Inflation in the U.S. started cooling down towards the end of last year. The refinement of the Consumer Price Index numbers over the past few months re-affirmed the said trend. Inflation fell to 7.1% in November, a number lower than expected. Likewise, it further dropped down to 6.5% in December. Well, the streak is now renewed.

Inflation for January drops to 6.4%

The U.S. Bureau of Labor Statistics just released the much-awaited numbers for January. According to the same, inflation dropped to 6.4%. The said figure, however, is higher than expectations.

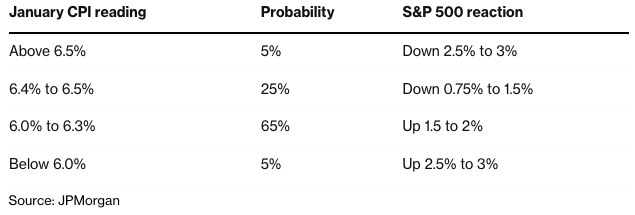

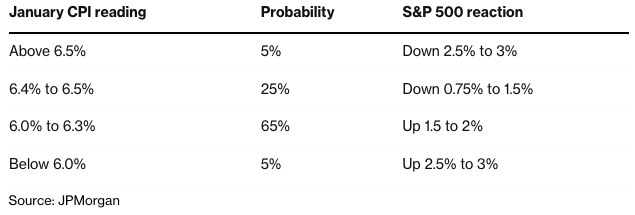

Economists at JPMorgan Chase & Co. expected a decline to 6.2% in January, from the prior month’s 6.5%. Morgan Stanley’s economists, however, forecasted the month-over-month number to show a 0.4% increase.

According to the former FinServ giant’s game plan, any reading below 6% to 6.3% would likely have a positive impact on the market. On the contrary, it predicted that any number above 6.4% would rub off negatively on equities.

Thus, keeping the latest released figure in mind, stock prices can be expected to slightly retrace. In hindsight, Bitcoin and the rest of the cryptocurrency market can be expected to follow suit.

Also Read: U.S. Unemployment Drops to 3.4%: Bitcoin Trades at $23.3K

The latest data-set release by the Bureau of Labor will play a pivotal role in helping the Federal Reserve officials to determine the next interest rate hike figure. After a series of eight interest rate increases, markets currently expect the Fed to raise the number two more times from its current target range of 4.5%-4.75%.

That said, the said measures are expected to improve the state of the economy over the long term. Recently, Federal Reserve Chair Jerome Powell shared his expectation that 2023 will show “significant declines in inflation.” Despite positive signs within the disinflationary process, he said, it still “has a long way to go.”

Read More: Federal Reserve Chair Jerome Powell Expects 2023 to Show “Significant Declines in Inflation”