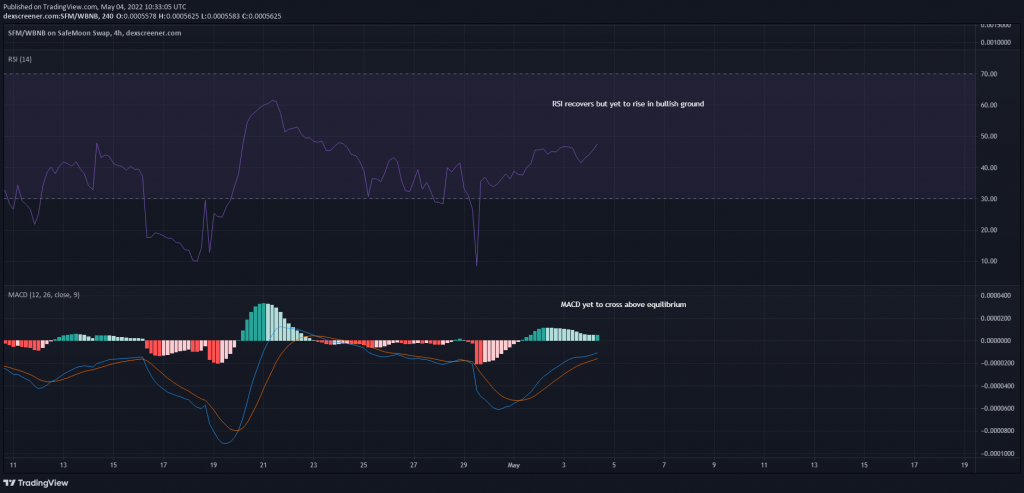

It’s been a difficult past few weeks for SafeMoon V2. Allegations of fraud against top executives shed unwanted light on the project while broader market losses have made compounded losses on SFM. The result? SafeMoon V2 is trading below its major moving averages and downside risks are still intact, with the 4-hour RSI and MACD yet to fully recover.

Although SafeMoon V2’s price slipped constantly in April, bears forced major losses during the second half of the month. Between 16 and 20 April, SFM shed 50% and lost out on $0.0009466 support, resulting in further losses.

A discounted price did bring back some investors briefly as SFM regained 60% of its value between 19-20 April but the lack of sustained buy volumes eventually dragged SFM back to weekly lows of $0.0003803.

Since then, bulls have attempted a workaround. Investors have been accumulating since 30 April and important indicators such as the RSI and MACD have shown that bulls were gaining more strength in the market.

In normal circumstances, such readings can reignite interest among bullish investors but the situation was anything but straightforward for SFM. FUD was still a factor among the SafeMoon community while a below-par Bitcoin, which suffered another weekend correction, was not ideal for the overall health of the crypto market.

Several bearish signals were still active on SFM’s chart as well, despite the accumulation. The candles traded below their 100-period (blue) and 50-period (white) Exponential Moving Averages and traders often maintain caution until the abovementioned indicators (RSI & MACD) fully recover above their respective mid-lines.

SafeMoon V2 Trading Strategy

A major network update or further clarifications by the SafeMoon team on recent allegations seem to be the only saving graces for SFM. Without one, downside risks remain, and shorting would be a safer bet. Short positions can be taken at $0.00500 and take-profit can be set at $0.0003805. A break above $0.0005810 can disrupt a short setup and a stop-loss can be maintained at similar levels. The trade setup carried a 1.48 risk/reward ratio.