to follow suit.