Alongside cryptocurrencies, the adoption of blockchain technology has also been on the rise. Apart from hosting crypto networks, this tech also provides a host of real-life use cases. Facilitating fast and secure payments is one of the most notable utilities that blockchains provide. Resultantly, payment protocols, like Ripple, have benefitted from the growing adoption.

Institutions or Retail: Who’s leading the way?

Institutions have a significant say in the world of blockchain payments. Per a recent survey conducted by Ripple, 70% of financial institutions are interested in using blockchain for payments.

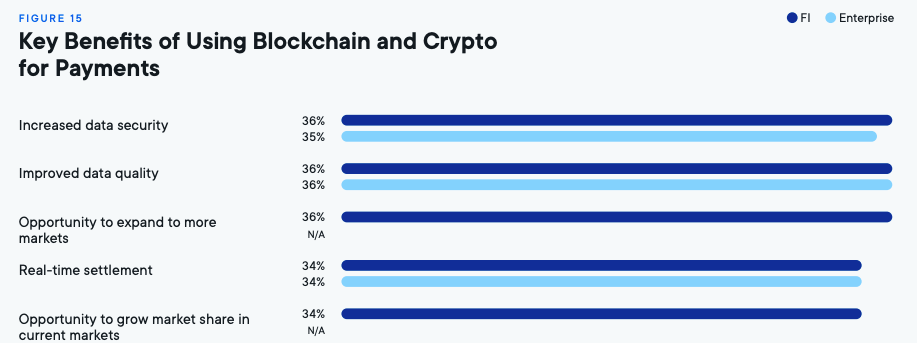

Right from data security and quality, to growth opportunities and real-time settlement, they collectively honored the perks. Outlining the same, Ripple’s report noted,

“When financial institutions were asked what they see as the key benefits of using

blockchain and crypto for payments, there was a relatively even spread across a

number of benefits, with data security and quality coming out slightly ahead of

growth opportunities in more markets or within market, and real-time settlement.”

Consumers, on the other hand, were relatively reluctant, for only 33% of Ripple’s respondents were willing to consider using crypto for purchases.

Like institutions, even consumers valued the safety and trust attributes. However, they did not really see “lower transactional fees” as a pro and gave it one of the bottom-most ranks among benefits.

Well, consumers’ transactions are usually restricted to friends or family, which are mostly non-cross borders in nature. And, most other domestic alternate payment modes are free, or already low cost. So, perhaps that’s why this set of users does not value the said attribute. However, Ripple expects this attitude to change with time.

What to expect going forward?

Here it is worth noting companies involved in crypto payments have noted growth in the first half of ’22. On CoinsPaid, for instance, the number of processed transactions increased by 2 times and reached almost 9 million in H1. Furthermore, the volume of the operations in the field of crypto payments increased by 180%, lending credence to the encompassing adoption of digital currencies across the board.

The momentum is likely to be transferred to the next half of the year as well. Elaborating on the same in a textual commentary to Watcher Guru, the CMO of CoinsPaid—Dmitry Ivanov—said,

“… we can expect this trend to continue in the second half of the year.”

As far as the macro outlook is concerned, Ripple’s report outlined that the perks will aid in elevating the reputation of crypto payments in the future.

“… there’s reason to believe that among emerging markets that face

currency devaluation, cryptocurrencies are highly valued for their ability to make

remittance payments and business transactions more affordable. Therefore, we

believe that as crypto usage grows so will its reputation as a payments cost saver.”