Most of the cryptocurrencies in the coveted top 10 were enduring a loss. Following the recent rally, the community believes the market could be going through a correction. However, there were a few exceptions. Aptos [APT], Quant [QNT], as well as Threshold [T], were the top 3 assets pocketing gains amidst this corrective period.

At press time, Quant was trading for $155.26 with a 6.55% daily surge. The asset’s weekly gains were simultaneously pushed by 9.30%.

The one-day price chart of QNT noted that the Altcoin might move beyond $200 if it manages to push past $168.31, a strong resistance level. However, if the asset fails to persist in its ongoing trend, it could drop to its nearest support zone of $135.41 or even stoop down to $100.42.

Currently, there is increased buying activity in the QNT market. The Relative Strength Index [RSI] indicator highlighted how the asset was overbought.

It should be noted that QNT continues to trade 63.87% below its all-time high of $428.38.

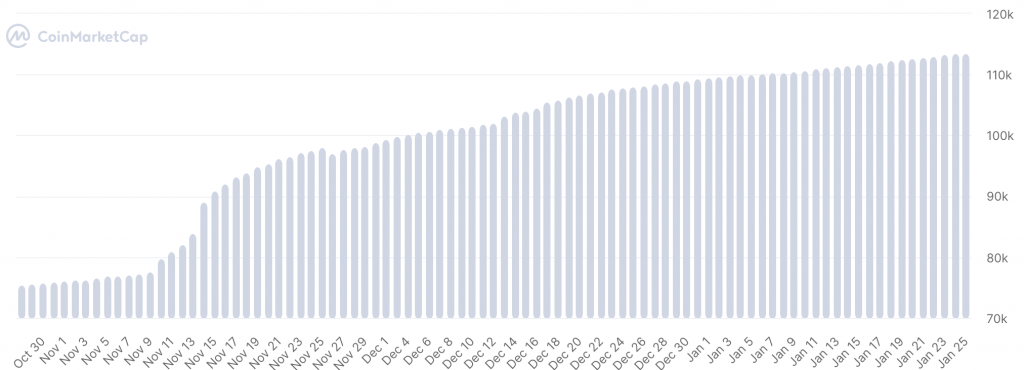

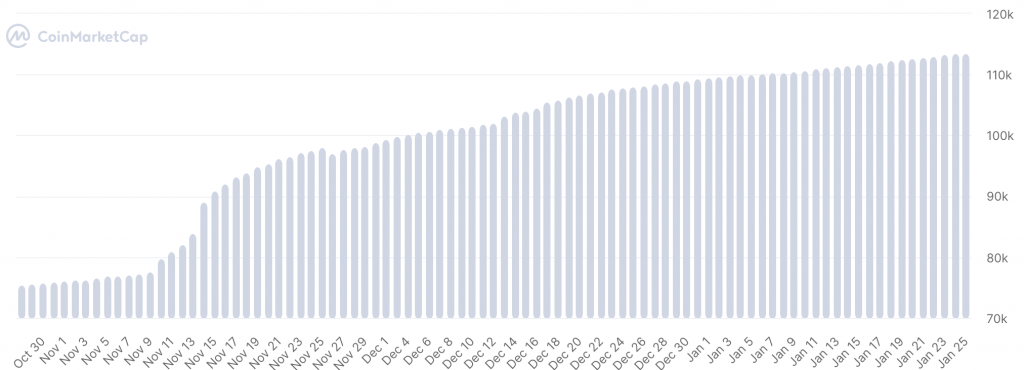

Quant lures in new investors

With the RSI marker in the overbought zone, holders were visibly pocketing QNT. Better yet, new holders could be in on this as well. As seen in the below chart, the holder count of the altcoin has recorded an upswing over the last 3 months. At present, the total number of unique addresses were at 113,424.

Additionally, more than half of these holders were seen booking profits. According to IntoTheBlock, QNT holders that were making money at the current price were at 78% while only 19% weren’t.

The social strength of the asset was also at par with this notion. Throughout the last week, the social volume pertaining to Quant soared by 21.3%. The total number of social engagements reached a high of 49.31M.

The reason behind the asset’s short-term gains could be related to the wider market. However, the Quant Network is expected to come out with more use cases for the asset amidst working alongside projects like LATAM Dollar and LACCHAIN. Therefore, QNT’s long-term gains are likely to be associated with its possible boost in utility.