The digital ruble mandate is changing how Russia handles its money and banking rules. The Central Bank of Russia has launched this project to create a new digital currency while reducing dependence on the dollar. This move will change how Russians pay for goods and services, marking a new chapter in the country’s financial system.

Also Read: Ripple: Here Are The 4 Price Targets That XRP Could Hit In 2025

Understanding Russia’s Digital Ruble and Its Impact on Global Finance

Mandatory Implementation Timeline

Russia has a new law about the digital ruble mandate. It’s a law that tells banks what to do. The law has simple rules about when banks must start using this new type of money. These rules come from a special group in Russia’s parliament. This group makes all the big money decisions for the country. Anatoly Aksakov leads this group. He’s the one in charge of this big change. His team has created a step-by-step guide for every Russian bank.

The official proposal is very specific: “Systemically important banks crucial to the national economic stability must integrate the digital ruble by July 1, 2025, with complete banking sector implementation required by 2027.”

The government picked these dates carefully. They want to make sure every bank switches to the digital ruble. And they want this to happen within just a few years. This shows that Russia is very serious about this change.

Business Adoption Requirements

The digital ruble mandate sets clear rules for businesses. Those making over 30 million rubles yearly must start accepting digital payments by July 2025. “The threshold will decrease to 20 million rubles by July 2026,” according to the legislation. Businesses without good internet access don’t have to follow these rules.

Also Read: Ethereum: Can ETH Hit $5000 In 2025?

Banking Sector Participation and Expansion

More banks are joining Russia’s digital ruble mandate program. “Sberbank, TBank, and Tochka Bank have joined the pilot program for transactions using the digital ruble,” confirms the Central Bank’s announcement. These banks and 12 others, including Alfa-Bank, VTB, and Gazprombank, show strong support for this central bank’s digital currencies project.

Universal QR Code Integration

The digital ruble mandate includes a new QR code system for payments. This system will make it easier for people to use the digital ruble, supporting Russia’s move away from dollar dependence through better technology.

Regulatory Framework and Enforcement

New cryptocurrency regulation rules apply to all banks using the digital ruble mandate. Banks must follow consumer protection laws or face penalties. The Central Bank will check that everyone follows these rules on time.

Also Read: Can Solana (SOL) Reach $400 In January 2025?

Future Implications

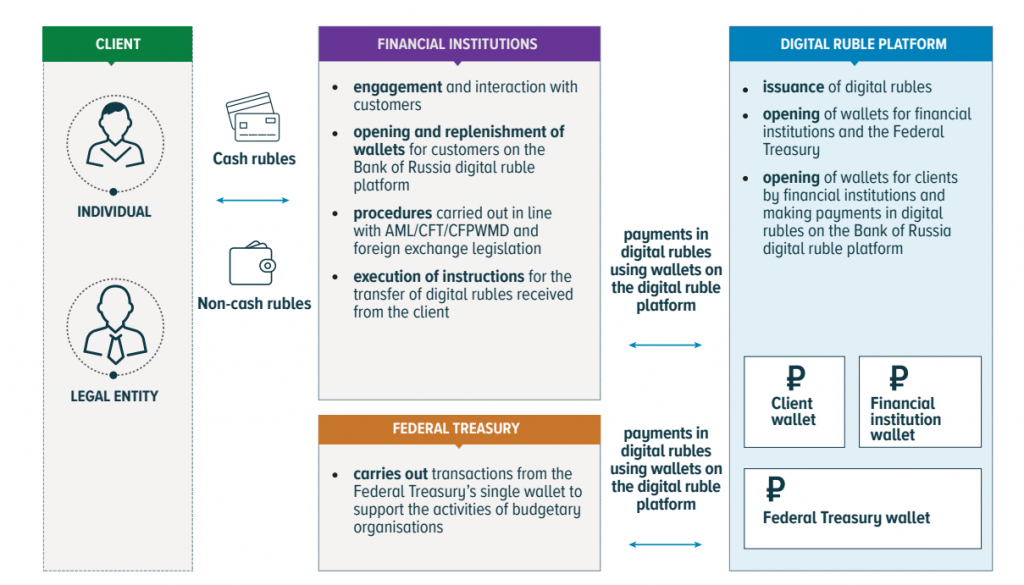

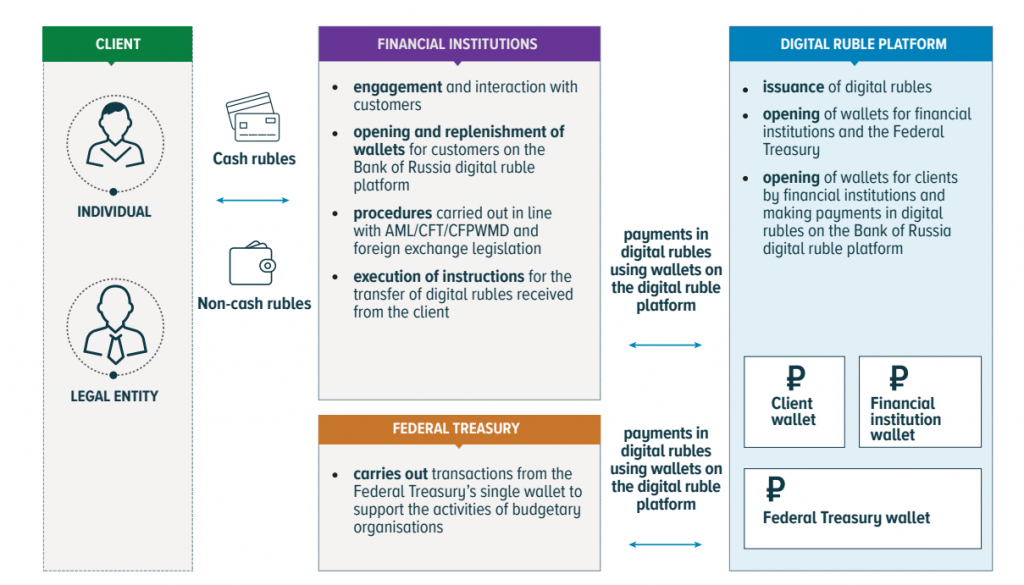

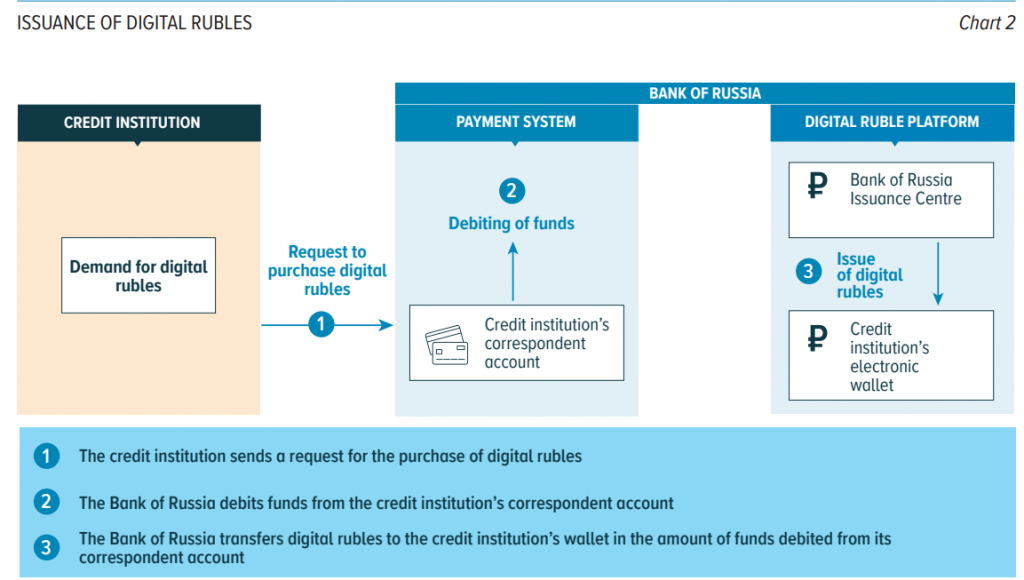

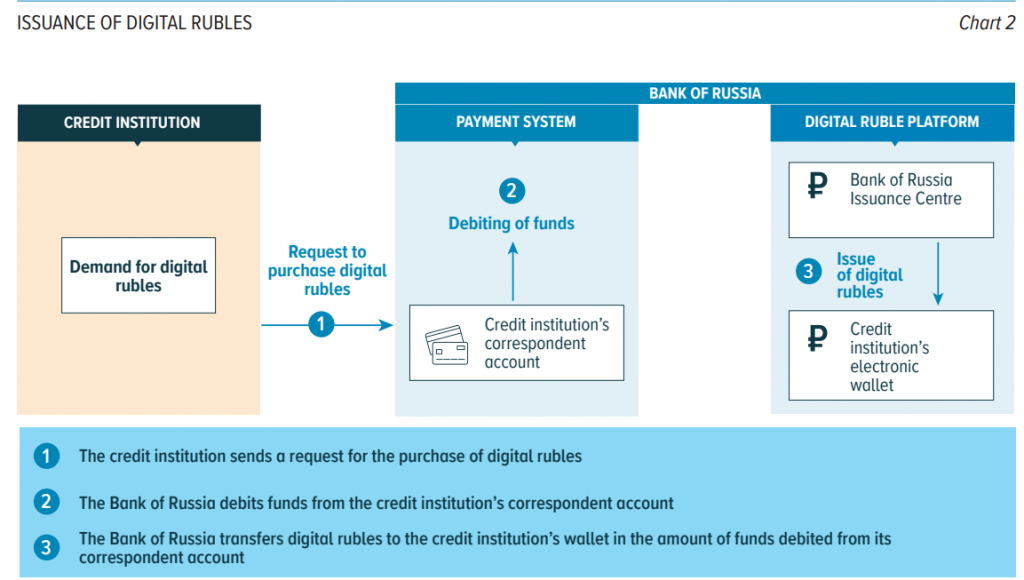

The digital ruble mandate creates Russia’s third type of official money. This project, which started testing in August 2023, puts Russia among the leaders in central bank digital currencies. It strengthens Russia’s control over its money while changing its role in global banking.