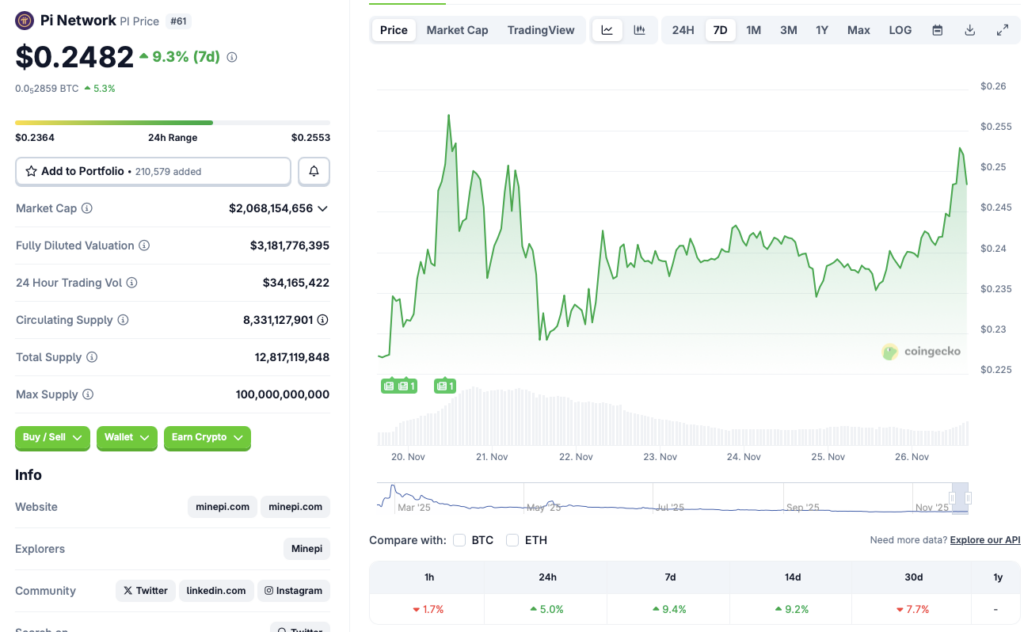

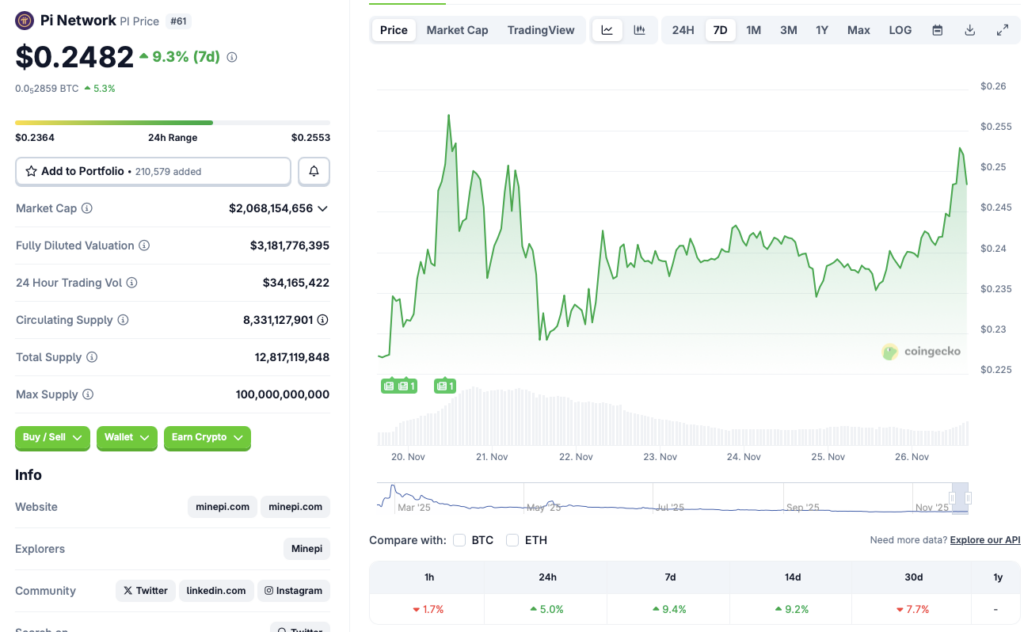

Pi Coin (Pi Network/PI) is currently one of the best-performing cryptocurrencies in the market, outperforming the likes of Bitcoin (BTC), Ethereum (ETH), XRP, etc. Pi Coin has experienced a rally across almost every time frame. According to CoinGecko data, PI is up 5% in the last 24 hours, 9.4% over the last week, and 9.2% in the 14-day charts. Despite the surprising rally, the asset is down 7.7% over the last month.

What’s Behind Pi Coin’s Rally? Will It Sustain?

Pi Coin (PI) has seen a consistent price rally since early November. The asset fell to $0.20 on Nov. 5, but has since reclaimed the $0.24 price level. The market crash over the last month led to a substantial dip in investor worry. However, the recovery over the last few days may have boosted investor sentiment.

Pi Coin’s reversal follows a market-wide recovery pattern. Bitcoin (BTC) has hit $87,000 after its recent descent to $82,000. BTC’s recovery may have led to investors buying PI as well. The market-wide resurgence could be due to investors buying the dip. BTC prices hit near seven-month lows, and market participants may have used the opportunity to stock up on crypto assets.

Pi Coin’s rally may have also been fuelled by developments within the project. According to an official post, the app creation platform in the Pi App Studio has become more intuitive, organized, and powerful. Investors may be anticipating more users flocking to the Pi Network ecosystem.

Also Read: Pi Coin Value in 2030 Set to Peak Near $1.87: What Could $1,000 Yield?

Given the ongoing market scenario, there is a chance that Pi Coin (PI) will not continue its rally. The crypto market is still fragile, and most other assets seem to be consolidating. PI may face a similar pattern. The asset could consolidate around current price levels or face a correction in the coming days.