Right after the U.S. released its inflation numbers yesterday, the cryptocurrency market started making bullish strides. In retrospect, the aggregate market cap was up by nearly 3%, and 92 out of the top 100 assets were seen flashing green returns on the daily. The same momentum was carried forward even on Wednesday.

Well, even though most coins from the market seem to be closely-knit at at moment, there are a few exceptions. Data from Cryptowatch brought to light the weakening bond between a few large-cap cryptocurrencies. XRP was one among them. At press time, the sixth ranked asset shared a correlation of only 0.66 and 0.69 with Bitcoin and Ethereum, affirming the said trend.

Also Read: U.S. Inflation Rate Falls to 6.4% in January

Key levels to keep an eye on for XRP

XRP has arguably been diverging from the rest of the market since the beginning of this year. While most assets greeted the new year with a pump, the XRP substantially dropped. However, it made up for its lacklustre behavior after that and inclined by ~30% over the next few days.

Towards the end of last month, however, the asset’s price initiated a steep downtrend. From its local peak of $0.43, it depreciated to $0.36. Resultantly, it dropped below all its crucial EMAs.

So now, if the bearish pressure intensifies, then XRP could drop down to either of the supports chalked below [around $0.36, $0.34, $0.33]. Contrarily, if bulls get back to the driving seat, then XRP will first have to break above its EMAs in the $0.38 to $0.41 range before heading towards its next test level around $0.47.

Also Read: XRP Starts Off 2023 With A 11% ‘Bang’

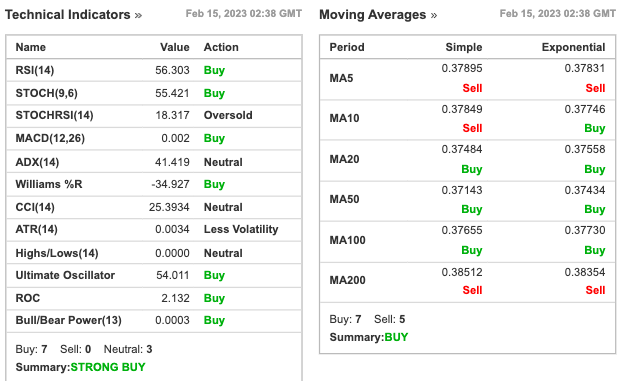

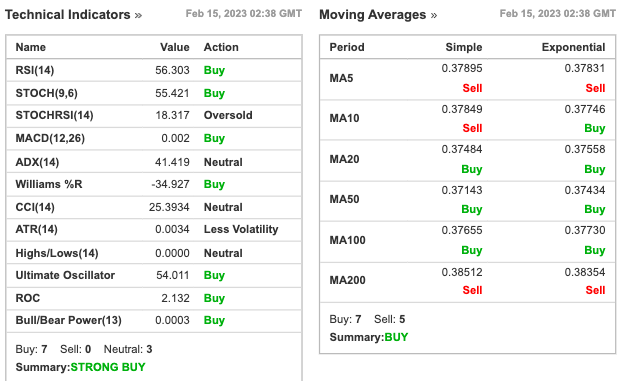

Given the discounted price of the asset, XRP seems to be a good buy at the moment. In fact, the readings of most technical indicators and moving averages of XRP pointed towards the same.

At press time on Wednesday, the $19.3 billlion market capped asset was trading at $0.03784.