Digital payments have taken center stage in economies around the world. The usage of cash in Sweden has already gone below 10%, according to the Central Bank’s Payments report for 2021. CBDCs are being considered by several nations as a way to create a cashless society. El Salvador and the Central African Republic have also embraced crypto as legal tender. However, the transition to digital payments is fraught with difficulties.

Digimentality 2022—Fear and Favoring of Digital Currency, is a report commissioned by Crypto.com, that examines the extent to which consumers trust digital payments and what impediments may remain to fundamental monetary operations being primarily electronic or digital.

Tobias Adrian, a financial counselor, and director of the Monetary and Capital Markets Department of the International Monetary Fund (IMF), who gave his perspective on the report, said

“It’s natural for physical cash to be complemented by digital cash as the world is becoming more digital and it’s a natural evolution.”

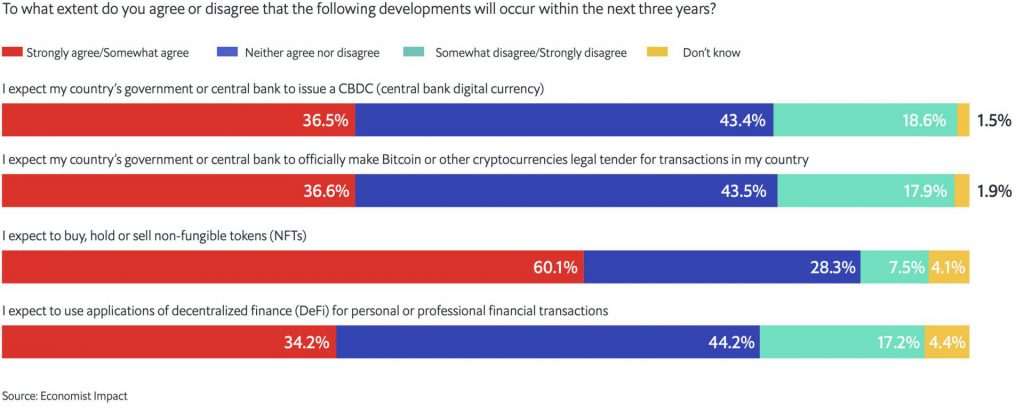

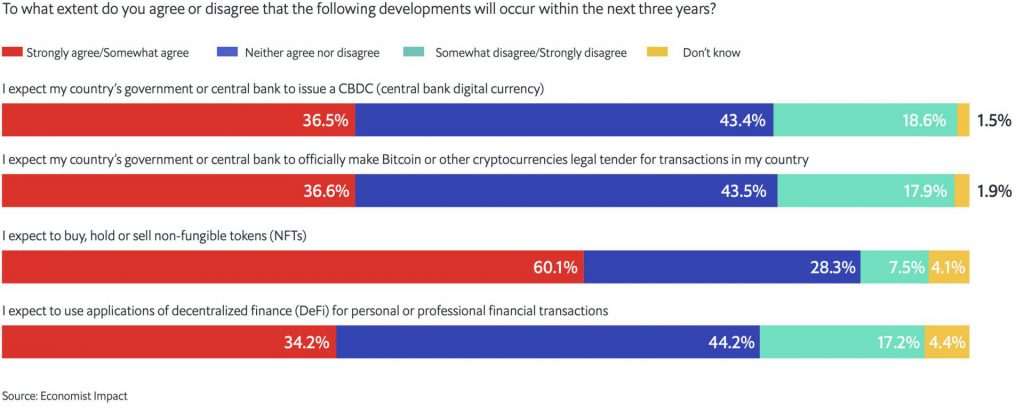

According to the report, CBDCs are currently preferred by 14% of consumers, up from 4% in 2021. As a result, about one-third of customers (37%) expect their government or central bank to start a CBDC and/or make crypto legal tender within the next three years.

When it comes to trust, cash reigns supreme. Cash is considered trustworthy by eight out of ten (85%) of respondents, a modest increase from last year (83%). In the last year, 24% of respondents said they always utilized digital payments rather than actual cash, coins, or credit cards. Another four out of ten people (36%) said they utilized digital payments frequently (at least 50% of their purchases).

Crypto remains the most popular form of digital payment (used by 13% of survey respondents), followed by a digital currency issued by technology and financial firms (12%), and a government-issued digital currency (9%), all of which are relatively unchanged year over year.

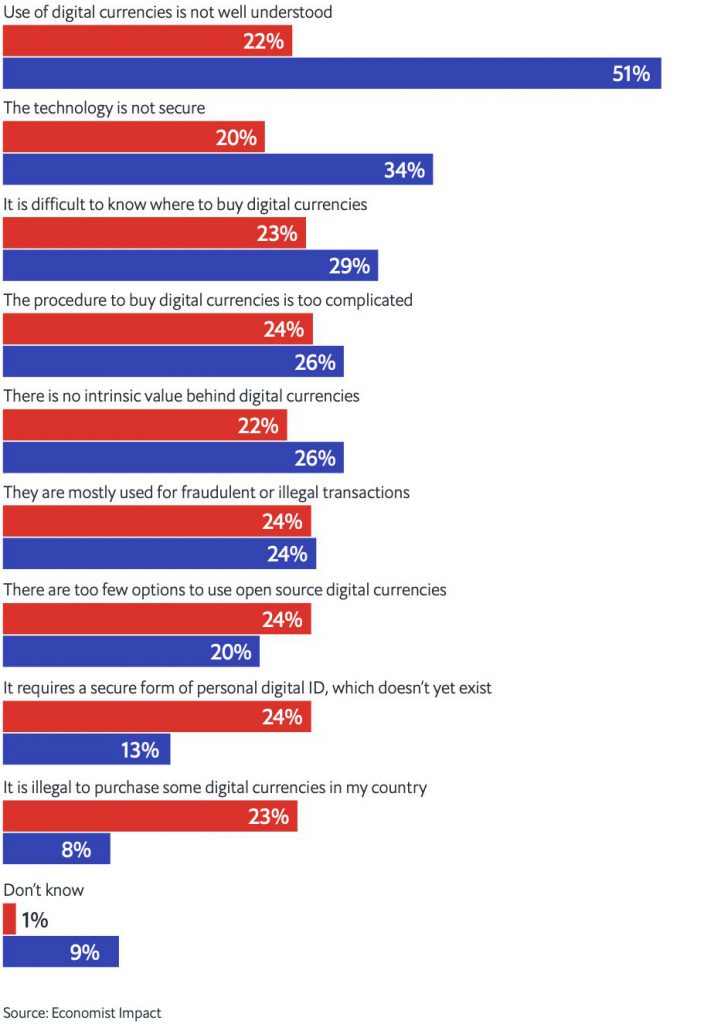

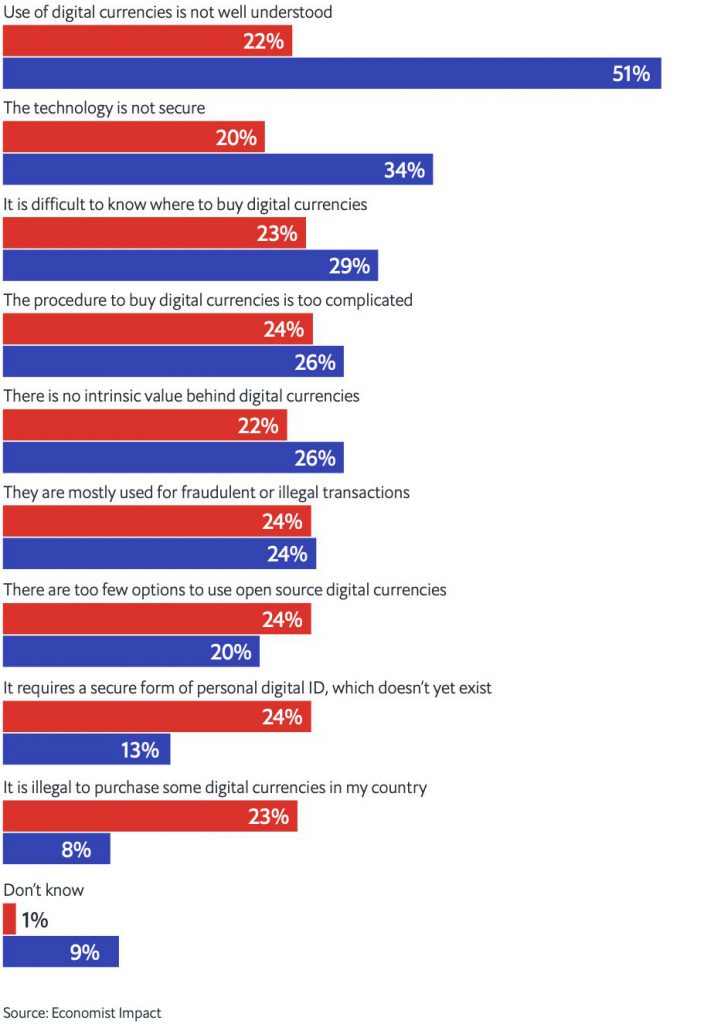

According to survey respondents, the lack of understanding of open-source digital currencies (such as crypto) has decreased from 51% to 22% year over year. Instead, the biggest stumbling block is currently seen as the lack of a safe form of digital personal identification, which does not yet exist.

Additionally, Non-fungible tokens (NFTs) are also rising. NFTs are only behind cash in terms of trustworthiness, with two-thirds (65%) thinking they are reliable, confirming the findings of an institutional poll that firms are actively considering their usage. 60% of those who responded to the study anticipate purchasing, holding, or selling NFTs in the next three years.