Most top coins from the space had created new ATHs in Q4’s November last year, but ended up negating the gains in the subsequent weeks. In effect, the crypto market stepped into 2022 on a bearish note.

On 1 January 2022, the total valuation of all the crypto assets revolved around $2.27 trillion. However, in the days that followed, it shrunk to $1.489 trillion. Then, with the gradual buying interest escalating, the global crypto market cap returned above $2 trillion by the end of March, making Q1 2022 seemingly decent.

Analyzing the state of the top 100

The top coins from the space too followed similar price trajectories over the past 3 months. From the top 100, 2 tokens had appreciated by more than 150%, while 6 tokens rallied by more than 20%. 10 tokens, on the other hand, were in a break-even no-loss, no-gain state, thus bringing the number of tokens in loss to 82.

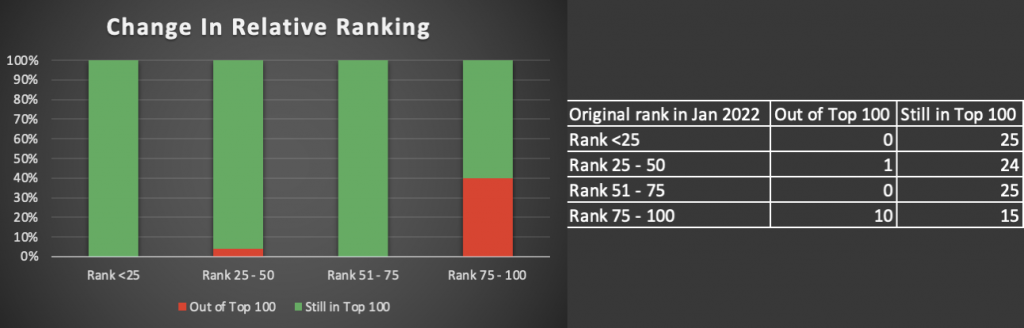

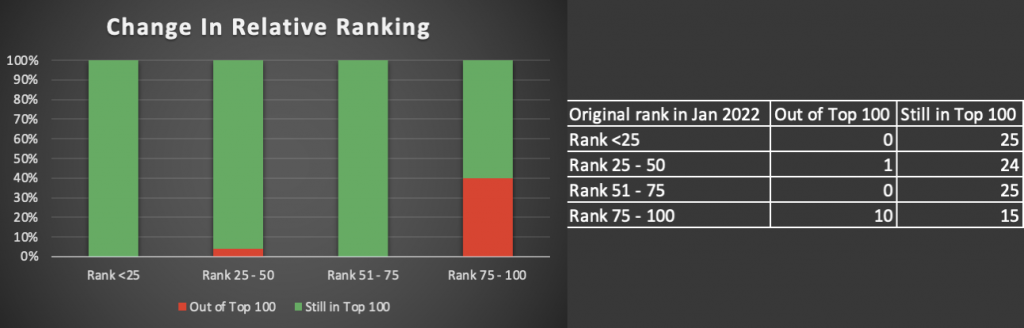

Of the said tokens in loss, 3 of them shed 50% of their value in Q2, while 11 of them paved their way out of the list. Here, it is interesting to note that 74 out of the top 75 tokens still hold their reigns in the top 100, implying that tokens ranking much lower were the ones who had existed on the list.

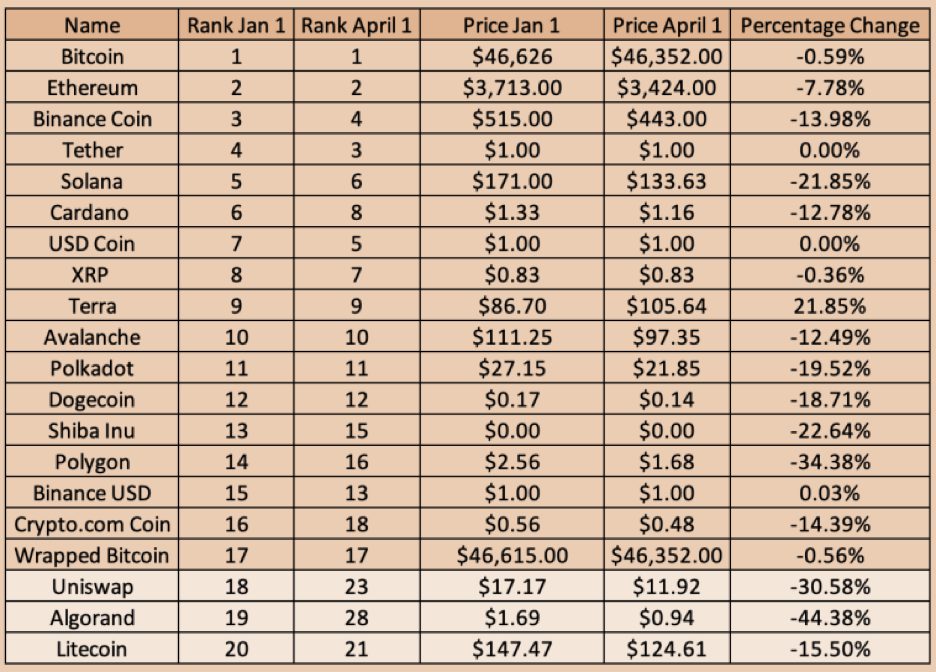

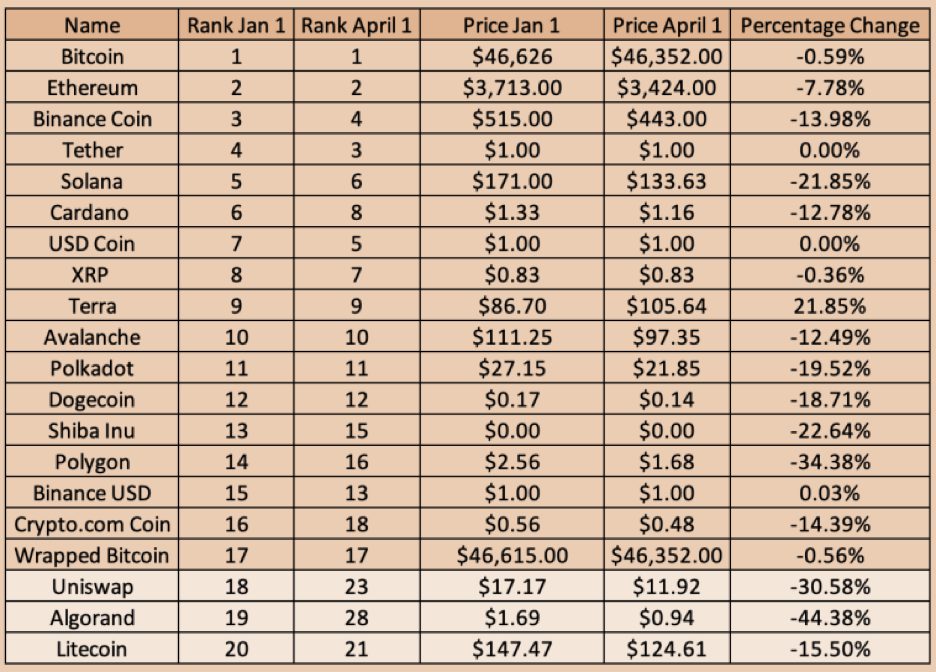

The ever-shuffling crypto rankings

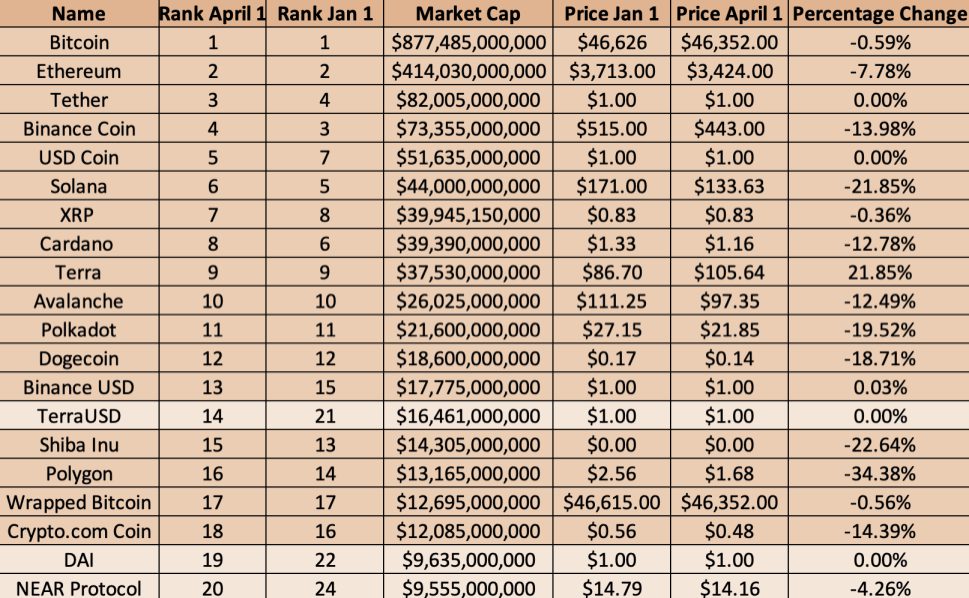

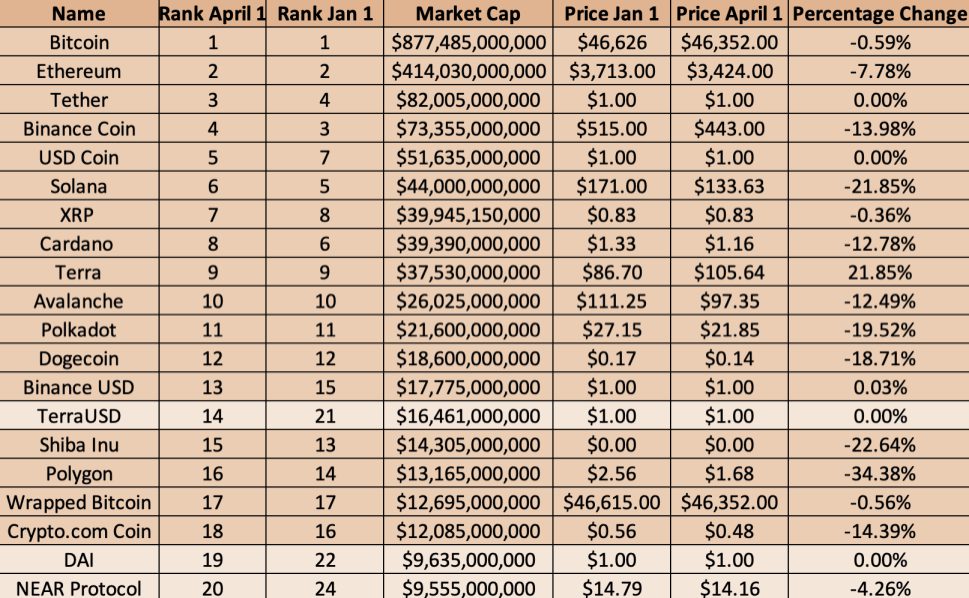

Crypto rankings are seldom the same. They keep shuffling daily. 17 out of the top 20 tokens managed to fare decently over the past quarter, and as a result, retained their spot in the list. Three tokens—NEAR, UST, and DAI—made their way into the list to occupy the vacant seats.

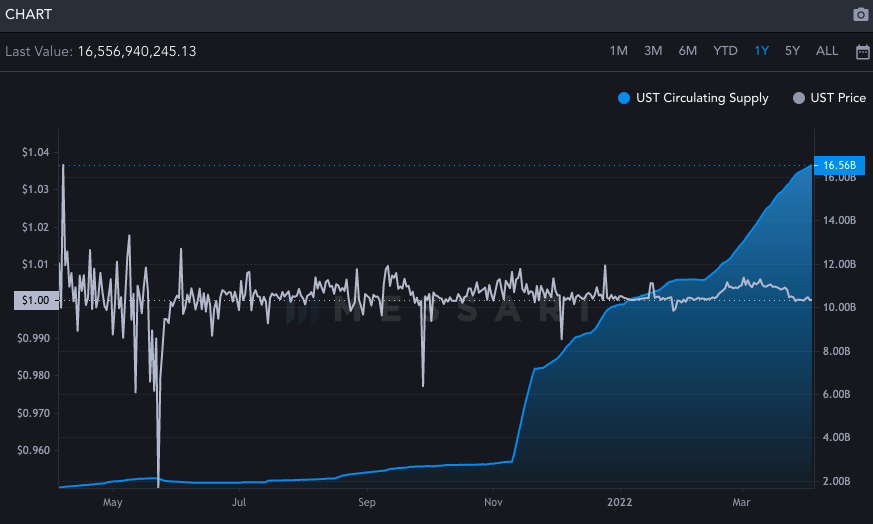

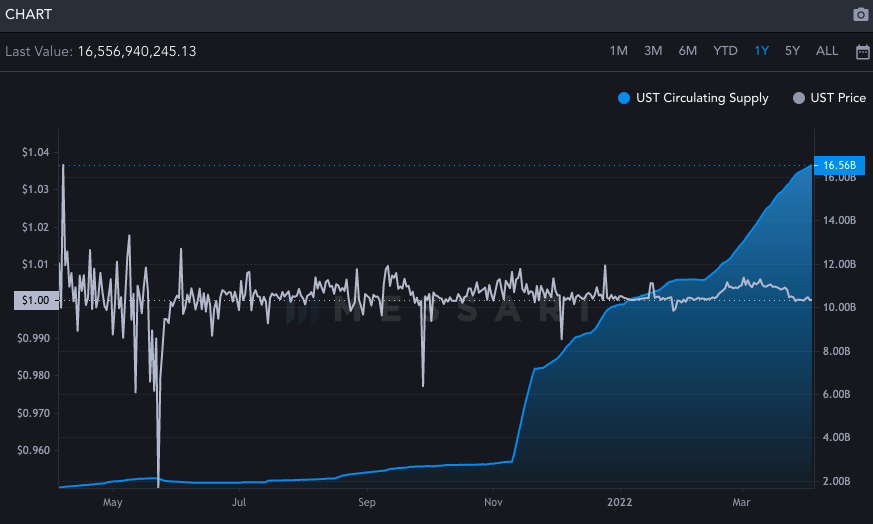

Notably, 2 out of the 3 tokens were stablecoins and the circulating supply of both of them increased in the said period, triggering them to climb up on the market cap rankings chart.

Per data from Messari, on 1 January, UST and DAI’s circulating supply stood at 10.122 billion and 9.269 billion respectively. By the end of the quarter, they had already notched up to 16.332 billion 9.651 billion.

Consequentially, Uniswap, Algorand and Litecoin were forced out of the list.

Price fluctuations and future outlook

Over the past quarter, assets belonging to all rank brackets noted small-time dips. However, they collectively posed a neutral figure of 0.22% at the time of analysis.

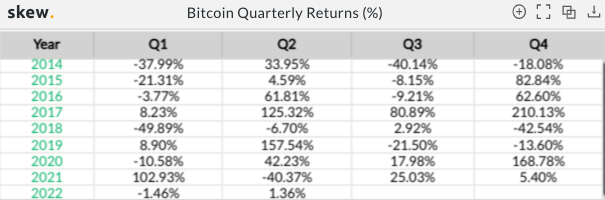

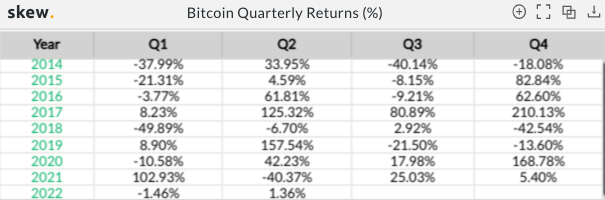

Well, Q1 has historically never been the best quarter for cryptos. Bitcoin, for instance, has fetched investors negative returns 6 out of 9 times since 2014.

The Q2 tale however looks different, with the negative returns’ number shrinking down to merely 2 out of 9. In fact, as far as Ethereum is concerned, it has never registered negative numbers thus far in any year’s Q2.

Well, the crypto market managed to border-line pass in Q1 2022, but keeping in mind the past precedents and the broader dynamics, there is definitely much more to look forward from Q2.