Corporate treasuries seem to be going all in on Bitcoin (BTC). Treasury purchases have played a significant role in BTC’s recent price spikes. According to Bitwise, the number of public companies that hold Bitcoin (BTC) surged by almost 40% in the third quarter of this year. A total of 172 publicly-traded companies hold a total of 1.02 million Bitcoin (BTC), worth around $117 billion. These companies collectively hold about 4.8% of the total BTC supply. According to an X post by Bitwise CEO Hunter Horsley, “People want to own Bitcoin. Companies do too.“

Will Demand For Bitcoin From Public Companies Drive Prices?

ETF inflows and corporate purchases have led to a significant price surge for Bitcoin (BTC). The original crypto has hit multiple all-time highs over the last few months. BTC hit its most recent peak of $126,080 earlier this month on Oct. 6.

Despite the price surge over the last few months, Bitcoin (BTC) faced a massive price crash last weekend. The correction was likely due to macroeconomic reasons, particularly the trade dispute between the US and China. The crypto market made a slight recovery after both nations held healthy negotiations.

Also Read: US Government Seizes $15 Billion in Bitcoin From Pig Butchering Scam

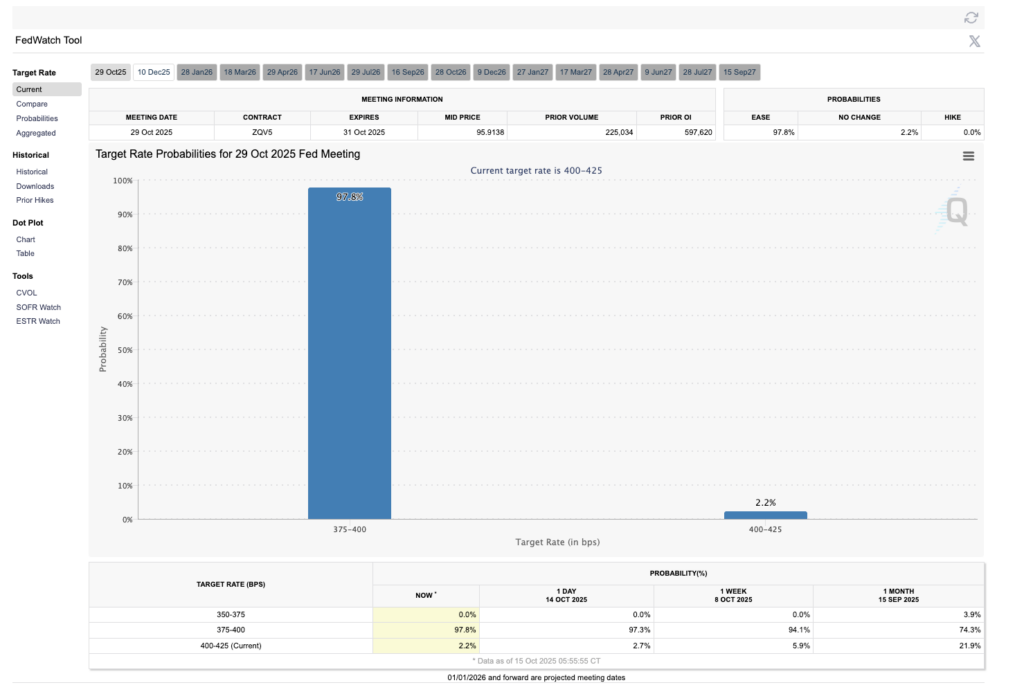

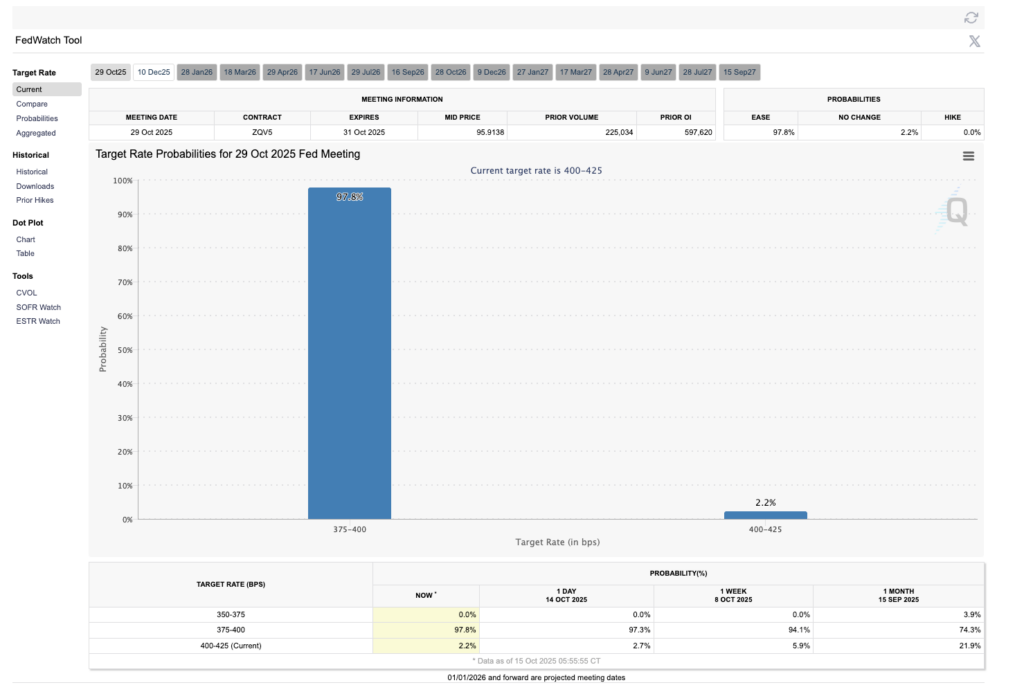

Bitcoin (BTC) and the larger crypto market are expected to rebound over the coming weeks. In his recent speech, Federal Reserve Chair Jerome Powell hinted that interest rate cuts are inevitable. According to CME’s FedWatch tool, there is a 97.8% chance that the Federal Reserve will lower interest rates by another 25 basis points after its next meeting. Another rate cut could trigger a bull run for Bitcoin (BTC).

However, the global economic condition is still quite fragile. Trade wars and slow economic growth could spell trouble for Bitcoin’s (BTC) price. Moreover, market participants seem to be moving their capital to safe havens, such as gold. The yellow metal climbed to a new all-time high, breaching the $4200 mark for the very first time.