The SEC has approved Bitwise’s Chainlink ETF, marking a significant milestone for the asset. The development marks LINK’s first entry into the US equity markets. The ETF will launch on the New York Stock Exchange. According to reports, the ETF could begin trading sometime this week. Moreover, Bitwise is offering the ETF for a 0% management fee for the first three months. The move could lead to a substantial price rally for LINK. Let’s discuss.

Will Chainlink Hit $50 After The ETF Launch?

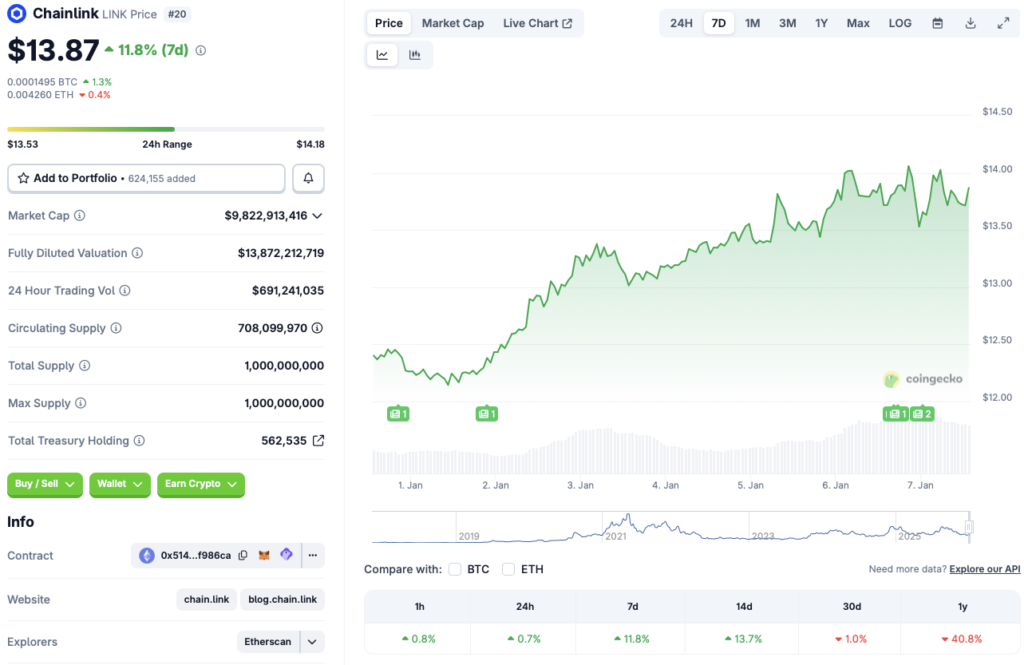

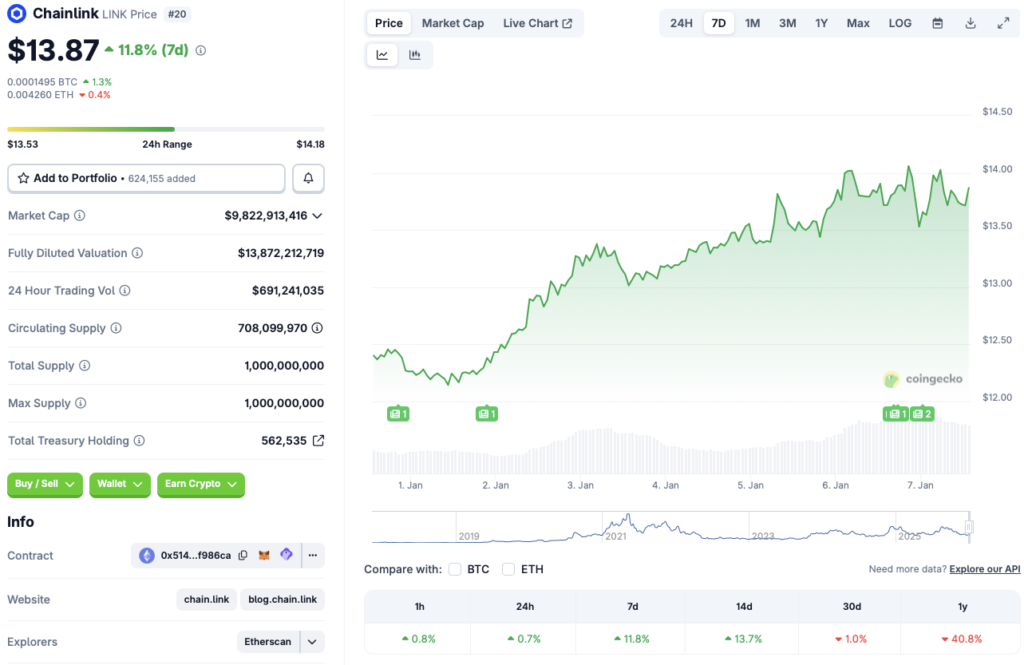

Chainlink (LINK) has seen quite a rebound over the last few days. According to CoinGecko data, LINK’s price has risen 0.7% in the last 24 hours, 11.8% in the last week, and 13.7% in the 14-day charts. However, LINK continues to struggle from last years market crash, dipping 1% over the last month and 40.8% since January 2026.

Bitwise’s Chainlink (LINK) ETF launch could change the game for the asset. ETFs played a vital role in the 2025 market cycle. Both Bitcoin (BTC) and Ethereum (ETH) hit new all-time highs thanks to increased ETF inflows. Moreover, major financial institutions have once again amped up their buying for their crypto-based ETF products. LINK could follow a similar trajectory.

Also Read: BlackRock Buys $100 Million Ethereum, Price Jumps 10%

However, one should note that Bitcoin (BTC) was the only cryptocurrency that hit a new all-time high soon after its ETF launch in 2024. Ethereum (ETH) did not see much positive price action until a year after its ETF launches. Solana (SOL), XRP, etc., have also not hit new peaks after their ETF debuts. It is unclear if Chainlink (LINK) will reclaim its all-time high price level of $52.70 after its ETF debuts in the market. LINK is currently down by more than 73% from its peak.

Furthermore, market participants are currently following a risk-averse strategy. Chainlink’s (LINK) price may not see much action until the larger economy shows signs of improvements.