The market saw an outright sentiment change after the CPI data release. The funding rates crept back into the positive territory, affirming the same. After that came the FOMC. Bulls got back to the driving seat and Bitcoin eventually went on to breach the $24k mark.

The market is yet again at a critical juncture. The U.S. Non Farm Payrolls (NFP) report has just been released. This statistic represents how many people are employed in the U.S. in manufacturing, construction and goods companies.

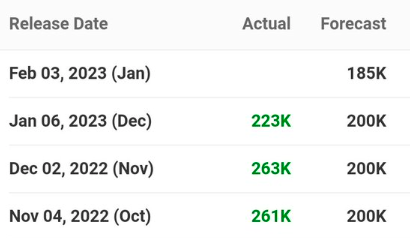

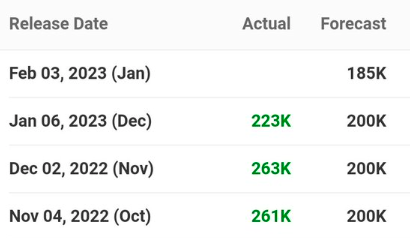

According to official data, a whopping 517k new jobs were added in January. The current number is around 2.5 times more than December’s 223,000. The latest numbers are quite unexpected. A Reuters survey of economists had called for a rise in Non Farm Payrolls by only 185,000 jobs in January.

Parallelly, unemployment has noted a slight drop to 3.4% from December’s 3.5%. The same, however, was expected to rise to 3.6%.

Opining on the overall state, Rubeela Farooqi, chief U.S. economist at High Frequency Economics, recently told Reuters,

“We caution against extrapolating. Overall, the BLS data show the economy continues to create jobs at a strong pace, and the labor market is showing only gradual signs of softening despite a rapid increase in interest rates.”

Which direction will Bitcoin march towards?

Conventionally, lower than expectation numbers or less jobs added hint towards a weakening Dollar. In retrospect, such a scenario is ideal for inversely correlated assets like Bitcoin. Similarly, more jobs added is a boon for the Dollar and bane for Bitcoin.

The market, however, has not stayed true to the thumb rule. Over the last three instances, the actual NFP numbers have been higher than the consensus forecast. Yet, on all occasions, BTC’s daily candle closed in green.

Now, one might perceive that the unemployment rate is what dictates the market. Well, that has also not been the case over the past three months. In November, when the number increased, BTC traded in green. In December, it remained unchanged, yet the largest cryptocurrency asset fetched positive returns that day to investors. A similar scenario unfolded last month also when the rates fell.

If Bitcoin follows its own footprints, there are odds of a reactionary incline this time. In a bullish scenario, it can be expected to incline upto $25.4k.

Given the massive NFP deviation from expectations, the aforementioned scenario will likely have to be striked out from the equation because BTC’s price has already started free-falling. From $23.5k, the number was already down by ~1% at press time.

Given the current pessimistic tune, Bitcoin could likely drop down to either of the supports marked below. Nevertheless, the state of the overall market has drastically improved when compared to the past year. Thus, the mid-term targets of $28.6k and $32.4k remain unchanged.

Also Read: Bitcoin, Ethereum ‘Bulls’ Are Coming After FOMC: Here’s Why