The crypto market greeted Wednesday on a green note. Even though almost all top tokens from the market were trying to negate their losses incurred from Monday’s dump, the spotlight remained to be on a handful of tokens including Polygon’s MATIC. The reason, of course, is Robinhood’s listing.

Just a day back, the said American exchange listed a few tokens, and most of them ended up reacting positively on the charts. As other large-cap alts kept their daily gains capped around 1%-2%, MATIC had registered a 5% incline and was trading at $1.43 at the time of press.

Polygon’s fundamental clutter and chaos

Despite the said price hike, the fundamental landscape of Polygon continues to remain unstable.

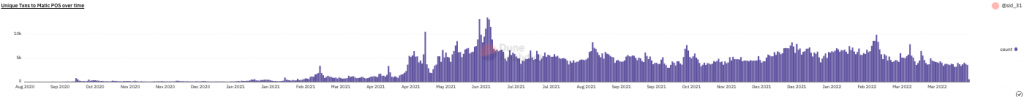

The number of unique transactions to Matic’s PoS, for starters, fairly remains to be deflated when compared to the levels noted during the December to February period. From an average of 6k registered at that time, the number of transactions has slipped down to the 3k range already.

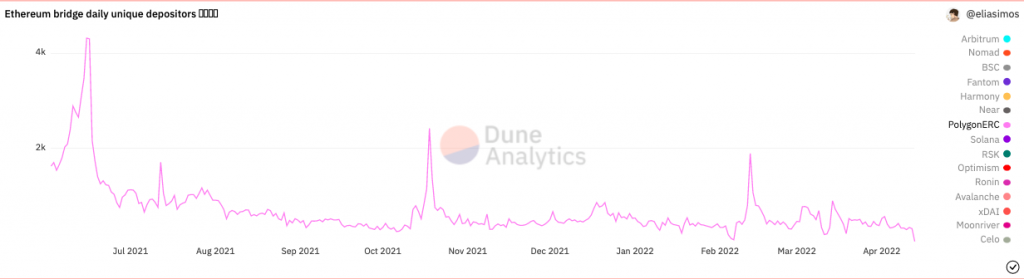

Next, take the case of the number of daily unique depositors on the PolygonERC bridge. This curve had remained flat since March and more or less hovered in and around the 400-500 mark. However, over the last couple of days, it dipped substantially and merely reflected a value of 84 at the time of press.

The cumulative value locked on Polygon bridges too has lost some worth over the past week. Data from Dune brought to light that the same dipped by 8% in the past 7 days. However, it is interesting to note that despite the dip, the TVL on Polygon remains to be the highest [$5.518 billion] amongst other Ethereum bridges, indicating that the majority of current DeFi users have a soft spot for Polygon.

So, to capitalize and make most of the said situation, the lost users, along with additional ones, ought to re-enter the Polygon’s arena and start actively carrying forth transactions. Else, if the state of the initial two metrics continues to deteriorate, Polygon would find it quite challenging to thrive.