This week has been quite eventful for Ripple. It all started with a positive development in its court case against the SEC. Judge Analisa Torres of the U.S. District Court for the Southern District of New York rejected the agency’s request to keep the Hinman Speech documents sealed.

The SEC had previously filed a motion seeking to seal internal emails, text messages, and expert reports related to the speech. The plaintiff argued that these documents were irrelevant to the case. Judge Torres, however, dismissed the SEC’s request to seal the documents and highlighted that the materials were considered “judicial documents.” The XRP Army and the investor community were quite elated about the point scored by Ripple. In fact, that day, XRP spiked on the chart by around 8%.

Then, right after that, Ripple announced that it had acquired Metaco, a Swiss crypto custody firm. The acquisition brings to light that the company intends to expand its international presence and widen its service range. Ripple invested around $250 million from its own balance sheet to acquire the firm.

Also Read: Ripple Buys Crypto Custody Firm Metaco for $250 Million

Ripple scores big, again

Next, the Hong Kong Monetary Authority announced the launch of its e-HKD Pilot Program yesterday. Around 16 firms from the FinTech sector will take part in the trial run of Hong Kong’s CBDC program. Ripple Labs is the only representative from the crypto space. Its proposed use case revolves around the settlement of tokenized assets.

Ripple will partner with Taiwan’s Fubon Bank and others to demonstrate its use case under the e-HKD Pilot Programme. Specifically, it will focus on ‘real estate asset tokenization and equity release leveraging the e-HKD.’ Commenting on the aforementioned development, James Wallis, Ripple’s Vice President of Central Bank Engagements & CBDCs said,

“We now have the opportunity to demonstrate how real estate asset tokenization could be brought to the citizens of Hong Kong, and are confident that our fully integrated solution will be an industry-first use case demonstrating the power of leveraging a CBDC for real estate equity asset release.”

According to the official statement, Ripple’s solution combining the e-HKD, tokenized real estate, and lending protocols will run on a private and secure ledger. That will be built with the same technology as the XRP Ledger [XRPL].

State of XPRL

Interestingly, activity on the XRP Ledger noted a swift improvement in the January-March period. According to a recent analysis report by Messari,

“Overall network activity metrics increased in Q1.”

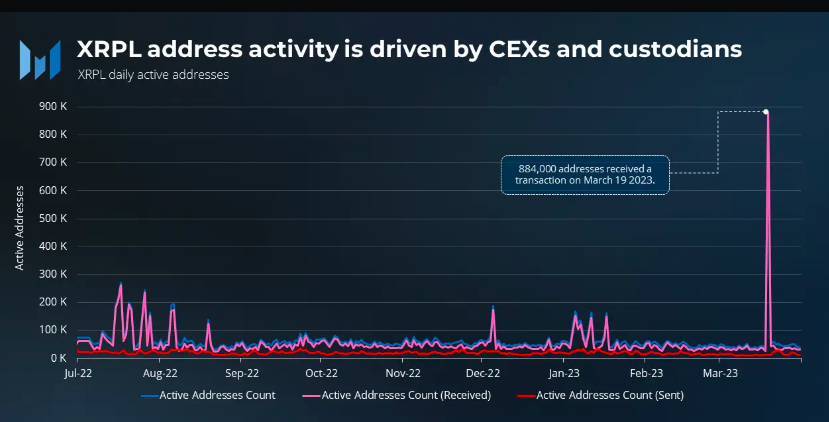

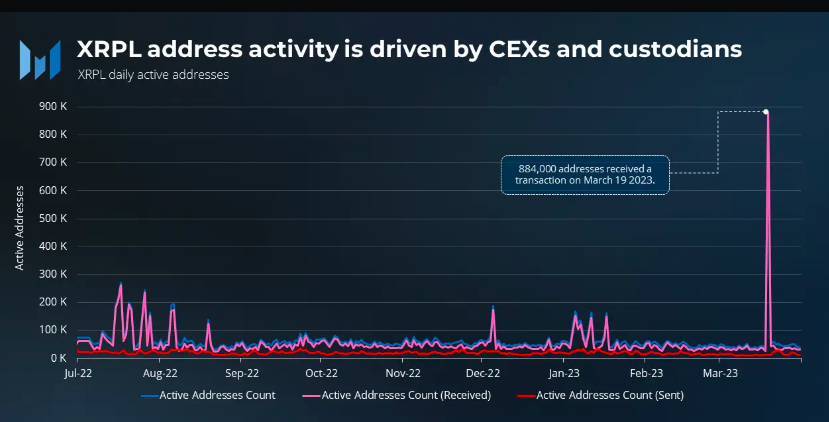

As far as the numbers are concerned, the daily active addresses and daily transactions increased by 13.9% and 10.7% QoQ, respectively. The receiving addressing grew by 17.1% from 47,000 to 55,000, helping the total active addresses notch up. Furthermore, one year back in Q1 2022, receiving and sending addresses were nearly equal. However, they have diverged since then. According to Messari’s report,

“On March 19, 2023, nearly 900,000 addresses received a transaction, which was 20-30x the daily average in Q1. The spike can likely be attributed to users exiting centralized exchanges and custodians in anticipation of news on Ripple’s SEC case.“

Another stride made on the CBDC front

In another parallel development, the blockchain firm also announced the launch of the ‘Ripple CBDC Platform’ yesterday. The said end-to-end solution will help central banks, governments, and financial institutions to issue their own CBDC.

The Ripple CBDC platform is developed to address multiple use cases. The same includes wholesale and retail CBDCs on a private ledger or issuing a stablecoin. Specifically, the platform offers its customer’s ledger technology, an issuer, an operator, and end-user wallets. Commenting on the said development, Ripple’s Chief Technology Officer David Schwartz tweeted,

“The CBDC Platform reaffirms the significance of the XRP Ledger as it’s built with the same core ledger technology. It has the ability to interact with XRPL and use XRP as a bridge currency for cross-currency and cross-border payments.”

So, to sum it all up, the goals scored include the Hinman win at court, the Metaco buy, the Hong Kong CBDC tie-up, and the launch of the CBDC, stablecoin issuing platform.

XRP is up 10%

The crypto market has been moving sideways and consolidating of late. Bitcoin continues to hover in the $26.5k-$27k bracket, while Ethereum has been stuck around $1.8k. Most other assets reflected similar stagnant trends. As a result, the global crypto market cap stood at $1.13 trillion on Friday, May 19. The same marked a 0.71% decrease over the past day.

XPR, however, was trading in green. In fact, at press time, it was the third-largest gainer on the daily and was trading around $0.462. In fact, the $23.9 billion market-capped asset is already up by more than 10% from its May 16 lows.

Also Read: Why Is XRP Surging by Over 8% Today?